The Ultimate Guide to RESPs in Canada for 2022

One way to give your child a head start in life is to save for their education. The Registered Education Saving Plan

If you’re looking to learn more about robo-advisors and automated investing in Canada, then you’ve come to the right place.

One way to give your child a head start in life is to save for their education. The Registered Education Saving Plan

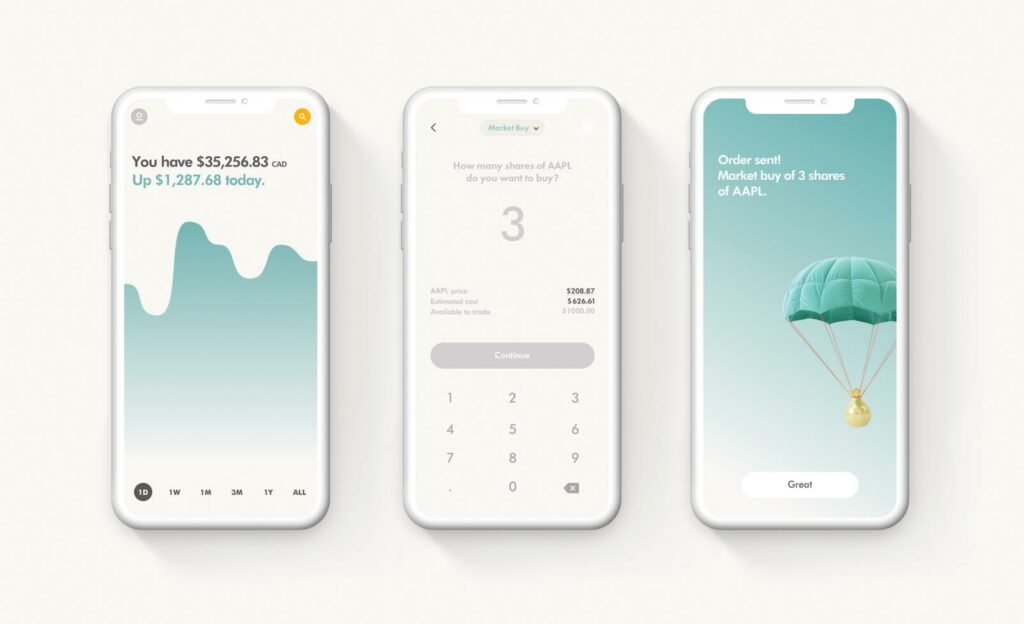

We started from the bottom now we’re here. Who’s we? Wealthsimple is the new kid on the fintech block kicking butt and

Over the last decade, robo-advisors have exploded onto the investing scene and disrupted how individuals invest. Old-school investment management companies employ lots

If you want to grow your money, stop saving it. The secret to building wealth isn’t a secret at all. You need

The S&P 500 index has gained close to 40% in cumulative returns since the start of 2020. Several indexes are trading near

The popularity of robo-advisor services is well established. Investors are most attracted to these products due to the fact that they are

The FIRE (Financial Independence Retire Early) movement’s popularity has been growing massively in recent years. Its ranks have been boosted by millions

Wealthsimple is an online investing service founded by Michael Katchen in 2014 in Toronto. Today the company has over $8.4 billion in

Robo-advisors are an increasingly popular way to invest because they offer portfolio management services online that do not require interactions between the

Subscribe to our free newsletter and receive personal finance content every week