If you’re looking for a quick method to transfer funds from one Canadian chequing account or savings account to another, Interac is a good option. Interac e-Transfers allow you to send and receive money within a few minutes. They’re safe thanks to security features like adding a security question to the transfer that the receiver will need to provide. This means that even if you mistakenly sent the money to the wrong recipient, they couldn’t collect the funds.

- E-Transfer limits

- What is Interac e-Transfer?

- What is an Interac E-Transfer Autodeposit and how do you get it?

- How does Interac e-Transfer work?

- Interac e-Transfer fees a limits

- How to send Interac e-Transfer

- Receiving an Interac e-Transfer

- Different Canadian banks' Interac e-Transfer fees and limits

- National Bank of Canada

- Laurentian Bank

- CIBC

- BMO

- TD Canada

- HSBC

- Simplii Financial

- Tangerine

- EQ Bank

- Scotiabank

- RBC

- Manulife

- Desjardins

- Vancity

- Alterna Bank

- Frequently asked questions bout Interac e-Transfer

E-Transfer limits

In most cases, Interac e-Transfers are free of charge for both parties involved. This makes them the cheapest and often most popular means of sending and receiving money. The one downside is that there are limits with how much money you can transfer at one time.

The amount you can transfer will vary from bank to bank. There are daily, weekly, and monthly limits for sending money via Interac e-Transfers. Also, customers at the same bank may have different limits depending on the account they have. The limit is higher for those with business accounts compared to personal chequing accounts. If you want to have higher limits, you can make a request through your bank.

E-Transfer limits are based on the kind of transaction. There are receiving, sending, and requesting features to accommodate you. If you have a receiving limit of $2500 and someone sends you $3000, the remaining $500 will be in your account.

What is Interac e-Transfer?

Interac e-Transfer is a fast, secure way to electronically transfer funds to a recipient. You have to be able to access your online banking. The transactions are usually instant or take just a few minutes to complete. The recipient will receive an email that you’ve sent them money and it’s easy for them to accept the transfer.

They just need to know the answer to the security question that you’ve asked. This is one of the features that make it fail proof. E-Transfer has pretty much replaced writing cheques or paying someone with cash. The process is faster, convenient, and more secure. You can transfer funds from your desktop computer or mobile device at any time.

This system supports transferring money to Canadian bank account holders. If you’re looking to transfer money to an international bank, there are other solutions like e-wallets or bank wire transfers. This is exclusively for transferring money within Canada in a safe, fast manner.

What is an Interac E-Transfer Autodeposit and how do you get it?

Autodeposit is a convenient way to receive funds directly without going through the fuss of answering security questions. The recipient just needs to register their email address with Interac to automatically get funds in their account. When a sender is giving someone money via Interac e-Transfer, they are notified a that the recipient is registered for Autodeposit.

How to set up an automatic e-Transfer deposit

- Log into your online banking or the mobile app.

- Look for Autodeposit in the Interac e-Transfer section.

- Register your email address and link to the account.

- Go to your email to find the confirmation message sent to you from your bank.

- Click on “complete registration.”

Once you’ve registered, you don’t need to log in to online banking or answer a security question to receive your e-Transfers. When someone sends you money, funds are deposited into your account without you having to do anything.

How does Interac e-Transfer work?

It’s incredibly simple as a Canadian to use e-Transfers whether you’re sending or receiving. The Interac Cooperation was developed by the largest banks in the country. It’s possible to use this service if both parties hold a Canadian bank account.

The security question ensures a secure transfer while other security features are also in place. Funds are put directly into the recipient’s bank account. If someone is expecting money, they have the option to initiate a request with the Request Money feature in any Canadian online banking platform. There are about 250 financial institutions that utilize e-Transfers.

Interac e-Transfer fees a limits

There is no fee to receive an Interac e-Transfer if you have an account at the same bank. Some banks may have an unlimited amount of free transfers for business and personal accounts. If your bank has a limit on how many free transfers you can do, you may need to pay. The fee is minimal and may be anywhere from $0.50 to $1.50, depending on the financial institution. We’ll go over the fees for each individual bank if there are any.

How to send Interac e-Transfer

It’s very simple to send an e-Transfer to someone. You go to your online banking and then click on the e-Transfers button. If you already have the recipient in your list of people, you can just click on them. If they’re not in your list, you add them. You will need their name and email address or phone number.

Once you have the recipient information and have selected them, you put in the amount you want to send. Add the security question when applicable and confirm the transaction. Make sure you send the answer to the security question to the person receiving your e-Transfer.

Receiving an Interac e-Transfer

When the sender completes the transfer, you’ll receive a notification. You can click on the link in the phone or email notification. There will be a list of banks. Choose the bank you’re with and you’ll be redirected to your online banking.

First, you’ll have to answer the security question, which you’ll get from the sender. If you’ve registered for auto-deposit already, you can skip these steps as the amount will go into your account directly. There’s no need for a security question.

Different Canadian banks' Interac e-Transfer fees and limits

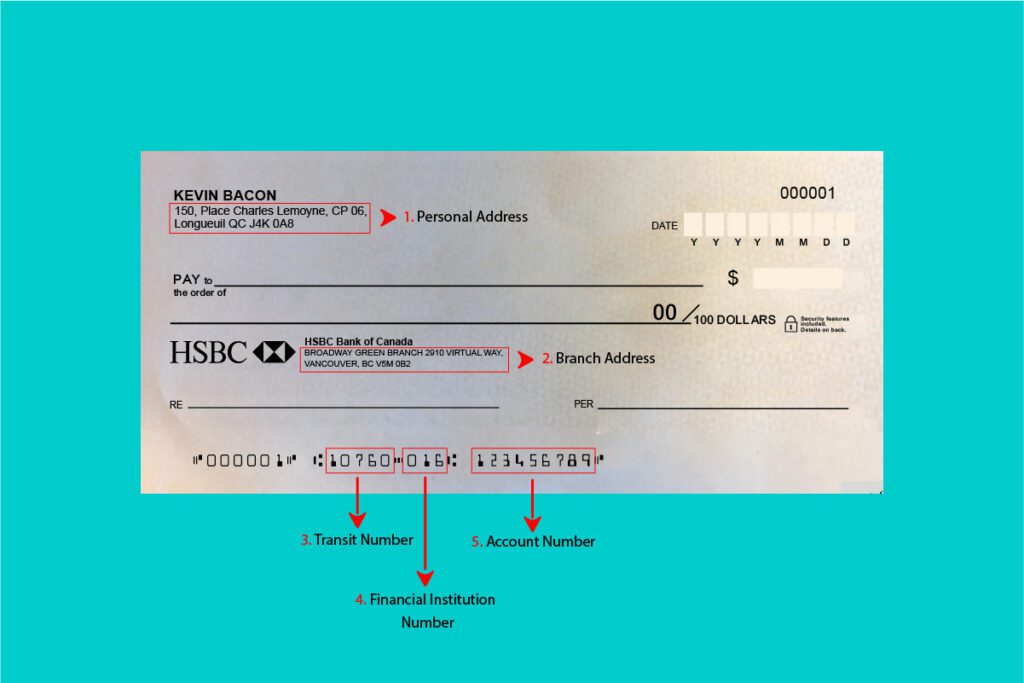

Every bank in Canada offers Interac e-Transfers as it’s a convenient way to send and receive money. You only need a chequing account. Their fees and limits may vary. Here’s a list of the main banks in Canada, their fees and limits.

National Bank of Canada

While you’ll have free e-Transfers monthly with the National Bank of Canada, they’re not unlimited unless you have the top-tier bank account. For example, if you have the Minimalist account, you get 12 free transfers. Should you exceed the number of transactions included in your package or offer, you pay an additional $1.50 for each e-Transfer you mae in the month. Here is the breakdown.

- You can send up to $5,000 per day.

- The weekly limitation is $25,000 per week.

- The maximum per transaction you can receive is $25,000.

Laurentian Bank

Each e-Transfer you do as a sender comes with a $1 fee with Laurentian Bank. The recipient doesn’t have any fees to accept the money. The maximum daily amount that can be transferred is $10,000 with a maximum amount of $3000 per transaction.

Interac e-Transfer limits at Laurentian Bank are as follows:

- $3,000 per transaction

- $10,000 per 7-day period

- $20,000 per 30-day period

CIBC

Select bank accounts allow you to make Interac transfers without paying a fee. However, if you have a basic plan, it’s $1.50 per transaction while free to receive money. If the sender wishes to stop the transaction and wants to cancel, there is a $3.50 fee.

There is no minimum limit amount of money when sending an e-transfer. There are limits to how much can be sent including:

- $3,000 per 24-hour period

- $10,000 per 7-day period

- $30,000 per 30-day period

If you’re sending someone a request, the maximum limit you can ask for per transaction is $1,000. However, you can request up to 10 money transfers one after the other.

BMO

BMO offers free Interac e-Transfer transactions with any of their Everyday Bank plans. This is also the case for those with any Canadian chequing or Premium Rate Savings accounts.

The receiving and sending limits differ and are as follows:

Sender limits

- $2500 to $3000 per 24-hour period depending on senders debit card limit

- $10,000 per 7-day period

- $20,000 per 30-day period

TD Canada

When you send an Interac e-Transfer from your personal TD account, it’s free with most account options. There are fees when you use Send Money or Request money with the basic account plans however. It costs $0.50 when you send up to $100 and $1.00 for anything over $100. While most business accounts offer free e-Transfers, the basic plans have a $1.50 fee for all e-Transfers.

Interac e-Transfer comes with sending limits, including:

- $3,000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day period

HSBC

HSBC waives Interac e-Transfer fees when you transfer with your Canadian chequing or savings account. It’s free to receive an e-Transfer. They’re flexible with their limits as well. They include:

Sending limits

- $7,000 per 24-hour period

- $10,000 per 7-day period

- $40,000 per 30-day period

Receiving limits

- $10,000 per 24-hour period

- $70,000 per 7-day period

- $100,000 per 30-day period

Simplii Financial

Simplii Financial lets you send and receive an interac e-Transfer for free. If the sender wants to cancel the transaction, it costs $3.50. The Request Money feature has a limit of $10,000 with no minimum.

Sending limits include:

- $0.01 minimum amount per transfer

- $3,000 per 24-period

- $10,000 per 7-day period

- $30,000 per 30-day period

Tangerine

There’s no cost when you’re sending or receiving an e-Transfer at Tangerine. They have set up daily, weekly, and monthly transaction limits that include the following:

Sending limits

- $3,000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day period

Receiving limits

- $10,000 per 24-hour period

- $70,000 per 7-day period

- $300,000 per 30-day period

EQ Bank

If you’re an EQ client, sending e-Transfers is free. However, your other bank may charge a fee for sending. Here is the breakdown.

Sender limits

- $3000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day period

Receiving limits

- Up to $25,000 per transaction

Scotiabank

At Scotiabank, there’s a $1.00 fee for sending an e-Transfer and the limits will depend on the account you hold. However, they are quite strict with their $2,500 limit for those with basic and everyday accounts. If you’re a Scotiabank client, the best thing to do is go to your Accounts page and click on “Fastcash account setting & ScotiaCard limits.” Here, you’ll see exactly what your personal e-Transfer limit is for the account you hold. For business account users, your limit is $10,000.

RBC

There is no cost when it comes to sending an interac e-Transfer with RBC. The limits will depend on how much clients spend with their client card daily. To know how much your limits are, go to your online banking and click on “Daily Transaction Limit”. This is found in your account section and you’re free to edit limits that suit you.

Manulife

If you have a Manulife One account, e-transfers are free. With other accounts, you only get three free e-transfers per month and after that, they charge $1 per transaction. The minimum transfer limit is $10. There are maximum daily, weekly, and monthly limits as follows:

Sending limits

- $10 minimum transfer amount

- $3,000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day period

Receiving limits

- $10,000 per 24-hour period

- $70,000 per 7-day period

- $300,000 per 30-day period

Desjardins

If you have a monthly plan with Desjardins, Interac e-Transfers are free. If you exceed the transactions in your plan, It’s $1 per transaction.

They offer a higher than average limit for personal banking at $5,000 in a 24-hour period. You can receive up to $25,000 per transfer as well. If you have a business account, you can send up to $10,000 in a 24- hour period.

Vancity

While there are free e-Transfers available on select accounts, an e-Transfer costs .90 cents if it’s not covered within your account features. The following are personal sending and receiving limits.

Sending limits

- $3,000 per-transfer limit

- $10,000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day period

The maximum fund to receive in one transaction is $25,000.

Alterna Bank

With either a business or community account, senders are charged $1.25 for every Interac e-Transfer.

Sending limits

- $3,000 per 24-hour period

- $10,000 per 7-day period

- $20,000 per 30-day limit

The receiving limits are the following.

- $10,000 per 24-hour period

- $70,000 per 7-day period

- $300,000 per 30-day period

Frequently asked questions bout Interac e-Transfer

You can increase your daily debit limit and therefore send or receive higher transfer limits. This feature can be found online at your bank. You can also call your bank or visit the branch to raise your limits. Generally, most banks have a $3,000 per day e-Transfer limit.

In the menu of your online banking, search transactions and choose Interac e-Transfers. Look under pending transfers and select the transfer you want to cancel. Click “Delete” and confirm. You’ll need to specify which account you want the money to go back to.

It will often be instant but in some cases can take up to 30 minutes before the e-Transfer is successfully sent to the receiver’s account.

You can receive an Interac e-Transfer via email or SMS text. To accept the money, you select the link in the email or text message and follow the instructions that your bank gives you. This can be different with every bank but instructions are always straight forward.

You’ll need to be logged into your online banking or mobile banking app. From there, you’ll select your account and select the Interac e-Transfer option. Choose a recipient that you’ve already added or add a new recipient. You’ll add their name, email and/or phone number. Enter the amount you want to send to the recipient and a security question. If the recipient has registered for Interac e-Transfer Autodeposit, you won’t need to ask for a security question.

You’re able to set up a Pre-Authorized Transfer Service where you can set the amount to be transferred and the date. You can also make it a pre-authorized recurring transfer for your convenience.

If the person you’ve sent money to doesn’t accept the transfer within 30 days, they’ll receive a notification. If another 30 days go by, the sender is charged a $5.00 fee and the money is sent back to the account you used to send the e-Transfer. You can retrieve funds anytime if the recipient hasn’t accepted the e-Transfer.

Usually, Interac e-Transfers don’t take long. They will usually be in your account in less than 30 minutes. However, if you’re sending or receiving a large amount, a review may happen, which takes longer than 30 minutes. It may also be that your email system or internet speed is slow so you’re not being notified of the transfer in a timely manner.

Interac is only available to Canadian bank account holders and doesn’t work in the US.

If the receiver hasn’t accepted the e-Transfer you sent, you can cancel the transaction and the money is put back in your account. If they’ve already accepted the transfer, you’ll have to personally request for the money back from the recipient.

You click on the link that is sent to you, answer the security question if applicable. You can then choose to accept or decline.

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois