The best bank for students in Canada shouldn’t just give you a free account with unlimited transactions, it should reward you too. Why? Because people rarely change banks, even when there are better deals out there. That makes you a prime money-making target for banks. They want to earn your business early and turn you into a lifelong customer, so make them work for it.

When you’re a student, every penny counts, and so does your time! You might be a broke joke now, but you won’t be for long and banks know it. Take this opportunity to save as much as you can and even earn some free stuff in the process. But there are so many options available for free or low-cost bank accounts for students. Which is the ideal bank account for you?

Worry less, study more. We've created a list of the 8 best banks for students in Canada, what they offer, costs to consider, and how to qualify.

- Why do I need a student bank account?

- The best bank for students: what to look for

- The 8 best banks for students in Canada

- 1. A Free CIBC Chequing Account

- 2. Scotiabank's Free Unlimited Account

- 3. The Free Student Account At TD Bank

- 4. RBC's Free Banking Account

- 5. Student Account At BMO

- 6. Tangerine Bank

- 7. EQ Bank's Savings Plus Account

- 8. HSBC Bank's Free Account

- What did you learn?

Why do I need a student bank account?

By law, students are not required to use a student-specific account offered by a financial institution. But it's usually a good idea to take advantage of the special and short-lived perks they offer. Quick, while you still can!

Generally, most financial institutions have no monthly fees or minimum balance requirements on student accounts. In addition to free Interac e-Transfers and student-specific guidance, several provide sign-up bonuses in cash.

A student bank account enables you to own a credit card which offers you access to various credit products (such as credit cards or loans). The banks may also give discounts on other financial products, such as credit cards, investments, insurance, and a lower borrowing rate because these accounts are specifically designed for students.

Finally, having a student bank account with a budgeting program can help you learn the fundamentals of financial management and responsibility.

In most cases, your student account can be immediately converted into a regular adult account once you have graduated. Most of the time, this comes with additional costs and fewer rewards. So do your homework before this happens and get a better deal from one of the best banks for students in Canada.

The best bank for students: what to look for

Identifying the best bank for students in Canada begins with knowing what you want and need from your banking experience. In contrast to domestic and overseas students, they may have unique demands.

Students in Canada should consider the following before opening a bank account:

Fees & transactions

If you’re the average student in Canada, your income is probably pretty low. Every penny counts so you don't want to spend more money than you have to. When looking for a student account, ensure it has a low or no monthly account fee. You also want to understand if there are any unlimited transactions or not, why types of transactions are included, and how many. If transactions are not unlimited, how many are allowed per month and how much does each one cost?

For students with little financial resources, even paying $40-$50 in annual banking fees is an unnecessary burden. That same money could help go towards a textbook or even be invested.

Read More: A Beginner’s Guide on How to Invest in Canada

Savings accounts & interest rates

If your parents routinely give some sort of allowance to help pay for the cost of living and college expenses, an interest-earning account is a smart financial move. You may need to consider other aspects beyond just interest rates when choosing a bank account.

Read More: 30 Best High-Interest Savings Accounts in Canada

If your income and/or allowance disappears from your account several days after it is received, it makes more sense to focus on the cost of fees and transactions. Transfer fees, time constraints, and the ease with which money can be transfered from one bank to another are essential considerations for international students.

Low or no minimum account balance requirement

If you maintain a minimum balance of $3,000, your bank may not charge you a monthly service fee. While these deals could be alluring, the monthly fee kicks in if your balance falls below the required minimum for even one day.

The best bank for students should offer a student account that does not require a minimum balance. Keep in mind, there are many online-only banks that offer virtually free accounts with no limit on certain types of transactions. Because an account is called a ‘student’ account, doesn’t mean it’s the best one for your needs.

Read More: The 7 Best Neobanks in Canada

Essential features

Choosing a bank account is an important decision since you want to be able to manage your money effectively. For instance, it ought to have minimal or no transfer costs, allow you to pay your educational expenses and support things like education grants, scholarships, and student loan-related transactions.

Reward points

A good rewards program has the potential to make one student account better than another. Nevertheless, be wary of “bait and switch” schemes that will not serve your interests in the long run. Do the type of rewards and redemption options align with your needs and goals? If not, there is no value added.

Interac eTransfers & other types of transactions

It is to your advantage to have free unlimited transactions like Interac eTransfers. You should also consider a high debit card transaction limit that is as high as possible and as frequent as possible to cover big things like paying tuition, purchasing books, and other incidentals. It would be best if you were allowed to conduct as many online transactions as possible without being charged a fee by your bank.

ATMs: access & use

One of the crucial factors is how easily you can find an ATM for the bank where you have your student account. So, you must ask whether your bank's ATM network is free, easy to use, and easily accessible. The best bank for students should offer accessible ATMs with minimal or no fees. Check out our page of ATM reviews.

Sign-up bonus

Banks often provide new customers with a sign-up incentive to encourage them to open an account. Your college campus is a gold mine for banks advertising aggressive sign-up offers, so take advantage of it.

The best banks for students should offer a generous sign-up bonus for an account that already has all the features you need. You won't find it at every bank, but it's a nice perk to be on the lookout for.

Credit cards & credit score

Student credit cards can be a powerful tool, but they come with great responsibility. It's essential to keep this in mind before you apply for one. There is a right and a wrong way to use a credit card, and the latter could have serious long-term consequences that hold you back from things like getting an apartment or even your dream job.

Read More: How to Build Credit for Beginners: Introduction to Credit Cards

If you start using a credit card from a young age, you're more likely to develop excellent spending habits and a strong credit score. Additionally, search for extra features like cash back in the categories where you spend the most money.

Read More: What is a Credit Score? The Complete Guide For Canadians

The 8 best banks for students in Canada

Your next step should be to compare different banks in Canada to see which ones meet your specific needs. Here are the 8 best banks for students in Canada:

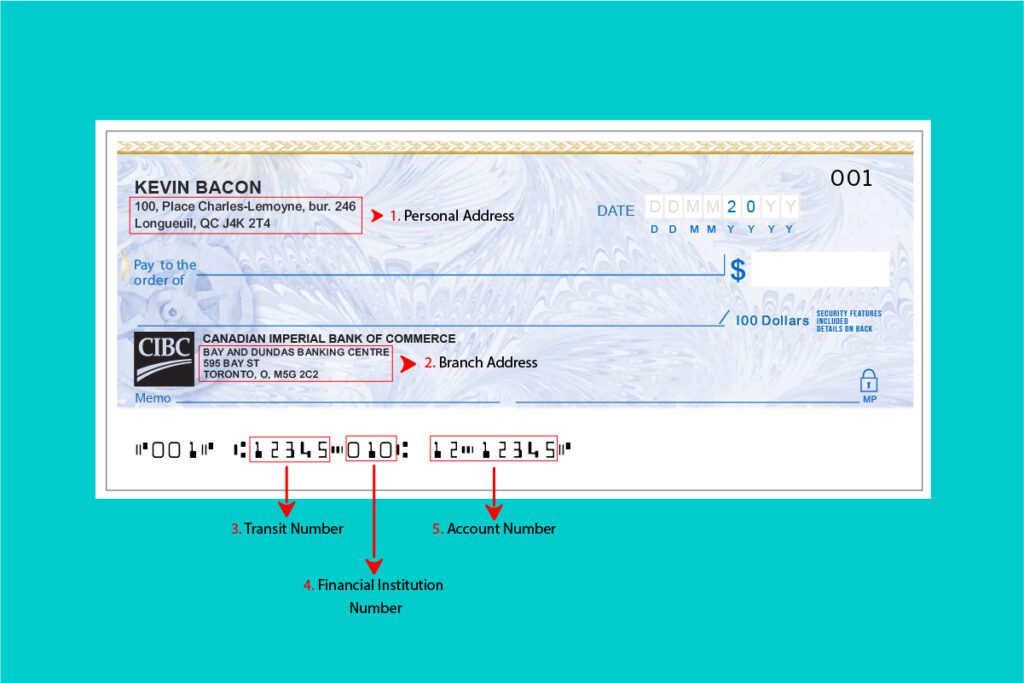

1. A Free CIBC Chequing Account

Students can open a Smart Account with CIBC. It is a free checking account that allows for unlimited transactions and unlimited e-Transfers through Interac. That's a beneficial account that eliminates the need to keep track of your monthly transactions. Transactions should not be one of the many things you must keep track of. Your focus should be on studying as much as you can.

Read More: CIBC ATM Review

However, there is an expiration date on CIBC's Smart Account for Students. Once the 4.5-year limit expires, it instantly becomes a regular bank account with fees.

In addition, CIBC often comes up with welcome offers for new customers. As soon as you open an account and meet the terms and conditions, you'll be eligible for a bonus, which is usually cash. Your bonus money can buy roughly 20 energy drinks for all-nighters if pepperoni pizza isn’t your thing.

Rewards

SPC membership (Studen Price Card) is included in the CIBC Smart Account. You can take advantage of discounts, competitions, and other promotional incentives for services or goods at merchants across Canada while saving the $10 SPC membership cost.

Qualifications

Students currently enrolled in an accredited institution, college, or CEGEP are eligible to open an account in this bank. Moreover, students can access their CIBC accounts at over 1,100 branches and 4,000 ATMs. This account is open to Canadian and non-Canadian students, regardless of nationality.

When you’re not a student anymore

When you’re no longer a student, consider switching to Simplii Financial for a free account. Simplii Financial is an online-only bank owned by CIBC.

Read More: Simplii High-Interest Savings Account Review

2. Scotiabank's Free Unlimited Account

The free Scotiabank Student Banking Advantage Plan allows for an unlimited number of transactions and Interac eTransfers. In addition, you'll have access to over 4,000 branches and ATMs around the country with this account type. This account is also open to students from Canada or the United States enrolled at a university or college in either country.

Read More: Scotiabank ATM Review

Rewards

Students can earn Scene+ points and redeem them for movie tickets, dinning, shopping, travel and more. Earn points just by using your Scotiabank student account in the same way as other Scotiabank accounts.

Read More: Scotia SCENE Rewards Program: How to Maximize Your Points

Qualifications

A student must be enrolled full-time in a post-secondary institution to qualify for the Student Banking Advantage Plan. Scotia SCENE or Scotia Passport cardholders can receive a bonus of 5000 SCENE points or Scotia Rewards points if they apply for a credit card.

Credit card

Scotiabank offers students a no-fee SCENE Visa Credit Card, which may be used to earn free movie tickets and meals at participating restaurants. A $75 cash bonus is also available to new customers who meet the requirements.

Read More: Scotiabank's Best Credit Cards in Canada

When you’re not a student anymore

When you’re no longer a student, consider switching to Tangerine for a free account. Tangerine is an online-only bank owned by Scotiabank.

Read More: Tangerine: The definitive guide to Canadians’ favourite online bank

3. The Free Student Account At TD Bank

A Student chequing account at TD is free and offers 25 free transactions per month and unlimited Interac eTransfers for students. Each additional transaction costs a total of $1.25 dollars of your hard-earned money. While the interest rate is low at 0.01%, it's one of the few student accounts that even pay interest. The critical advantage of opening an account with this bank is the personal service you receive. So, if that matters to you, go ahead and benefit from opening a student bank account.

Student line of credit

However, the credit line for students is considerable, especially for certain study programs. Full-time and part-time students can qualify for up to $20,000 over 4 years, bringing the total to $80,000. If you're studying for a professional or graduate program, you can qualify for more. For example, you could qualify for up to $350,000 for a graduate dental or medical program.

Credit cards

Two of TD's four student credit cards have no annual fees, making them ideal for students. Some offer cash back and others offer TD reward points. Certain TD credit cards even have perks for Starbucks and Amazon lovers. Visa-Debit is available on the TD Access Card, their standard debit card, for online and in-store purchases.

Read More: The 6 Best TD Credit Cards

ATMs

TD Bank has more than 1091 locations in Canada and over 3000 ATMs. Each ATM withdrawal from a machine not owned by TD Bank costs $2.

4. RBC's Free Banking Account

Students at RBC have two options. Students can open a free Interac e-Transfer account and get up to 25 transactions each month without paying any fees. On the other hand, there is a one-year fee waiver on the No Limit Banking for Students account, which usually costs $11.95. The name “No Limit Banking” refers to the ability to make as many transactions and Interac e-Transfers as you want.

Sign-up offer

Additionally, RBC provides bonuses and promotions, such as a $60 starting incentive for new customers. They also make a $60 donation to the charity of your choice on top of that already generous offer.

You must do at least two of the following to receive their promotions: mobile check deposit, Interac e-Transfer, or any transaction.

Read More: RBC sample cheque: everything you need to know to find it and understand it

Financial literacy

RBC has a unique app for students that emphasizes e-Transfers, customization, and a more straightforward understanding of banking jargon.

Credit cards

You may also be eligible for a reimbursement of up to $39 each year on some credit card annual fees. Furthermore, If you prefer to purchase online, RBC can give you a virtual Visa debit card.

ATMs

In Canada, RBC has the most expansive network of bank branches and ATMs. You should be able to easily access an RBC ATM no matter where you go to school.

5. Student Account At BMO

BMO Bank of Montreal offers a $10.95 discount to students on the Plus, Performance, and Premium accounts. The Plus subscription is now free, thanks to the discount. Although the most basic account is not discounted, it is cheaper (free) to upgrade to a full-featured Plus account than to stick with the less-featured Practical one. The banking app has a CreditView tool that allows you to check your credit score at any moment without affecting it.

Unlimited Interac e-Transfers are also included in the Plus account. Performance account holders get unlimited transactions, but it costs $5.00 per month to be allowed more transactions.

Qualifications

A full-time student at an accredited university, college, or private vocational school qualifies. BMO also extends the student discount for up to a year after your degree program.

International students can also create a student account with a Canadian visa or study permit, a government-issued photo ID, and evidence of enrollment at the institution. Students from China can open a chequing account in Canada before they even arrive. It's also possible to buy a guaranteed investment certificate (GIC) to aid in getting an official study visa.

Student line of credit

Medical and dentistry students can take advantage of BMO's specialty accounts, which offer student loans tailored to their needs.

Cash back perks

A student chequing account with BMO offers a $70 benefit. A BMO cash back Mastercard provides a $125 bonus, and a BMO Student Line of Credit rewards up to $500. (these offers are during the promo period only). To be eligible for the opening bonus, you must be a new BMO customer and perform four Interac e-Transfers with your new account.

ATMs

This bank has around 900 branch locations and 2,200 ATMs across the country. Depending on where you go to school, you should be able to find a BMO ATM close to you.

Read More: BMO Automated Teller Machine Review

6. Tangerine Bank

Scotiabank's online banking division, Tangerine Bank, is the most well-known digital bank in the country. This account isn't advertised as a student one but offers many of the same benefits. You won't be charged a monthly fee because it's free. One chequebook is provided without charge, and additional ones cost $50.

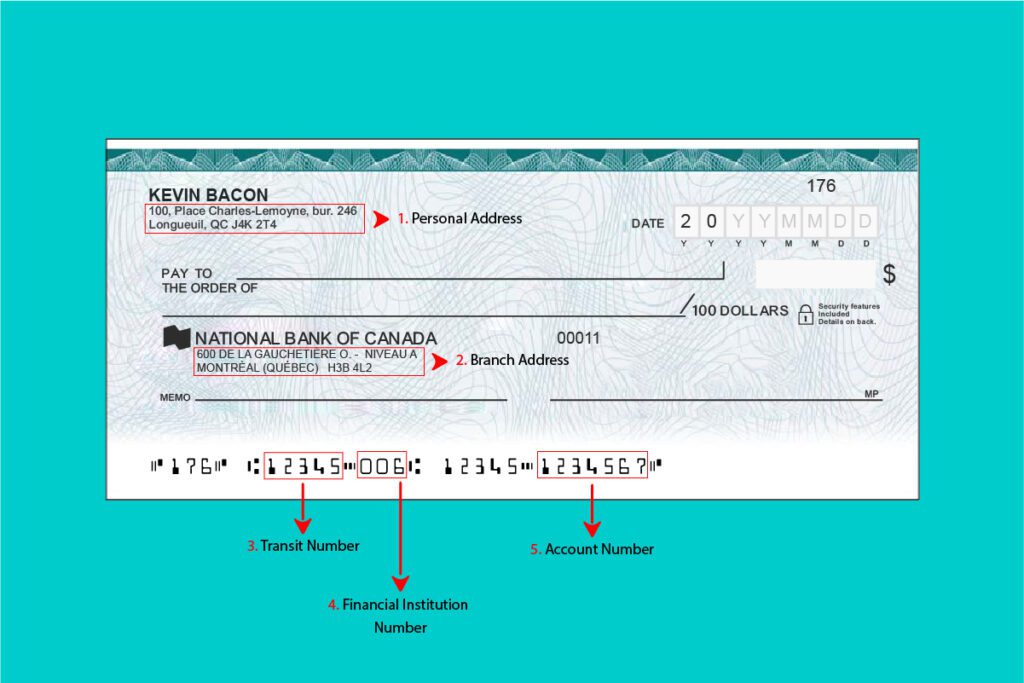

Read More: Tangerine sample cheque: everything you need to know to find it and understand it

In addition, it offers more features than most student accounts, such as bill payments, unlimited debits, pre-authorized payments, Interac e-Transfers, and email money transfers. You also get an interest rate on deposits in your chequing account of up to 0.10%, and deposits in your savings account up to 0.40%.

ATMs

Since Scotiabank owns Tangerine, its ATMs are available to you fee-free and without any restrictions. You'll be able to use 3,500 free Scotiabank ATMs in Canada and 44,000 worldwide, thanks to Scotiabank's Global ATM Alliance. You might not even need an ATM since free mobile cheque deposits are another perk.

Read More: Scotiabank ATM Review

Credit cards

Additionally, you can apply for the Tangerine Money-Back Credit Card, which doesn't have an annual fee and gives limitless 2% cash back on purchases in up to three categories. You earn 0.50% cash back on all other purchases.

Read More: Tangerine Money-Back Credit Card Review

7. EQ Bank's Savings Plus Account

A Canadian Schedule 1 bank, Equitable Bank is the parent company of EQ Bank. For several reasons, its Savings Plus Account isn't the kind of account you're searching for when it comes to your regular banking and spending. Due to the lack of a debit card and bank machine access, electronic transfers are the only means to get money out of the account once it has been deposited.

To get around this, you can link your EQ Bank Savings Plus Account to another chequing account. You can also send and receive Interac eTransfers. The quickest way to withdraw money from your EQ account is to eTransfer it to yourself and deposit the funds into another account of yours that has a debit card. Or you can write a cheque to yourself and deposit it in another bank account.

Read More: EQ Bank Void Cheque: Everything you need to know to find and understand it

Interest on deposits

Despite the accessibility downside, The EQ Bank Savings Plus Account offers a competitive interest rate if you need a safe place to store your money, which is a huge pro. You earn up to 1.65% on your account balance, which is 165x more than what most other banks offer.

A student loan hack

Keep the money from your student loans or any other funds in the Savings Plus Account at EQ Bank, where it can grow rather than sit in another account and not earn anything. Then transfer it to some different bank account in portions when required. This will help any interest you may have to pay on a student loan.

8. HSBC Bank's Free Account

You'll find HSBC Bank Canada on the list of major financial institutions in Canada. This bank's main business, HSBC Holdings Plc, has over 40 million customers worldwide. There are no monthly fees on their student bank account, allowing unlimited transactions. In addition, there is no minimum balance required.

With an HSBC account, you'll have access to free Interac e-Transfers®, free mobile cheque deposits, and free cash withdrawals at thousands of ATMs throughout Canada. It also enhances accessibility with mobile and online banking. This bank has 130 locations across Canada and offers access to over 3650 ATMs across Canada.

Read More: HSBC Canada Void Cheque: Everything you need to know to find and understand it

Qualifications

You must be at least 18 years old, a Canadian citizen, and enrolled full-time in an educational program at a Canadian post-secondary institution to create an HSBC Student Chequing account.

Credit cards

If you wish, HSBC can provide you access to an HSBC credit card. The HSBC +Rewards Mastercard is a low-interest rate card with student-friendly perks.

Read More: HSBC +Rewards Mastercard Review for 2022: a Low-Interest Credit Card with Many Perks

What did you learn?

Since everyone has different banking needs and goals, their definition of the best bank for students in Canada could differ. However, lists such as these are super helpful to compare banks and narrow down the right one for you.

Many of the banks mentioned above offer free banking for students, like: CIBC, Scotiabank, and Tangerine Bank. You can pick one of these three if free banking is what you're looking for. On the other hand, BMO has excellent offers for international students.

Most banks on this list offer perks like credit cards and sign-up offers. So, you can select the one that best suits your needs and delivers the best value for your money.

Even though you won't be able to use your student bank account after you graduate, you should still make the most of the opportunity while you still have it.

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois