I’m really happy to unveils a secret plan we’ve been working on for the past few months. We’re going to launch a new cryptocurrency through an Initial Coin Offering or ICO. I know I might have lost some of you, but bear with me. If you take the time to read this post, you’ll understand everything and will have a secret weapon to bring home the bacon.

Why an ICO?

For those who are not familiar with the crypto-slang, a lot of companies have been creating their own cryptocurrency or coin, in order to raise money. When they sell those coins to the public, they say they are doing an Initial Coin Offering or ICO.

While it sounds similar to an Initial Public Offering or IPO, those coins offering do not allow those who purchase the coins to own shares of the company. They only own coins that can be used on the platform that the company is building.

Often times, those cryptocurrencies could be replaced by real money or any virtual credit system; in other words, a lot of companies are launching a cryptocurrency for no other reasons than those are quite popular right now.

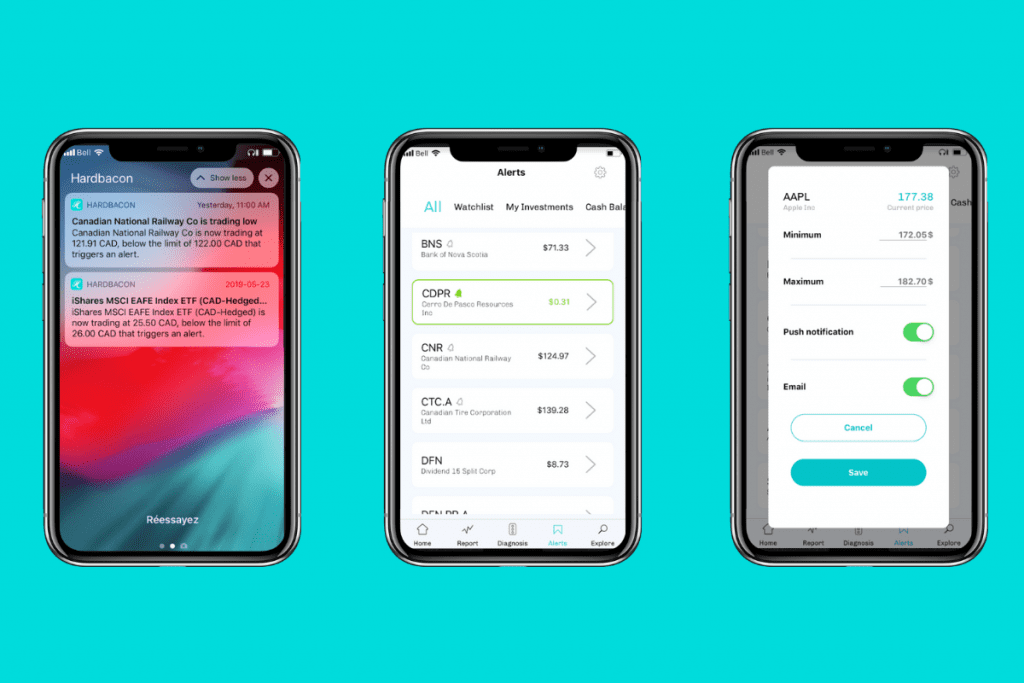

We thought about it long and hard at Hardbacon and we found a way to launch a coin that would really benefit from the blockchain technology. We’re launching InsiderCoin, a coin that will democratize insider trading all around the world by making it safe and seamless. And our users, who are already managing their stock market portfolio through our iPhone app, will be able to track and spend their InsiderCoins from within the app.

What is insider trading?

For those of you who are not familiar with insider trading, let me give you an example. Say you brother-in-law is a salesman at Bombardier and, while eating at your place for dinner, he boasts that the company just got an order for 500 planes from Singapore Airlines.

An order of that magnitude is huge for the small aircraft manufacturer! He knows it. You know it. However, the general public doesn’t know it yet, since the press release to announce this large order is only due for next week. He probably should not have told you yet, but until then, nothing that you or your step-brother did was illegal. However, let’s say you decide to invest in Bombardier’s stock after dinner, then, you what you did is called insider trading and it is technically illegal.

You might get away with it the first time, but at some point, you’re going to catch the attention of the regulators, since your ability to predict the future on the stock market seems limited to one stock and, guess what, it won’t take long for them to figure out your step-brother is working at Bombardier.

Many studies have proven that insider trading is ubiquitous among professionals on Wall Streets and their richest clients. It is extremely common for a stock to rally on rumours before a big announcement. About a quarter of mergers and acquisitions involving a public company end up benefiting insider trading practitioners. And leaks are not only coming from disloyal employees; they are also coming from government officials and politicians.

How does InsiderCoin works?

With InsiderCoin, no need to be among the wealthiest clients of a prestigious investment bank to benefit from insider trading. You don’t even need to have political connexions or even a step-brother working at Bombardier.

First, you download the Hardbacon app and then, you select the predictions tab. There, you see a list of predictions from anonymous insiders. For example, the aforementioned step-brother could have listed a prediction on there. What you would see is a prediction on a Canadian stock, which would allow you to make at least a 10% return in one week.

To see his prediction, however, you would need to spend some bacon. Let’s say $500 worth of InsiderCoin. That’s where the blockchain technology is useful. First, it allows you and the Bombardier’s employee to remain 100% anonymous. Second, it allows you to go through a smart contract to make sure he’s telling the truth. Basically, the coins won’t be paid to him unless Bombardier’s stock actually increase by 10% or more within one week. If it does not, the money would automatically be returned to you and the reliability score associated with the step-brother would take a drop.

Is it illegal?

Insider trading is definitely illegal in North America and our lawyers told us we should write here that we discourage anyone from using InsiderCoin for such purposes. I also want to mention here that I was making a joke when I wrote that our coin “will democratize insider trading all around the world by making it safe and seamless”. Sure, the name is a wink to this illegal practice, but we would be deeply saddened if anyone used the InsiderCoin to break the laws.

We designed the InsiderCoin in such a way that we don’t have access to the actual content of the predictions generated by InsiderCoin’s users and don’t want to, in order to protect your privacy. Furthermore, predictions disappear from your phone as soon as each contract is executed.

If Snapchat was never prosecuted for facilitating insider trading, despite its convenient self-destructing messages and widespread use on Wall Street, we believe Hardbacon and its InsiderCoin are on the right side of the law.

Subscribe to our newsletter if you want to know before everyone else when we our ICO will take place.

[Update : If you've read this post up to this point, you probably figured out on your own, but since it's April 2 today, I just wanted to point out this was an April Fool. Nope, we're not preparing an ICO nor launching a coin called InsiderCoin.]

About The Author: Julien Brault

Julien started Hardbacon to help Canadians make better investment decisions. He’s raised more than two million dollars and signed strategic partnerships with financial institutions across the country. Before starting Hardbacon, Julien shared his passion for personal finance and the stock market while working as a business journalist for Les Affaires.

Julien manages his stock portfolio with National Bank Direct Brokerage. He uses a pre-paid KOHO Mastercard® for his online purchases and Borrowell to keep an eye on his credit score. Julien also has a Tangerine high-interest savings account.

More posts by Julien Brault