Regaining control of your finances begins with budgeting. Yes, you can create one by recording your income in one column and your expenses in another on a sheet of paper or in an Excel file, but there are a growing number of easy-to-use applications that can make your life easier. With the number of budgeting apps on the market, learning to manage a budget is within reach. No matter which budgeting method you prefer, there is an app for you! Here is a list of the 15 best mobile budgeting apps in 2020:

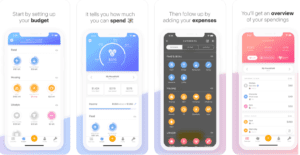

Hardbacon

Of course, this app is our favourite! Hardbacon is an investment, budgeting, planning, and tracking application. You can link all of your bank accounts to the app to keep tabs on your spending, as well as set limits for each category. When Hardbacon's algorithm determines that you are likely to exceed the limit set in a particular spending category, you’ll receive an alert to urge you to slow down.

Hardbacon also provides an overview of your recurring spending as well as a list of the businesses and categories in which you spend the most. Based on your behaviour, Hardbacon gives you personalized suggestions to help you become wealthier faster. The Hardbacon app is available in a free version that can link to your bank accounts, provide statistics on your expenses and view your expenditures and recurring expenses. This application also has premium version that helps you go even further in your financial journey.

How much does it cost?

Budget-related features are 100% free. Hardbacon also offers a premium version at a cost of $12.99 per month for those seeking more investment-related features.

Number of stars

App Store: 4.5/5

Google Play: 4/5

Average: 4.2/5

Mint

Mint is sort of the grandfather of all budgeting apps. You can use it to easily manage your budget. Mint gives you everything you need to create a budget, monitor your credit rating, and more. You can see your spending at a glance and view your transactions in a few clicks. You can also customize your alerts to be constantly aware of your financial situation.

How much does it cost?

Mint offers much of its services for free, but does have a premium version that provides a credit rating monitoring service for $16.99 per month.

Number of stars

App Store: 4.6/5

Google Play: 4.5

Average: 4.55/5

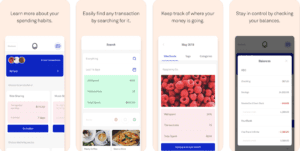

Wallet

Wallet is a flexible budgeting app. In addition to budgeting features, Wallet provides personal finance educational resources on their website. A premium version is also available with graphics to give you an overview of your financial situation, automatic categorization of your transactions and connection to an unlimited number of bank accounts.

How much does it cost?

There is a free version of the Wallet application as well as a paid version that costs $21.99 per year.

Number of stars

App Store: 4.6/5

Google Play: 4.6/5

Average: 4.6/5

EveryDollar

EveryDollar is a free app that lets you create a budget and monitor your spending. EveryDollar also offers a paid version that links to your bank accounts in order to add each of your transactions automatically to your budget. The premium version also allows you to view your account balances and receive educational content on financial topics such as debt, retirement, savings and more.

How much does it cost?

EveryDollar has a free version, as well as a premium plan that costs $99 per year.

Number of stars

App Store: 4.8/5

Google Play: 4.3/5

Average: 4.55/5

YNAB

You Need A Budget (YNAB) is an application that helps you manage your daily budget. YNAB teaches you how to manage your cash flow, save money and get rid of your debt. The particularity of this application is that it uses the budget envelope method. This method leads the user to allocate their money in different envelopes corresponding to different categories of expenditure. This app has a unique rule that “makes every dollar work”. This means that every dollar earned has a specific purpose (paying off debt, travel, studies, etc.). These features include real-time spending updates, goal-based tracking and progress reports.

How much does it cost?

YNAB does not have a free plan. There is a monthly plan for $11.99 per month and an annual plan for $84 per year.

Number of stars

App Store: 4.8/5

Google Play: 4.2/5

Average: 4.5/5

Good Budget

Good Budget is a personal finance app that lets you budget, track your debts, and manage your money. The application, which is available in both web and mobile format, stands out by allowing its users to share their budget with loved ones. Good Budget also generates useful reports to help you make better decisions about your budget and expenses, including income and expense reports, debt development report and expense reports by category. Good Budget offers a free plan that allows connection to a single bank account and saves its transaction history for 12 months. The paid version allows you to link an unlimited number of accounts and keep a transaction history for the last 5 years.

How much does it cost?

Good Budget has a free version as well as a paid version, which charges an annual fee of $45, or $5 per month.

Number of stars

App Store: 4.5/5

Google Play: 4.5/5

Average: 4.5/5

Spendee

Spendee helps you better understand your finances, manage your daily expenses, and optimize your budget to save you money. The app links with your bank accounts automatically to give you the most up-to-date financial profile possible. With Spendee you can invite family members who share the same expenses as you, in order to split certain expenses in two.

How much does it cost?

Spendee provides a free version so that you can create a budget without linking a bank account. Spendee also offers two paid plans; these are Spendee Plus, which costs $1.99 per month (or $14.99 per year) and Spendee Premium, which costs $2.99 per month (or $22.99 per year). These plans offer features like linking to bank accounts and budget sharing.

Number of stars

App Store: 4.6/5

Google Play: 4/5

Average: 4.3/5

Emma

Emma is a budgeting app designed to help you save money. This app analyzes your personal finances by logging into your bank accounts. In fact, until you have connected a bank account, you cannot access the app. Among its features are the ability to identify recurring expenditures and schedule the repayment of debts. Emma also has a paid version for those who want to go further within their budget. This version lets you customize the transaction categories.

How much does it cost?

All the main features mentioned above are free. The paid version of Emma costs $5.99 per month or $49.99 per year.

Number of stars

App Store: 4.6/5

Google Play: 4.5/5

Average: 4.55/5

KOHO

Koho is an application used to track your expenses. App users must use the KOHO Mastercard® Prepaid card (formerly KOHO prepaid Visa) card for their expenses, which can be used as a substitute for a chequing account, since you can receive your pay directly into your Koho account. Key features include cash back rewards on your spending (0.5% on all purchases), rounding of your purchases to the nearest dollar (like Moka), and real-time insight into your spending. KOHO also offers a paid membership that provides even more features like 2% cash back on your groceries, food and transportation expenses.

How much does it cost?

Koho offers a free version as well as a paid subscription that costs $9 per month or $94 per year.

Number of stars

App Store: 4.8/5

Google Play: 4.4/5

Average: 4.6/5

Wally

Wally is a personal finance app that helps you monitor your spending and budget so you can easily reach your financial goals. It also gives you access to all your transactions organized into categories. You can also receive a complete overview of your budget and your upcoming expenses thanks to its “Highlights” and “Insights” functionality. Wally is a perfect mobile app for families or anyone with whom you share the same expenses. One of its features allows you to share your budget in order to keep your loved ones informed of all expenses.

How much does it cost?

Wally has a free version and also offers a paid version called “Wally Gold”. This premium version costs $19.99 (one-time payment) and includes features like adding foreign currency accounts and managing your savings goals as a team.

Number of stars

App Store: 3.6/5

Average: 3.6/5

Fudget

Fudget is a budgeting app that helps you create income and expense lists to better understand the state of your finances. This app is easy to use and allows you to create a budget in just a few minutes. Add a star next to an income or expense item to indicate that it is recurring. You can also select a currency symbol of your choice from a list in order to take foreign currencies into account. Fudget has a paid version that enables you to share your budgets with your loved ones. You can save your data to a Dropbox account or export it in CSV format and open it in Excel.

How much does it cost?

Fudget has a free version as well as a paid version, which costs $2.99 (for how long? A month?) (one-time payment).

Number of stars

App Store: 4.8/5

Google Play: 4.7/5

Average: 4.75/5

Daily Budget

Daily Budget is a personal finance app that lets you create a simple and comprehensive budget in minutes. It offers a free version that features a daily budget calculator, a savings planning for upcoming larger expenses, and basic categories with which to categorize your expenses. (The paid version offers personalized expense categories.) You can also export your budget via Dropbox or to a CSV document. The paid version of Daily Budget provides you with even more analytical charts of your spending. Daily Budget is only available on the App Store.

How much does it cost?

Daily Budget offers a free version. The paid version of Daily Budget costs $10 (one-time payment).

Number of stars

App Store: 4.7/5

PocketGuard

PocketGuard is an application that helps you stay in control of your finances. Its features include building a budget based on your goals, and tracking expenses. You can add your credit cards or other bank accounts to see all your transactions and account balances. The ‘In my pocket' feature shows you exactly how much discretionary income you have left after paying your bills and saving. PocketGuard identifies the expenditures you’re no longer using in order to save you money. Like any budgeting app, PocketGuard lets you select your goals and helps you reach them and track your progress. An “Autosave” feature helps you reach your goals even faster by saving you a predetermined amount of money over a predefined period of time. PocketGuard does have a paid version, “PocketGuard Plus”, which gives you access to even more features.

How much does it cost?

PocketGuard is offered in a free version. It also has a paid version costing $34.99 per year or $4.99 per month.

Number of stars

App Store: 4.5/5

Google Play: 4.2/5

Average: 4.35/5

Buddy

Buddy is an app that helps you manage your budget and track your expenses. You can keep your budget to yourself or share it with your loved ones. It provides you with an overview of your expenses, income and savings. With the Buddy app, you can easily create savings plans to pay off debt or fund future goals such as travel, a vehicle purchase, or education. Buddy is available in a free version as well as a premium version. The app is only available on the App Store.

How much does it cost?

Buddy offers a free version as well as a paid version for $4.99 per month or $34.99 per year.

Number of stars

App Store: 4.7/5

Wellspent

Wellspent is an app designed to build good personal finance management habits that sets itself apart by emphasizing that managing your finances well makes you feel better. This application is based on the technique of financial “journaling”. All of your expenses are in one place to help you better visualize your financial situation. You can link your different bank accounts to record transactions automatically (you can also do it manually). Wellspent helps you stay organized with your spending. The application also allows you to tag your expenses in relation to your life events. For example, if you want to know how much you spent during your trip to Thailand, use #Thailand2020 to identify all your expenses during this trip.

How much does it cost?

Wellspent is a free mobile application.

Number of stars

App Store: 3.1/5

Google Play: 3.8/5

Average: 3.45/5

This Top 15 of the best budgeting Application in Canada was compiled by Hardbacon. Hardbacon also helps you save money on savings accounts, chequing accounts, online brokers, robo-advisers, mortgages and personal loans. If you want to take things one step further and take control of your finances, you should download Hardbacon’s mobile app, which links to your banking and investing accounts, helps you plan and budget for your financial goals, and helps you invest better.

About The Author: Sophie Albo

Sophie is the content specialist at Hardbacon. She is currently in her 3rd year of a bachelor's degree in marketing at Concordia University. Her passion for Fintech and was revealed during the 2016 Cooperathon where she received special award.

More posts by Sophie Albo