When depositing your money into a saving account, why not make your money work for you at a higher rate? Selecting a high-interest savings account is your answer. From the Big 5 Banks in Canada to individual financial companies, you have a variety of high–interest savings accounts available to you regardless of where you are in Canada. From no minimum or maximum deposit to no additional account fees, we have gathered the 30 best high-interest savings account in Canada, in no particular order. You can check out our savings account comparison tool for yourself to help you select your next high-interest savings account!

- Tangerine Savings Account

- Simplii Financial High Interest Savings Account

- High-Interest Savings Account from CI Direct Investing

- EQ Savings Account

- High Rate Savings Account HSBC

- Smart eSavings from Bridgewater Bank

- CIBC eAdvantage Savings Account

- E-Savings from People’s Group

- High-Interest eSavings Account Alterna Bank

- High-interest saving account from Motusbank

- Momentum PLUS Saving Account from Scotiabank

- The Investment Excellence Account From Laurentian Bank of Canada

- Savings Builder Accounts BMO

- The Advantage Account by Manulife

- TD ePremium Savings Account

- High-Interest Savings Account Desjardins

- TD High-Interest Savings Account

- High-Interest Savings Account National Bank of Canada

- RBC High-Interest eSavings

- First Nations High-Interest Savings Account

- High Interest Savings Account from First Nations Bank of Canada

- AcceleRate Financial Savings Account

- Daily Interest Saving Account from Achieva Financial

- Summit Saving Account From CWB Canadian Western Bank

- High-Interest Savings Account from Meridian Credit Union

- Oaken Savings Account

- HiSAVE Savings Account Online ICICI Bank

- Implicity Financial High-Interest Savings

- ATB High-Interest Savings Account

- High-Interest Savings Accounts From Equitable Bank

Tangerine Savings Account

The Tangerine Saving Account is a saving account with no minimum balance, no service charges, and no extra fees. It helps you earn high interest on every dollar. This saving account has an interest rate of 0.10%. A special offer is currently available, where you can get 2.50% on saving rate for the first 5 months when you open your first savings and chequing account, and earn $300 when you add a payroll. Some of the key features this saving account bring are advantageous rates, no service or extra fees, no minimum balances, and a personalized saving goals. With the Automatic Saving Program, you can move money directly to your Tangerine Saving Account. A saving calculator is available on the Tangerine website, which helps you visualize your saving objectives. For example, if your total saving goal is $15,000, your regular savings amount is $200 that you withdraw bi-weekly. It will take you three years to achieve your objective with the Tangerine saving account.

Available across Canada

Perfect if you want to open a checking and saving account with Tangerine.

Simplii Financial High Interest Savings Account

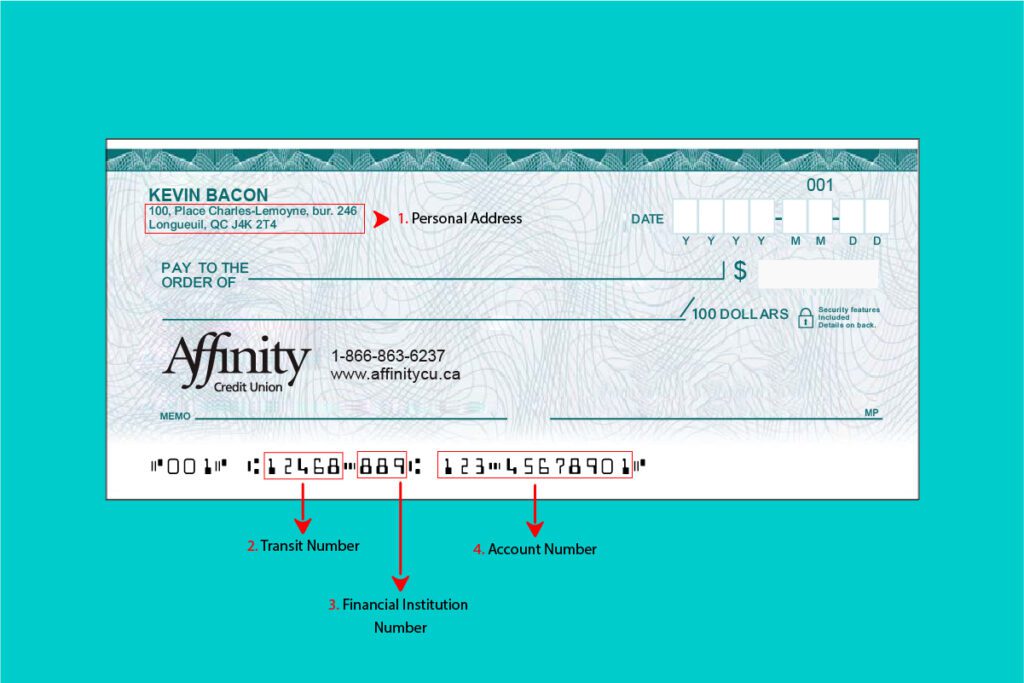

Simplii Financial is an online digital bank brought to you by CIBC. The Simplii Financial High Interest Savings Account offers no monthly or transaction fees, or minimum balance requirements. The standard interest rate on this account is 0.10%, which is calculated daily on your closing account balance and then paid out to your account monthly. New accounts will enjoy a promotional interest rate offer of 2.20% until April 30, 2022; after that it reverts back to the standard rate of 0.10%. The Simplii Financial High Interest Savings account cannot be accessed through an ATM. You have to transfer funds from your savings account to your chequing account first, then you can use an ATM to withdraw the money from your chequing account. You can access your money for free through any CIBC ATM in Canada; non-CIBC ATMs usually come with transaction fees and a surcharge from the owner of the ATM. For the quickest and easiest access to the money in your Simplii Financial High Interest Savings Account, you’ll want to open a chequing account with them too. A Simplii Financial Chequing account comes with free unlimited debit card purchases, withdrawals, bill payments, and Interac eTransfers. To grow your savings even faster, refer a friend and get a $ 50 cash bonus. There is no limit to the number of people you can refer, which means there is no limit to the referral cash bonus you can earn. Conditions and restrictions apply.

High-Interest Savings Account from CI Direct Investing

The high-interest saving account from CI Direct Investing lets you put your savings to work with its 0.75% interest rate. This interest rate is calculated daily and paid monthly. This savings account offers no additional fees. There are no monthly fees, account fees, low balance fees, or withdrawal fees. There is also no minimum balance required for this savings account. To help you grow your money faster, you can set up automatic contributions and watch your money grow. The balance in your savings account also helps you access lower management fees for your CI Direct investing accounts. The investment fee discount is available in tiers based on the balance of your savings account. As you achieve certain minimum balance milestones, you'll unlock a better and better investing management discount.

Available across Canada

Perfect if you want to deposit a small amount and want to avoid additional fees related to your saving account

EQ Savings Account

The EQ savings account offers you an interest rate 30 times higher than other banks. Earn an interest rate of 1.25% on every dollar without monthly fees and transaction fees. Some other perks include zero everyday banking fees and free Interac eTransfers. Enjoy free bill payments and electronic funds transfers. All transactions made from one EQ account to another are free of charge. There is no minimum balance required but has a maximum balance of $200,000 per customer. For any international money transfer, EQ is partnering with Wise to help you pay less on any money transfer sent abroad. There are no additional hidden fees or markups, the real exchange rate is what is displayed online. A calculator is available on the EQ website to check out the real exchange rate for yourself. For example, let’s say you want to send CAD $1,000 in Euros to a friend, Wise will take a fee of $5.85 and the remaining CAD $994.15 will be converted to EUR $725.96 and sent to your recipient. You can check out other currency rates on the EQ website and compare them with other financial institutions that offer you.

Available across Canada (excluding Quebec)

Perfect if you want to send money abroad and won't deposit an amount higher than $200,000 into your saving account

High Rate Savings Account HSBC

The High Rate Savings Account from HSBC offers you the maximum savings and control over your funds and finances. This savings account has a different interest rate based on the amount you deposit. For any amount below $25,000 the rate will be 0.05%, and for any amount above $250,000 the rate will be 0.20%. There is a promotional offer on this account between April 4th and June 24th 2022 that allows you to earn up to 2.40% interest on your savings during the promotional period. If you have a balance over $25,000 you'll get the 0.20% rate plus an additional 2.20% on new deposits from April 4 – June 24. Conditions and restrictions apply so make sure you read the fine print. There is, however, no minimum balance of how much you can deposit with no monthly fees associated with this account. All balances under $25,000 get 0.05% interest. You have a limit of 3 debit transactions with this savings account, if you go over that a $5 fee will be charged. Your funds can be accessed through different channels. You can either call one of the thousand HSBC Banks in Canada or use the EXCHANGE network ATMs available across Canada and around the world. There are no fees charged when you want to transfer your money between your HSBC High Rate Savings Account and your other HSBC account. The ATM fees are $1.50 for any internal ATMs and $5 for any international ATMs outside Canada.

Available across Canada

Perfect if you do not need to make debit transactions.

Smart eSavings from Bridgewater Bank

The Smart eSavings account from Bridgewater Bank offers you an interest rate of 1.20% with an initial deposit requirement of $25, and no minimum ongoing balance is required. You can easily transfer your funds from other financial institutions. The feature “Set it and forget it” lets you set automatic pre-authorized contributions. This savings account includes several service fees. Receive one free withdrawal per month, after that it is $5 for any additional withdrawals per month. The fee for the dishonoured cheque or pre-authorized debit reversal is $20. There is no additional fee for inactive accounts, account history inquiry, duplicate statements, and transfers to another Bridgewater Bank Smart eSaving Account or a Bridgewater Bank GIC Account.

Available across Canada (excluding Quebec)

Perfect if you don't need to withdraw from your saving account

CIBC eAdvantage Savings Account

The CIBC eAdvantage Saving Account lets you maximize your savings by earning interest on every dollar you save. This saving account has an interest rate of up to 1.65% with no monthly fee. Each transaction has an additional fee of $5 which includes debit purchases, CIBC withdrawals even through CIBC ATMs, Interac eTransfers, CIBC personal cheques, automatic pre-authorized withdrawals, and bill payments. Any transfers of money between your CIBC personal bank accounts using online banking are free. A special offer is available now, where you can receive a bonus interest rate of 1.20% for the first 4 months when you open your first CIBC eAdvantage Saving Account. You'll earn 0.20% on every dollar, or 0.25% if you save at least $200 per month every month. The only qualification to apply for this savings account is to be a Canadian resident and reach the age of majority in the province/territory of residence. Some of the features included with this saving account are a recurring transfer option to help you achieve your saving faster, some expert guidance to steer your finances in the right direction, and the possibility to deposit cheques with your phone using the CIBC eDeposit. The CIBC Smart Balance Alert gives you a heads-up when your account is short on funds. It is a helpful tool to avoid non-sufficient funds fees and declined payments. A savings calculator is available on the CIBC website to give you the amount of time required for you to achieve your savings goal. For example, if you are saving for a car with a goal amount of $15,000 with a $200 monthly contribution. It will take you six years to buy your car given the annual rate of return of 3%.

Available across Canada

Perfect if you don't need to do transactions within your account

E-Savings from People’s Group

The E-Savings account from People’s Group is a savings account that offers no monthly fees and because it is a non-register account there are no deposit limitations. With an interest rate of 1.30%, this is one of the highest interest rates on the market. This saving account includes additional features such as interest calculated daily and paid monthly, online banking support, view of monthly transactions online and easy transfer funds between your People Trust accounts and other financial institutions.

Available across Canada

Perfect if you want to deposit small amounts into your saving account

High-Interest eSavings Account Alterna Bank

The high-interest eSavings account from Alterna Bank helps you grow your money with its high interest of 0.90%. It also offers no monthly fees, free unlimited bill payments, transfers, debits, and Interac e-Transfers. No minimum balance is required when using this saving account. Alterna Bank has an online banking interface to give access to your finances anywhere and anytime.

Available across Canada

Perfect if you want to deposit small amounts and need to do lots of transactions within your account

High-interest saving account from Motusbank

The high-interest saving account from Motusbank gives you a high-interest rate on your savings regardless of your balance. This saving account has an interest rate of 1.00% with zero monthly account fees and no minimum balance required. You are eligible to deposit an insured amount of up to $100,000 by CDIC with unlimited debit purchases and withdrawals. You are able to withdrawal from over 3,600 Exchange Network ATMs across Canada for free. This savings account comes with zero daily banking fees and unlimited use of the Price Drop features. This feature helps your bargains online to help you find the best price you claim your money back at over 40 retailers like Lowe’s, Hudson’s Bay, Home Depot, and more. One tool made to help you grow your saving faster is the Auto-Save features. It lets you round up your debit purchases from $1 to $5, and the difference goes right into your saving account.

A saving calculator is available on the Motusbank website to give you the amount you’ll be able to save using this saving account. For example, with an initial deposit of $2,000 plus a monthly deposit amount of $200, you'll have an amount of $11,880 after 4 years.

Available across Canada

Perfect if you are an avid shopper and want to combine your saving account as a budgeting tool

Momentum PLUS Saving Account from Scotiabank

The Momentum PLUS saving account from Scotiabank lets you save for multiple goals in one account. You can easily choose the timeline for your savings goals and track it as you earn. With the Momentum PLUS saving account, you can earn up to 0.75% interest with regular interest, premium period interest, and the ultimate package. The regular interest is 0.05% and is calculated daily and paid monthly. The premium period interest is calculated daily and paid at the end of each premium period as long as no debit transactions have occurred within the premium period. If no debit transactions have been made after 90 days the premium period interest will be 0.3%, after 180 days the rate will be 0.4%, after 270 days the rate will be 0.5%, and finally, after 360 days, the rate will be 0.6%. As for the ultimate package is an additional 0.10% annually added to any Momentum PLUS saving account which is calculated daily and paid monthly. Some of the additional features offered with this saving account are no monthly account fees or minimum balance required, unlimited self-service transfers, automatic savings plans, mobile and online banking, and finally mobile cheque deposits. Each debit transaction that is not a self-service transfer will be charged $5.

Available across Canada

Perfect if you don't need to do debit transactions

The Investment Excellence Account From Laurentian Bank of Canada

The Investment Excellence saving account from Laurentian Bank of Canada will accommodate all your baking needs. This saving account offers you an attractive progressive annual interest rate. Depending on the amount deposited into your account the interest rate will vary. For any amount below $4,999, the interest rate will be 0.05%, between $5,000 to $24,999 the interest rate will be 0.1%, between $25,000 to $59,000 the interest rate will be 0.2%, between $60,000 to $99,000 the interest rate will be 0.5%, finally for any amount above $100,000 the interest rate will be 0.6%. The Investment Excellence saving account has no monthly account maintenance fees. Other transactions include a $1 fee on withdrawal, preauthorized payment or transfer at an ABM or through LBC Direct services. Note that a monthly $1 rebate is offered for the first debit transaction. Also, any cheque has a transaction fee of $1.25.

Available only in Quebec

Perfect if you want to deposit a higher amount ($100,000 or above) and you have few transactions to make

Savings Builder Accounts BMO

The Saving Builder Account BMO rewards you with a bonus interest rate for growing your savings monthly, which helps you reach your financial goals faster. This savings account has an interest rate of 0.5% when you increase your monthly balance by at least $200 each month and you will receive a bonus interest rate. Without the bonus interest rate, you will be able to earn a base interest rate of 0.05% This savings account comes with a maximum balance of $250,000. You have access to one free transaction out of the account and for any additional transfer out, the fees are $5 per transaction.

Available across Canada

Perfect if you make monthly deposits of $200 or more

The Advantage Account by Manulife

The Manulife Bank Advantage Account combines your banking to get the flexibility of a chequing account with the high interest of a savings account. This high interest savings account offers an interest rate of 0.15% without any minimum balance required. Receive unlimited free transactions when you maintain a minimum account balance of $1,000. For any amount below that, the additional debit transactions are $1 per transaction. You always have easy access to your money from thousands of ATMs and in-store cash back, plus online mobile and telephone banking. The fee of an external ATM is $1.50, withdrawing from ATMs outside Canada will be charged $3.00 per withdrawal, and ATMs outside the The Exchange Network usually charge their own convenience fees too.

Available across Canada

Perfect if you have a balance of $1,000 or more

TD ePremium Savings Account

The TD ePremium Savings Account helps you save more with its high-interest rate free online transfers. This saving account offers a rate of 0.25% for any account balance over $10,000. You will not earn any interest at all if your balance is under $10,000. No monthly fee is charged with this account and comes with unlimited online transfers between other TD Canada Trust deposit accounts. Debit transactions will cost you $5 each. Interac eTransfers are also free of charge. An automated saving service is available to help you save even more. Finally, the ATM fees are $2 for external ATM withdrawals, $3 for ATMs in the US withdrawals, and $5 for abroad ATM withdrawals outside the US or Mexico.

Perfect if: you want to deposit an amount above $10,000.

Available across Canada

Perfect if you have a balance of $10,000

High-Interest Savings Account Desjardins

The high-interest savings account from Desjardins, spelled S@avings account, is a high-interest savings account only available on Personal AccèsD the Internet and mobile. The regular interest rate offer is 0.20% paid monthly. There is no service or monthly fees associated with this savings account. Inter-institution transfers between this account and your other Desjardins accounts are permitted and free at all times. Finally, this account gives you unlimited amounts of debit transactions.

Available across Canada

Perfect if you already have any type of Desjardins accounts and/or want to do a lot of debit transactions.

TD High-Interest Savings Account

The TD High-Interest saving account helps you achieve your goal faster with its high-interest rate. This savings account offers a 0.05% interest rate for any amount balance greater than $5,000, any amount below that has a 0% interest rate. All transaction fees are waived if you maintain a monthly balance of $25,000. If your balance is below this amount fee of $5 will be charged for any additional transactions. An automated savings service is available which can help you save faster. As for the ATM fee, for an external ATM the fee will be $2 per withdrawal, for a US or Mexican ATM the fee will be $3 per withdrawal, and finally, for any other international ATM withdrawals the fee will be of $5. The TD High Interest Savings account comes with additional benefits. Some benefits include the free pre-authorized transfer service to another TD chequing or savings account, the Simply Save Program which automatically helps you grow your savings, the TD MySpend which keeps track of your spending, the TD Mobile Deposit for all your cheque deposits, and finally online statements.

Available across Canada

Perfect if you maintain your amount balance above $25,000 and do not need to make debit transactions.

High-Interest Savings Account National Bank of Canada

The High-Interest Savings Account from the National Bank of Canada has an interest rate of 1.20% with no minimum balance or monthly fees. There is a promotional offer running until June 30, 2022; new accounts opened will earn an introductory rate of 1.50% during the promotional period which ends June 30, 2022. You will receive one free debit transaction, for any additional transactions made a fee of $5 will be charged. All Interac eTransfers will have a fee of $1 per transaction. You have access to free and unlimited funds transfers between your National Bank accounts. Some additional benefits with this High-Interest Savings Account include easy access to your funds at any time and the systematic saving plan which is deposited automatically into your savings account. This saving account can act as your emergency fund which will provide you with a financial cushion against the unexpected and withdraw it anytime.

Available across Canada

Perfect if you want to deposit a small amount into your savings account and do not need to make debit transactions.

RBC High-Interest eSavings

The RBC High-Interest eSavings Account offers you a 0.10% interest rate on all amounts deposited. There is a promotional offer right now that gives you 1.55% for the first 3 months on new accounts opened by 3 pm EST on April 13, 2022. This savings account comes with no fixed monthly fee. You can deposit the amount you want into your account as there is no minimum deposit required. You will receive one free debit transaction, for any additional transactions made a fee of $5 will be charged. All Interac eTransfers will have a fee of $1 per transaction. Get one free RBC ATM cash withdrawal per month, for any additional debit transactions a fee of $5 will be charged. All Interac eTransfers and cross-border debits will have a fee of $1 per transaction. Receive free electronic self-service transfers which include ATM and unassisted telephone fund transfers from this account to any other RBC Royal Bank personal deposit account in your name. You will also receive free access to RBC Online, Mobile, and Telephone Banking. For all ATM withdrawals made abroad, the fee will be of $5, and all ATM withdrawals made in the US will be a fee of $3. This saving account comes with expert guidance, cash bonuses for saving and some exclusive perks with the First-Time Home Buyer Saving Program. Finally, you can set up your Save Matic from your banking account to help you save more automatically.

Available across Canada

Perfect if you want to deposit a small amount into your savings account and do not need to make debit transactions.

First Nations High-Interest Savings Account

The First Nations High Interest saving account lets you create emergency funds which offer greater flexibility than other short-term savings and investment options. This savings account has an interest rate of 0.05% regardless of your account balance, and with no monthly fee. The interest is calculated daily and paid monthly. There are no free debit transactions for this savings account unless you maintain a minimum balance of $25,000 at all time, then the transaction fee of $5 will be waived. Some other additional fees include Interac eTransfers sent, money requests, and Interac ATM withdrawals which are all $1.50 per transaction. However, all Interact eTransfer fulfill requests for money are free. For all ATM withdrawals inside the US and Mexico, the fee per transaction will be $3, for all other international ATM withdrawals the fee is $5 per transaction.

Available across Canada

Perfect if you are looking to maintain your account on reserve, will keep a balance of $25,000 or more, and do not need to make debit transactions.

High Interest Savings Account from First Nations Bank of Canada

The High-Interest saving account from First Nations Bank of Canada lets you create emergency funds which offer greater flexibility than other short-term savings and investment options. No, you're not seeing double. This is a different high interest savings account offered by the First Nations Bank of Canada. The interest rate is 0% for any account balance below $5,000. All amounts above that will receive a 0.05% interest rate. The interest is calculated daily and paid monthly. This savings account offers no monthly fee. No free debit transactions are available unless you maintained a minimum balance of $25,000 at all times, then the transaction fee of $5 will be waived. Some other additional fees include Interac eTransfers sent, money requests, and Interac ATM withdrawals which are all $1.50 per transaction. However, all Interact eTransfer fulfill requests for money are free. For all ATM withdrawals inside the US and Mexico, the fee per transaction will be $3, for all other international ATM withdrawals, the fee is $5 per transaction.

Available across Canada

Perfect if you are looking to maintain your account on reserve, will keep a balance of $25,000 or more, and do not need to make debit transactions.

AcceleRate Financial Savings Account

The AcceleRate Financial savings account offers you competitive interest on short-term savings with the freedom to access your funds at any time. This saving account has one of the highest rates in Canada. Its variable interest rate is 1.40%. The interest is calculated on the daily closing balance and paid on the last day of each month. You can withdraw your funds at any time via Interac eTransfer or with your AcceleRate Financial personal cheques. This savings account also comes with your AcceleRate Flash Enabled debit card to withdraw funds from ATMs. There are no monthly service fees, deposits are free, one free cheque transaction, point-of-sale transaction or electronic funds withdrawal every month. You can set up automatic transfers from other financial institutions.

Available across Canada

Perfect if you need to make a lot of deposits

Daily Interest Saving Account from Achieva Financial

The Daily Interest Savings Account from Achieva Financial allows you to earn high interest on your savings while keeping them fully accessible. This saving account has one of the highest rates in Canada. Its consistent interest rate is 1.30%. The interest is calculated on the daily closing balance and paid on the last day of each month. There is no minimum balance and account fee. An automatic Saving Program allows you to save more money faster. This saving account has free deposits, one free cheque, direct transfer or pre-authorized payment every month. One dollar per month is paid to you when you choose to receive your documents electronically. A referral bonus of $100 maximum per year is available if you can refer up to 4 friends to Achieva Financial; you and your referral will each make $25 each when they open an account with your referral code.

Available across Canada

Perfect if you want to deposit a smaller amount and make a lot of deposits.

Summit Saving Account From CWB Canadian Western Bank

The Summit Savings Account from CWB Canadian Western Bank makes your dollar work harder for you so you can spend it at any time. The interest rate is 0.25% regardless of the amount deposited. This rate is calculated on the daily closing balance and paid on the last day of the month. This savings account has free transfers between CWB accounts to help you move your funds easily. There are no monthly fees or minimum balance required. There are no free debit transactions, every debit out of your account will cost you $5. All ATM withdrawals external, in North America, or internationally have a fee of $5 too.

Available in Alberta, British Columbia, Saskatchewan, and Manitoba

Perfect if you want to deposit smaller amounts and do not make debit transactions.

High-Interest Savings Account from Meridian Credit Union

The High-Interest Savings Account from Meridian Credit Union lets you earn 0.45% on every dollar you deposit. This rate is calculated daily and paid monthly. This saving account has no monthly fee and offers unlimited free debit transactions. You can withdraw your funds without surcharge fees at over 1,000 EXCHANGE Network ABMs across Canada and over 40,000 AMBs in the US through the Allpoint network. For any external ATM withdrawals, a fee of $2 will be charged and for any international ATMs withdrawals, such as the US, a fee of $3 will be charged. A High-Interest Savings Calculator is available on the Meridian website where you can see how you can achieve your savings goals. For example, let’s say you have an initial deposit of $20,000 with a recurring monthly deposit amount of $400, you will have a saving of almost $25,000 after only 1 year. You can access your funds through multiple ways including branches, online, mobile, and telephone banking. With your high-interest savings account, you’ll get your Meridian debit card with Interac Flash to make payments through Interac Debit in Canada and ACCEL in the US. All Interac eTransfers have a fee of $1.50 for each transaction.

Available in Ontario only

Perfect if you make a lot of debit transactions.

Oaken Savings Account

The Oaken Savings Account gives you an interest rate of 1.32%. This is one of the highest in Canada! On the Oaken website, you can compare the different rate offers in Canada with Oaken’s rates. With this savings account, you have no monthly fee or minimum account balance. Receive no limit to the number of transactions you can make free of charge. You can easily transfer money from your account to an Oaken GIC. You can also easily transfer your money out of your Oaken GIC once it reaches the matured balance. With Oaken Online Banking, you’re able to check your balances and manage your account whenever you need to. Set up automatic contributions as a saving strategy. You can also set up pre-authorized transfers from other bank accounts to your Oaken Saving Account.

Available in British Columbia, Ontario, Nova Scotia, and Alberta

Perfect if you want to deposit smaller amounts and require a lot of transactions between your account.

HiSAVE Savings Account Online ICICI Bank

The HiSAVE Savings Account from ICICI Bank offers you an interest rate of 0.50% on a Canadian Dollar savings account and 0.45% on a US dollar savings account. There is no banking fee or monthly fee. You can add the amount you want to your account with it’s no minimum balance required. There is no need to change your existing bank account, just link up to three of your existing checking accounts at any Canadian financial institution with your HiSAVE Savings account. You will then be able to transfer your funds between your accounts. ICICI Bank offers convenient banking services. You can have access to your funds in different ways, like online banking, by phone, or at an ABM. Debit transactions come with different fees depending on the type of transaction, which you can find in the fee disclosure statement for all accounts.

Available in Alberta, British Columbia, and Ontario

Perfect if you want to deposit smaller amounts and require a lot of transactions between your account.

Implicity Financial High-Interest Savings

The High-Interest Savings Account from Implicity Financial helps you keep more money in your pockets. The interest rate offered is 1.25%, calculated daily and paid monthly. Pay no monthly account fees while earning high-interest rates, and still have more cash on hand when you need it. There is no minimum balance required to open a savings account. For easier access to your funds, Implicity Financial offers checking privileges and a debit card for ATMs and Point-of-Sale Access. Debit transactions come with different fees depending on the type of transaction, which you can find in the Service Fee section of the website.

Available across Canada

Perfect if you don’t want to pay any additional fees, and want to deposit small amounts.

ATB High-Interest Savings Account

The ATB High-Interest Savings Account offers you liquidity, security, and high-earning potential for your money. You can access your funds at any time you want with no terms or maturity dates. The current rates for this savings account are 0.45% for the Personal Series A, 0.60% for the personal Series F, 0.45% for the Personal Series SA, and finally 0.60% for the Personal Series SF. All those rates are for Canadian Dollar accounts. The minimum investment for a Series A and F is $1,000, and for the Series SA and SF, it’s $25,000. There is, however, no maximum amount you can invest. You can earn annual interest in either a registered or unregistered investment plan.

Available only in Alberta

Perfect if you want to access your funds at any time and want to deposit a high amount.

High-Interest Savings Accounts From Equitable Bank

The High-Interest Savings Account from Equitable Bank offers two types of products; Series A and Series F for both personal and corporate clients. For the purpose of this article, we are only looking at personal high-interest savings accounts. The interest rate of Series A is 0.55%, and for Series F is 0.70%. This saving account has a minimum balance of $500 and a maximum of $500,000. All interest fees are calculated daily on the closing balance and paid monthly as reinvested distributions. You’ll get an unlimited amount of deposits or withdrawals transactions without any fees for non-registered and registered accounts. Get easy access to your funds at all times. There are not locked-in periods or maturity dates.

Available across Canada

Perfect if you make a lot of transactions (deposits/withdrawals) and keep a balance between $500 and $500,000 at all times.

This top 30 of the best high-interest savings accounts in Canada was compiled by Hardbacon, which has designed a credit card comparator listing hundreds of Canadian credit cards. Hardbacon also helps you save on savings accounts, chequing accounts, online brokers, robo-advisors, life insurance, mortgages and personal loans. If you want to go one step further and take control of your finances, you should download Hardbacon’s mobile app, which links to your bank and investing accounts, helps you plan for your financial goals, create a budget and invest better.

About The Author: Sophie Albo

Sophie is the content specialist at Hardbacon. She is currently in her 3rd year of a bachelor's degree in marketing at Concordia University. Her passion for Fintech and was revealed during the 2016 Cooperathon where she received special award.

More posts by Sophie Albo