Are you looking for a better way to bank? A neobank could be just what you need. But what exactly is a neobank? Well, it's all in the name; neo means new or revived. A neobank is an online bank or financial technology (fintech) company that offers financial products and services directly to consumers. But there’s a catch; neobanks exist entirely online which means their services can only be accessed through a device like a computer or a smartphone. Without the expensive operating cost of brick-and-mortar locations, neobanks pass the savings on to you with reduced fees or no fees at all, better rates, and attractive rewards. It’s time to break up with your branch. Let’s take a look at some of the best neobanks in Canada and what they have to offer.

What is a neobank? Online banks and challenger banks

Finance can be a pretty intimidating place. Neobanks can take many forms, and it can get a little confusing. Here are some key terms to understand so you can choose a neobank like a boss:

A digital-only online bank

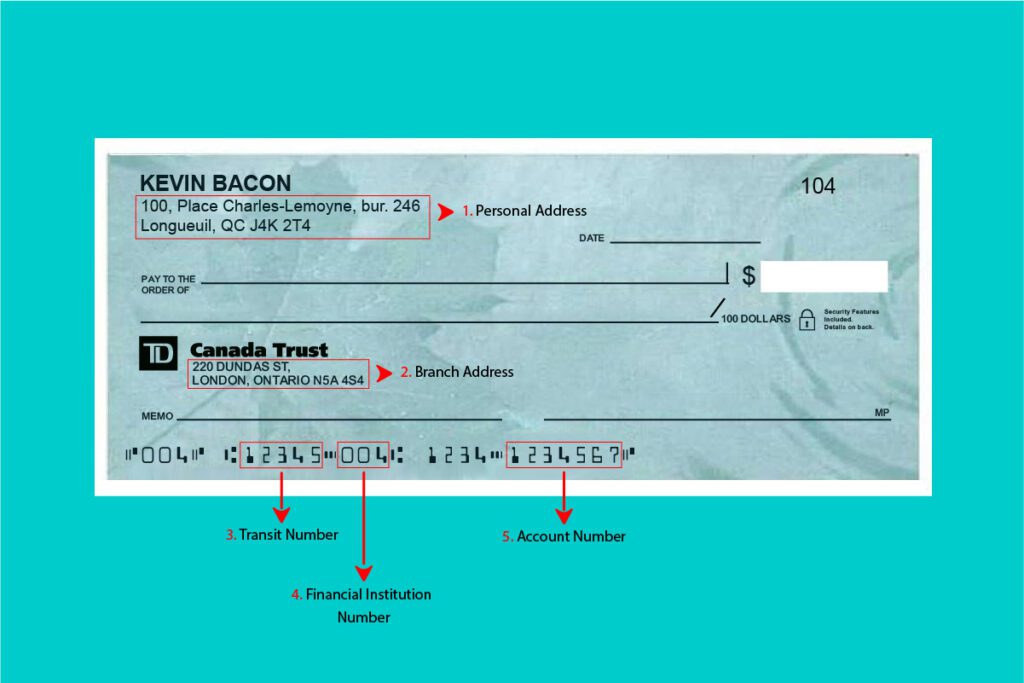

An online bank is a type of neobank. An online bank is a financial institution that can only be accessed online because it does not have any physical branches. Financial services are provided digitally and you need reliable access to an internet-connected device like a smartphone or a computer. Some online banks exist independently, others are owned by a bigger, more traditional financial institution. Either way, you can access all the same essential banking services entirely online. Because online banks don’t have branches, the overhead costs are significantly lower. Therefore, most products and services offered by online banks are usually free.

Online bank vs online banking

Online banks should not be confused with online banking. Since online banks are digital-only, naturally all your banking is done online too. However, traditional banks also offer online banking to their customers. Have you ever signed into your Scotiabank Preferred Chequing Account to pay a bill, send an eTransfer, or check your balance? That’s online banking, but Scotia is not an online bank. Online banking is just a verb to describe how you do your banking, not who you do it with.

The challenger: a neobank from a fintech

A challenger bank is a financial technology company (fintech) that exists entirely online and provides creative banking services not typically offered by traditional banks. All your banking is done through an online platform on a device like a computer or a mobile app on your phone. Challenger banks challenge the traditional banking model with more creative and flexible financial solutions. Many services offered by challenger banks come at a fraction of the cost of the big guys, or at no cost at all. Some offer a full suite of banking services similar to a regular bank, while others only offer niched financial products or services. Whatever the case, they are independent entities not owned by a federally regulated institution, like one of Canada’s Big 6 Banks for example.

The Challengers: a neobank

A neobank can be an independent financial technology company (fintech) that offers financial services directly to customers. Below is a list of some of our favourite fintechs that are revolutionizing the financial services landscape. These are independent companies not owned by a bigger traditional bank. Instead, many have partnered with other institutions to help provide creative products and insure deposits.

Neo Financial

Neo Financial is a new online-only neobank in Canada that offers a host of financial services including a cash account, credit card, investment tools, and a killer cash back program. If you’re from western Canada, you’ve probably heard of SkipTheDishes; a popular food delivery app. The bright minds that revolutionized take-out are the same ones behind Neo Financial. Here’s a look at what Neo Financial has to offer:

- Neo Money is a hybrid chequing-savings account that lets you spend easily and save smarter. The account is free to use with unlimited free transactions and no monthly fees. Every dollar in your account earns an aggressive 1.3% interest rate, making it one of the best high interest savings accounts in Canada. In one account you can save more, pay bills, make purchases, and send and receive Interac eTransfers. Interest is calculated daily and paid monthly, and you can track how much interest you’ve earned through the Neo mobile app. Neo Money is not currently available in Quebec, but will be launching there soon.

- Neo Mastercard is a traditional credit card that offers one of the best cash back programs on the market. You’ll earn an average cash back rate of 5% at Neo partner retailers, a 15% cash back bonus on your first purchase at partner retailer, and a guaranteed minimum of 1% cash back on all your purchases. That means if your average cash back rate across all purchases falls below 1%, Neo will top you up.

- Neo Secured Mastercard is a secured credit card designed for those who don’t qualify for a traditional credit card. It’s easy to get with guaranteed approval and no hard credit check. Once your application is approved, you’ll provide a $50 security deposit, one of the lowest on the market. Start using your Neo Mastercard to start earning cash back rewards and other perks.

- Neo Invest is an actively managed investment fund partnered with CI Investments. You can start investing with as little as $1, and your portfolio is tailored to your goals, timeline, and risk appetite. With Neo, you can invest within an RRSP, TFSA, or a personal non-registered account. You’ll pay a 0.75% fee for assets under management. Depending on your particular portfolio, you may also need to pay a Management Expense Ratio (MER) fee that could range from 0.4% to 0.5%.

KOHO

KOHO is a Canadian financial technology company that provides essential banking services like an online bank, but better because it’s not a bank. With KOHO you’ll get incredible rewards, and creative financial solutions exclusively online. All your banking is done online through the KOHO mobile app. The KOHO prepaid card is one of the best prepaid cards on the market and the mobile app helps you spend, budget, and save better. Other perks include a program to build your credit score and early access to your paycheck.

- No Brainer Cash Back Account is a chequing and savings account in one that is free to use and offers unlimited free transactions. You’ll earn 1.20% interest on every dollar you deposit and comes with a prepaid credit card that is accepted almost everywhere credit cards are accepted.

- KOHO Prepaid Card comes free when you open a KOHO account. The card is accepted everywhere most credit cards are accepted. You’ll get a minimum of 0.5% cash back on every purchase you make with the card, up to 5% cash back at KOHO partner retailers. You can round up your purchases to meet your savings goals faster. For more perks and a higher cash back rate you can subscribe to KOHO premium for $9 a month.

- KOHO Credit Building program helps you build your credit history or repair your credit score. There are no hard credit checks and your approval is guaranteed. For $7 a month, KOHO will open a line of credit in your name, and every monthly payment will report to the credit bureaus. The program runs for 6 months at a time, and you can renew the program if you want to keep building your credit score.

- KOHO Early Payroll gives you access to $100 of your paycheck 3 days before your next payday, for free. For a $5 fee, you’ll get immediate access to $100 of your paycheque whenever you need it, as well as access to a KOHO financial coach for 15 days. You’ll never be charged interest because it’s not a loan. As long as you have your paycheque set up for direct deposit into your KOHO account you qualify for this feature.

MOGO

MOGO is an online financial services company anyone can use but caters to the crypto-enthusiast. This Toronto-based fintech offers a spending account that comes with a prepaid Visa card, crypto cash back rewards, crypto trading, and a soon-to-launch commission-free stock trading platform. MOGO is currently the only environmentally friendly neobank that helps you reduce your carbon footprint every time you make a transaction with your MOGO card, trade stock, or buy Bitcoin. Unfortunately, this neobank is not available in Quebec.

- MOGO Visa Platinum Prepaid Card comes free when you open a MOGO account, doesn’t require a credit check, won’t affect your credit score, and is accepted everywhere Visa is accepted. You load the card with your own money and it’s free to use with no monthly fee. The card offers unlimited free transactions except for foreign currency purchases, ATM transactions, and an inactivity fee. For every purchase you make with the card, you’ll earn Bitcoin cash back and MOGO will plant a tree.

- MOGO Crypto lets you buy Bitcoin directly through the MOGO crypto trading platform for a 1% trading fee. MOGO offers climate-positive Bitcoin through its commitment to plant enough trees to offset the C02 emissions associated with mining all the Bitcoin traded on their platform. You’ll get access to a Bitcoin price chart, track your investment in real-time, get price alerts, and even track the average cost of your Bitcoin trades.

- MOGO Money and MOGO Mortgage offer personal loans and mortgages that are easier to access than traditional lenders. For personal loans, they offer a satisfaction guarantee and will refund your interest and fees if you repay your principal in full within the first 100 days. If you get a new mortgage or renew with MOGO Mortgage you could get up to $3,100 cash back into your Bitcoin rewards account.

- MOGO Trade is a new commission-free trading platform set to launch in 2022. Right now, those who open a MOGO account and download the app will be added to the waitlist. For every trade you make on the MOGO platform, they’ll plant a tree to help restore Canadian forests devastated by wildfires. Until the trade feature launches, you can track your favourite stocks with real-time prices and create a custom watchlist.

Wealthsimple

Wealthsimple is an investing-centred fintech, and one of Canada’s favourite online trading platforms. Established in 2014, the company has now amassed over $8.4 billion in assets under management (AUM). They’re less of an online bank type of neobank, but still offer some key financial services for investing, saving, and spending. Let’s take a look at Wealthsimple’s key features:

- Wealthsimple Cash is a spending account and peer-to-peer cash app like Venmo.It comes with a free Prepaid Visa that is free to use and offers unlimited transactions. You’ll earn 1% cash back on every purchase you make with your Wealthsimple Prepaid Visa that you can either keep on the card to spend, cash out to your own account, or use to invest in stocks and crypto with Wealthsimple. In the app, you can instantly send and receive money to and from your contacts, deposit to your account, and withdraw your balance for free as well.

- Wealthsimple Invest is a robo-advisor that uses award-winning technology to build a personalized investment portfolio based on your time horizon, goals, and risk appetite. You can choose to invest within an RRSP, TFSA, RESP, RIFF, LIRA, or a personal non-registered account for only 0.5% management fees. All you have to do is deposit money into your account and they do the rest. Wealthsimple will automatically diversify your portfolio, rebalance it, and reinvest your dividends. For a truly passive experience, you can set up automatic deposits.

- Wealthsimple Trade offers commission-free stock trading for self-directed investors. You can get started with as little as $1 and invest within an RRSP, TFSA, or personal non-registered account. With a basic no-fee trading account there are no minimum account balances, you can access fractional shares, get instant deposits to your account, real-time price quotes, and set unlimited price alerts. For $10 a month you can upgrade your trade account to include no foreign transaction fees on US trades and instant deposits to your account of up to $5,000.

- Wealthsimple Crypto is a fully regulated cryptocurrency trading platform you can access within the Wealthsimple Trade app. You can get started with as little as $1 with no account minimums or fees to deposit or withdraw funds from your account. Trading fees are built into the spread between the bid price of a crypto and the asking price. According to Wealthsimple, you’ll never pay more than 2% per trade. There are currently 46 coins listed for trading, with more added frequently. All your crypto can be stored in custody on the platform and several can be transferred to your own private wallet.

- Wealthsimple Tax is a free tax filing service that helps you optimize your tax return with an easy-to-use platform. The software will auto-fill return by connecting to your CRA account, automatically split your return to get the best possible return, and helps you find credits and deductions with a smart keyword search function. If another tax service gets you a better refund, Wealthsimple will reimburse you up to $50 of what you paid to file with the other guys. Wealthsimple Tax also connects to your Wealthsimple Crypto account, and other platforms and wallets too, for easy crypto tax filing.

The online bank: a neobank owned by a financial institution

A neobank can also be owned outright by a traditional bank. Below are digital-only online banks that do not have any physical branches and are owned by a fully regulated Canadian financial institution. Instead of opening an account in a brick-and-mortar location, account setups and banking services take place on a digital platform through a computer or a mobile app on your phone. Here are some of our favourite neobanks that provide no-fee accounts, unlimited transactions, and other daily banking essentials.

EQ Bank

EQ Bank is the neobank often referred to as Canada’s “original challenger bank.” It is a digital-only online bank wholly owned by Equitable Bank; Canada’s 8th largest independent bank that is federally regulated under the Bank Act. With this neobank, you get access to personal bank accounts, investment accounts, global money transfers through Wise, and mortgages. On the downside, EQ Bank does not offer a debit card or cheques nor is EQ Bank available to residents of Quebec. Here are some EQ Bank highlights:

- EQ Bank Savings Plus Account, sometimes referred to as the EQ Bank High Interest Savings Account (HISA), is a hybrid chequing-savings account in one. You’ll earn an aggressive 1.5% interest rate on every dollar in your account. There is no account minimum to get this rate, and the account is entirely free with no monthly or annual fee. Unlimited free transactions include bill payments, electronic funds transfers, Interact eTransfers, and transfers between EQ Bank accounts. Open a Joint Savings Plus Account to enjoy the same benefits with up to 3 other people. This account does not offer a debit card or a chequebook.

- EQ Bank US Dollar Account allows you to earn 1.00% back on every dollar in your US account. It's free with no monthly fee and you can easily buy US cash with one of the lowest exchange rates available on the market. You can send US dollars to other USD account holders in the US and abroad, with free USD to USD transfers within Canada.

- Their investment products include Guaranteed Investment Certificates (GICs), TFSAs, and RSPs. The GICs offer a wide selection of terms with some of the highest rates on the market, can be registered or unregistered, and minimum deposits as low as $100. The TFSA and RSP accounts offer 1.5% interest on your balance, no account fees, and automated recurring deposit features.

- EQ Bank Mortgage Marketplace gives you access to over 2,000 mortgage products from Canadian lenders. This feature will help you find the best mortgage rate for you, even if its not through EQ Bank. The application process is done entirely online in just a few minutes. EQ Bank will match you with the right mortgage based on your needs and connect you with a broker. You can get a mortgage pre-approval or submit a full application to your lender of choice.

Tangerine

Tangerine is one of Canada’s favourite digital-only online bank. This neobank was originally ING Direct; a Netherlands-based challenger bank that entered the Canadian market in 1997. In 2012, Scotiabank acquired ING Direct and renamed it Tangerine. Until recently, Tangerine did have a handful of physical branches across Canada, called Tangerine Cafés. Those brick and mortar locations meant Tangerine wasn’t technically a neobank. However, the cafés have closed indefinitely, making Tangerine a digital-only online bank. It offers all the same essential banking services you’re used to but with no monthly fees, better rates, and attractive rewards. Let’s take a look:

- Tangerine Chequing Account is free with no monthly fees and includes a visa-debit card; a debit card that is also accepted like a credit card everywhere that Visa is accepted, including online and abroad. The account includes free unlimited transactions like debit card purchases, bill payments, Interac eTransfers, and free access to all Scotiabank ATMs across Canada.

- Tangerine Savings Accounts are some of the best high-interest savings accounts in Canada with a 0.10% standard rate, no monthly account fees, and no minimum balance. There are no surprise or unfair service charges, and you can set up an Automatic Savings Program (ASP) to put your savings goals on autopilot. Tangerine Savings Accounts include a basic savings account, TFSA, RSP, RIF, and a US Savings Account.

- The Tangerine World Mastercard and the Tangerine Money Back Mastercard are the only two credit cards offered by Tangerine, but are some of the best cash back credit cards on the market. Both are free with no annual fee, and you earn 2% cash back in 2 spending categories of your choice, and no limit on the amount of cash back you can earn. The Tangerine World Mastercard offers additional perks like Mastercard Travel Rewards, Boingo WiFi access, on-demand subscription services, rental car insurance, mobile device insurance, and airport lounge access.

- Other Tangerine products and services include Guaranteed Investment Certificates (GICS), non-registered investment funds, mortgages, home equity lines of credit, lines of credit, and business accounts.

Simplii Financial

Simplii Financial is a digital-only online bank owned by CIBC. Before venturing into the neobank space, CIBC had previously partnered with Loblaws to provide banking services to customers of President’s Choice Financial, commonly known as PC Financial. The partnership ended in 2017 when CIBC and Loblaw’s parted ways. CIBC created it’s own online-only neobank called Simplii Financial that offers free bank accounts and other financial services. Unfortunately, Simplii Financial is not available in Quebec.

- Simplii No Fee Chequing Account is a free bank account that offers unlimited debit card purchases, bill payments, withdrawals, and Interac eTransfers. You also get free access to all CIBC ATMs across Canada.

- Simplii High Interest Savings Account made the Hardbacon list of best high interest savings accounts in Canada. It’s a free account with no monthly fees, 0.10% interest on every dollar in your account, and no minimum account balance required. You cannot attach this account to your debit card or access it through an ATM. If you want to access the money in your Simplii Savings account, you need to transfer it to your Simplii Chequing account first.

- The Simplii Financial Cash Back Visa Card is a no fee credit card that gives you 4% cash back on restaurants, bars, and coffee shop purchases. You’ll get 1.5% cash back on gas, groceries, drugstore purchases, and pre-authorized payments. All other purchases earn 0.5% cash back and there is no limit on how much cash back you can earn. Spending limits apply to each category, and cash back is paid out annually in December.

- Other Simplii Financial products include, but are not limited to: global money transfers, digital gift cards, and foreign cash. They offer investment products like TFSAs, RRSPs, GICs, and Mutual Finds. You can also access loan products like a mortgage, personal line of credit, secured line of credit, and personal loans. Other accounts offered by Simplii Financial include a student banking offer, and a USD savings account.

Neobank pros and cons:

🟢 Free or low-fee banking services

🟢 Better interest rates on savings accounts

🟢 Lower rates on loan products

🟢 Better rewards or cash back rates

🟢 Quick access from anywhere

🟢 Fast application process

🟢 More creative and flexible products and services

🔴 Less personal with out branches and tellers

🔴 No physical branches if you need assistance

🔴 May require a credit check to open an account

🔴 Limited ATM access

🔴 Limited products and services

🔴 Banking requires internet access, a computer, or smartphone

About The Author: Heidi Unrau

Heidi Unrau is the senior Finance Journalist at Hardbacon. She studied Economics at the University of Winnipeg, where she fell in love with all-things-finance. At 25, she got her first bank job as an entry-level teller. She moved up the ranks to Credit Analyst, Loans Officer, and now a Personal Finance Writer. In her spare time, you'll find her hiding in the car listening to Freakonomics podcasts, or binge-watching financial crime documentaries with a pint of Häagen-Dazs. When she's not chasing after her two little boys, she's in the hot tub or arguing with her husband over which cash back card to use for date night. She’s addicted to coffee, crypto, and obsessively checking her credit score on Borrowell.

Fun Fact: Heidi has lived in five different provinces across Canada, loves her free Tangerine bank account, and will never cut back on Starbucks. Like ever.

More posts by Heidi Unrau