If you want to improve your credit score or credit rating, learn to understand your Equifax or Transunion credit report, or to get a lower interest rate on your next loans, then you’ve come to the right place.

Hooray! A 680 credit score puts you square in the good-credit category. Credit score ranges are between 300 and 900, and are

A 660 credit score is below average, but good enough to access most credit and lending products. Your credit score is a

A 650 credit Score in Canada is considered below average, but it’s easy to move up the ranks! A credit score is

What does a 600 credit score mean and how does it impact your life? A credit score is a three-digit number that

What are Consumer Credit Counselling Services and who needs them? Canadians are experiencing a tsunami of miserable economic conditions. We have inflation,

If you’ve recently checked your credit score, you might find yourself wondering what the number means. Or maybe you want to know

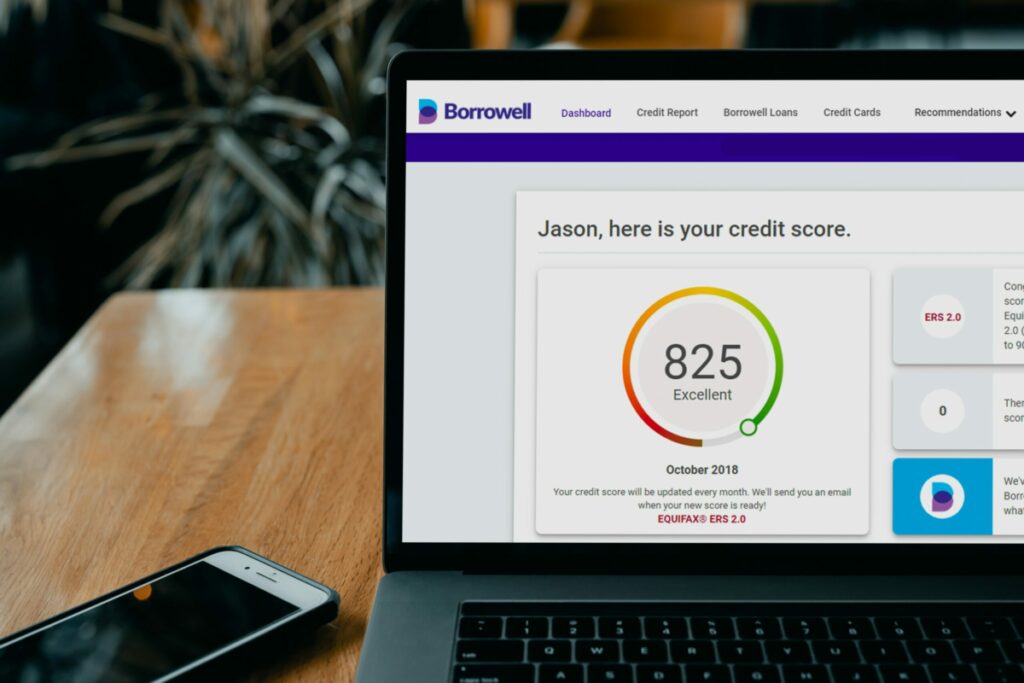

In collaboration with Borrowell “How to build credit” is one of the most searched credit questions on Google. Why? A good credit

A balance transfer credit card can reduce your debt by eliminating additional interest charges from the equation. But it can have a

You probably know by now that a bad credit score comes with not-so-fun consequences. But many fail to realize just how a

There are multiple ways to obtain your credit report for free in Canada. The most common way is to request a free credit report from the two main credit reporting agencies in Canada, Equifax and TransUnion. If you are a customer of RBC, Desjardins, BMO or CIBC, these banks have also partnered with these agencies to offer free reports to customers. Alternatively, you can also use the services of fintech providers such as Borrowell, Mogo and CreditKarma.

Credit agencies such as Equifax and TransUnion assign you a credit score based on your creditworthiness and history of debt management. This score ranges from 300 up to 900 with 900 being the highest score possible. In general, a score above 750 is considered to be excellent.

A credit reporting agency is an organization that gathers data on business and personal debts from creditors and lenders around the country, and uses it to assign people and businesses a credit score. This credit score is available on a comprehensive document called the credit report that also summarizes details like your other debt outstanding and history of repayments. In Canada, there are two main credit reporting agencies: (i) Equifax, and (ii) TransUnion.

Equifax last published average credit scores by age in Canada in 2018. At that time, the average credit score was 692 for the 18-25 age bracket; 697 for the 26-35 age bracket; 710 for the 36-45 age bracket; 718 for the 46-55 age bracket; 737 for the 56-65 age bracket; and 750 for the 65+ age bracket.

There are several reasons why you may need to file a dispute on your credit report. Some of the most common reasons include inaccuracies in personal identification details, closed accounts still being displayed as open, accounts being assigned to you because of identity theft, or errors in the number or quantum of debts outstanding. When this happens, you have two options.

You can file the dispute online with the specific credit agency (Equifax or TransUnion) by going to their website, opening a new dispute, and submitting the required documentation. Alternatively, you can also mail in your dispute with supporting documentation. Additionally, TransUnion also allows you to submit a dispute via phone.

An improved credit score brings with it several benefits like easier access to debt and favourable pricing on new debt. If you are seeking to bring your credit score up, some of the best ways to build credit are paying all bills and loan repayments in full on time, reducing your credit card utilization rates, increasing your credit limits, having a variety of different debts (such as a student loan, personal loan, car loan, etc.) instead of a single debt, and limiting the number of hard checks on your credit profile. You should also consider obtaining a free copy of your credit report to verify that there are no inaccuracies that are weighing down on your credit score.

Note that while having multiple debts outstanding can be used to drive higher credit scores, it is important to use this debt responsibly. Missed or late payments can have the opposite effect on your credit score.

A hard inquiry is conducted when a lender submits a request to view your comprehensive credit report to facilitate a credit application process. According to Equifax, a hard inquiry may stay on your profile for a period of up to 2 years. Unlike soft inquiries, hard inquiries do adversely impact your credit score by a few points each time that one is made.

Credit agencies such as Equifax and TransUnion assign you a credit score based on your creditworthiness and history of debt management. This score ranges from 300 up to 900 with 300 being the lowest score possible. In general, a score below 600 is considered to be poor.

There are several benefits to having a verified credit score like easier access to debt and favourable pricing on new debt. The fastest way to build credit is by getting a secured credit card. With a secured credit card, the lender will require the borrower to make an upfront cash deposit that is collateral for the debts incurred on the card. As you start making payments on time, you will be assigned a credit score that will progressively rise with regular payments.

Additionally, if you already have existing debt, paying off this debt in full or through regular payments can also enable you to start building your credit score quickly.

There is no universally common minimum credit score to buy a car as different lenders have different parameters for who they can lend auto loans to. If you are looking to obtain a car loan from a chartered bank, you will likely need to have a higher credit score (mid-650s or above). If you have a credit score below this threshold, you may still be eligible for a car loan, but you might have to approach alternative lenders instead.

Late payments on your credit report show up for a period of up to 6 years in Canada. If the late payment is reported correctly, it cannot be removed from the credit report.

If it is reported in error though, then you should immediately file a dispute with Equifax or TransUnion (depending on which agency reported the erroneous account). The agency will then conduct an investigation by contacting the lender, and if you are correct, then the late payment will be promptly removed from your record.

Subscribe to our free newsletter and receive personal finance content every week