Tangerine Bank is known for having no branches. Prior to being purchased by Scotiabank in November 2012, Tangerine had existed since April 1997 under the name ING DIRECT Canada. This online bank offers several financial services, including s, savings accounts, credit cards, and more.

In this article, we’re going to discuss Tangerine’s different products.

Free chequing account

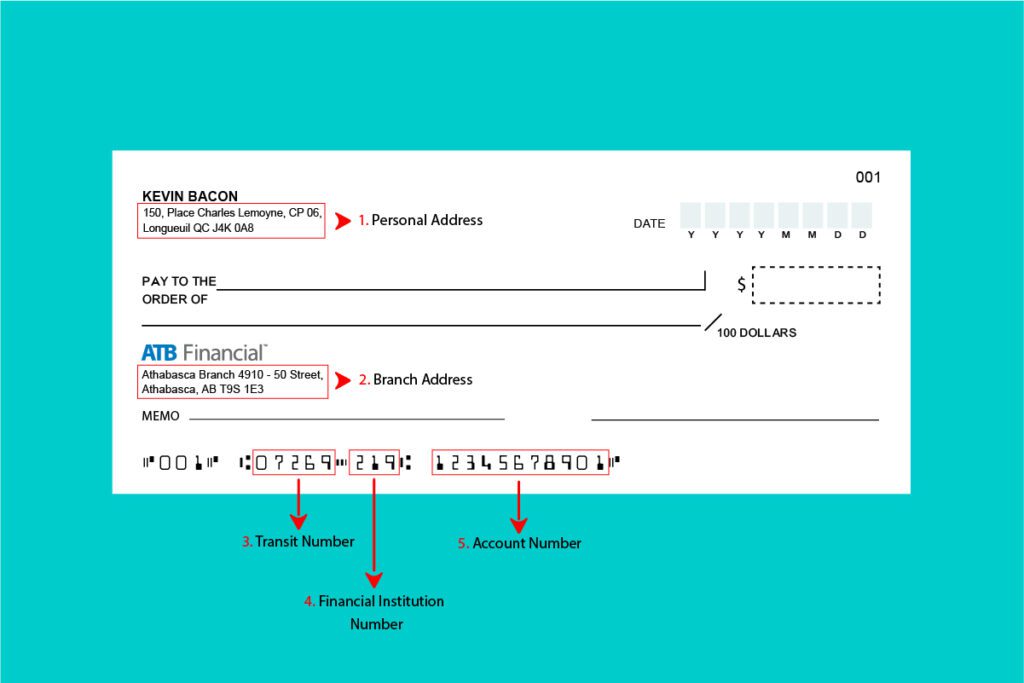

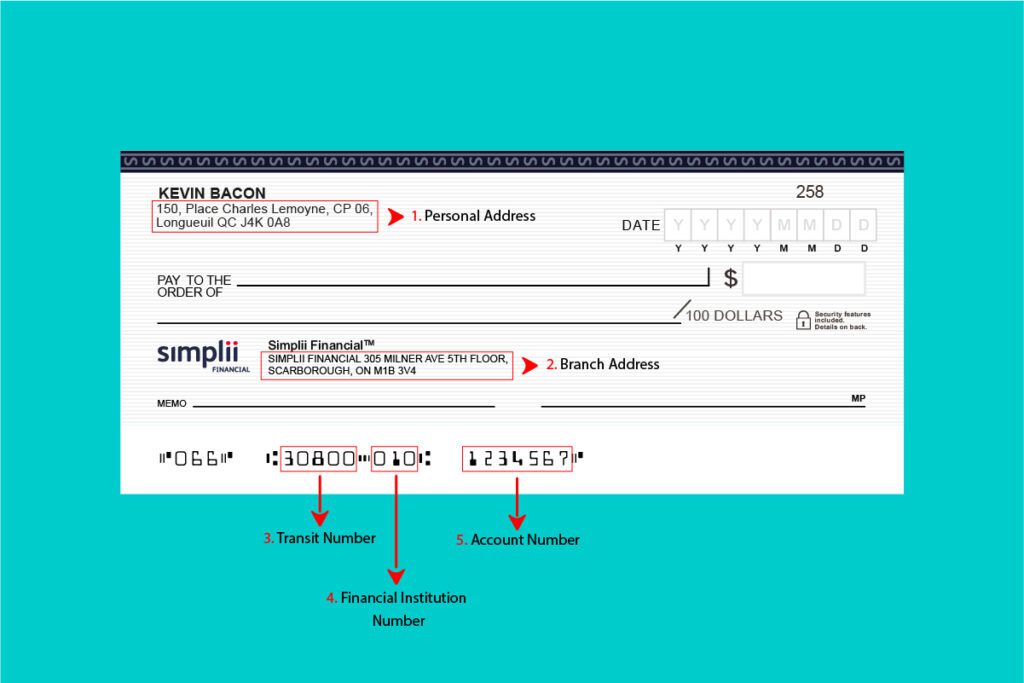

For Tangerine's no-fee chequing account, you get a rate of up to 0.15%. You get a special offer by opening your chequing and savings accounts with a 2.15% rate for your Tangerine savings account for the first 5 months. You also have the option of getting a $200 bonus. To do this, you must set up direct deposit of your payroll and maintain it for 3 consecutive months.

The chequing account has no monthly fee and features unlimited transactions. Online banking, email money transfers, Interac e-Transfers, and the first chequebook are free. After that, chequebooks cost $50. When you withdraw money from another Canadian institution’s ATM, there is a charge of $1.50. However, you can use Scotiabank ATMs free of charge. When making withdrawals in the United States, the fee is $2. It's $3 in other countries.

You have the option of replacing your debit card for free once a year. A second replacement in the same year will cost $15. If your chequing account is inactive for 10 years, a $40 inactivity fee is applied.

A Zero Liability policy from Interac and Visa Debit protects you against unauthorized purchases. You also have access to 44,000 ATMs around the world, in addition to using Scotiabank ATMs in Canada for free. You can put your debit card on your cell phone through either Apple Pay, Google Pay or Samsung Pay to make payments using your phone or smart watch.

You can use the Visa Debit feature to shop online with your chequing account.

Learn more about how to choose a checking account.

Tangerine Savings Accounts

Savings account

This account has no monthly fees and you earn 0.15% interest per year. No minimum balance is required to open your account. By opening both a chequing account and a , you get an additional 2% rate during the first 5 months.

Tax-Free Savings Account (TFSA)

With the Tax-Free Savings Account (TFSA), you can earn interest without the government dipping into your earnings. In fact, the TFSA gives you the same interest rate as the previous savings account, which is 0.15% and all transactions made by this account are free of charge. You are eligible for the 2.15% promotion under the same conditions listed above. You can use your TFSA not only as a savings account but also as an investment account.

RRSP account

With this account, you can reduce your tax footprint. Thus, the savings deposited into your RRSP savings account will help you to pay less tax at the end of the year. Of course, you must respect the contribution limit. This account has an interest rate of 0.15%, and 2.15% during the first 5 months.

US $ savings account

If you have US money and want to save it, the US $ savings account is for you. You pay no monthly fee and no minimum balance is required. You’re also eligible for the special offer of 2.15% interest for 5 months.

Tangerine credit cards

Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card earns cash back rewards. A 2% rebate per dollar spent is available in two of the following categories of your choosing: groceries, entertainment and transportation, home furnishings, restaurants, hotels and motels, fuel, recurring bills, drugstore purchases and parking. This card provides the possibility of benefiting from a third category at 2% if the cash back rewards are deposited in a Tangerine Savings account. Whether the cash back deposits are made to your credit card statement or to your Tangerine savings account, they are automatically paid every month.

All other purchases earn 0.5% back on every dollar spent. You are eligible for an unlimited amount of cashback rewards with the Tangerine Money-Back Credit Card. The card also has a welcome offer of 1.95% interest on balance transfers for 6 months, after which it increases to 19.95%. You can consult the Hardbacon comparator to learn more about balance transfers.

Purchase protection and extended warranty are included. Insurance provides 90-day protection on all items that have been stolen, lost or damaged. The warranty doubles the retailer's product warranty for up to one year.

This no-cost card requires an annual income of $12,000 to be eligible. All additional cards are free.

Tangerine World Mastercard

The Tangerine World Mastercard provides a 2% rebate in two of the following categories:

groceries, entertainment and transportation, furniture, restaurants, hotels and motels, fuel, recurring bills, drugstore purchases and parking. It also offers a third tier at 2% when you deposit your cash back rewards into a Tangerine saving account.

The rebate on all other purchases is 0.5%. Rebates are deposited monthly to the Credit Card or your Tangerine Savings Account. This card is only available to people with a minimum annual income of $60,000 (or $100,000 per household).

As it is a World Mastercard, you can enjoy several additional benefits:

- $1000 insurance in the event of theft or loss of a phone or tablet

- Damage insurance covering short-term rental vehicles

- Free access to Boingo Wi-Fi access points anywhere in the world

- Purchase protection and extended warranties

This credit card is free for the primary cardholder and additional cardholders. Lastly, the current welcome offer is 1.95% interest on balance transfers for 6 months.

This article was compiled by Hardbacon, which has designed a credit card comparator listing hundreds of Canadian credit cards. Hardbacon also helps you save on savings accounts, chequing accounts, online brokers, robo-advisors, life insurance, mortgages and personal loans. If you want to go one step further and take control of your finances, you should download Hardbacon’s mobile app, which links to your bank and investing accounts, helps you plan for your financial goals, create a budget and invest better.

About The Author: Antony Youssef

Antony is a project manager at Harbacon. A future graduate of the DESS - Business Analyst - Information Technology program at HEC in Montreal. He helped initiate and develop the Hardbacon comparison tool with the IT team. Passionate about the economy and the financial well-being of others, his goal is to inform readers on different topics concerning finance through his articles.

More posts by Antony Youssef