Want to know a secret, Canada? There are 15 Amazon credit cards for Canada. You just have to know how to find them. In addition to the Amazon Mastercard, there are 4 TD Visa credit cards and 10 American Express cards that you can use on Amazon.ca and trade your points for merchandise. Yes, you can get free stuff from Amazon.

You can also maximize your cash back and points from all your Amazon Canada purchases. Here is what you need to know about Amazon credit cards in Canada: it all comes down to having either the Amazon Mastercard for Canada, certain American Express credits cards, or one of 4 TD credit cards. You earn cash back or points on all of them. The only real difference is when you redeem those points.

- Amazon credit card Canada: free Amazon stuff?

- Amazon credit card in Canada: what can you buy with your points?

- Amazon credit card Canada: the best credit cards for 2022

- TD Rewards Visa* card

- TD First Class Travel® Visa Infinite* Card

- TD Platinum Travel Visa*

- American Express The Platinum Card

- American Express Cobalt Card

- American Express Gold Rewards Card

- American Express Green Card

- Amazon credit card Mastercard

Amazon credit card Canada: free Amazon stuff?

If you have one of the 4 TD credit cards or one of 10 American Express cards that are part of the Amazon.ca Shop with Points (SWP) program, you can redeem your cash back or points at the Amazon.ca checkout. Here is how you do it.

Register an eligible TD credit card on your Amazon.ca acccount

TD points will be initially set as your default payment method. If you don't want to use your TD points, you can switch to another payment method, even if it's just your TD credit card. You can also decide how many points you want to use on the purchase.

What if you only want to use some of your TD points or you don't have enough to finance the entire purchase? You have to use the TD card the points are attached to, a gift card, or an Amazon credit balance that you already have. The minimum amount you can redeem is 3 points.

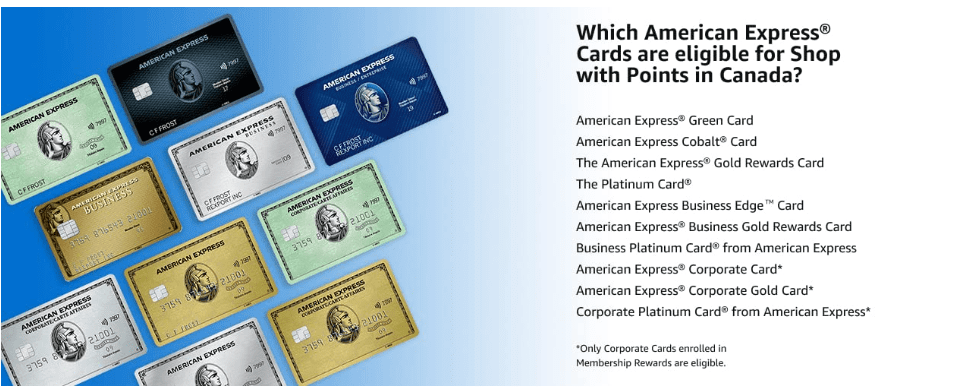

Register an eligible American Express card on Amazon.ca

The same process goes for registering your American Express credit card on Amazon.ca. You add your card as a payment method. When a product you want is eligible for the SWP, Amazon.ca will show your American Express Rewards points as a payment option.

As of the time of writing, 1,000 American Express Rewards points was equal to $7 CAN on Amazon Canada.

Amazon credit card in Canada: what can you buy with your points?

It's simple. An eligible product is usually sold and fulfilled, also known as sold and shipped, by Amazon.ca. The product will show if it is eligible for the SWP for TD program.

Plus, Amazon is offering a deal where you can get 40% off your Amazon purchase, up to a maximum of $30 CAN. This is an exclusive TD offer in Canada. There are certain conditions which we'll cover.

The SWP program only applies to certain products. The following products do not qualify for SWP:

- Amazon Appstore Apps

- Digital downloads (e.g., Apple Care)

- Individual digital music titles*

- Items ordered using Buy Now, except for Kindle eBooks

- Pre-order items

- Subscribe & Save items

- Prime Memberships through TD Bank Reward

Amazon credit card Canada: the best credit cards for 2022

There are many credit cards to choose from. While you can use business cards from TD and American Express, any shared business card has additional requirements, mostly to do with sharing points access. When it is a personal card, you have more control. The only available credit card branded specifically for Amazon is the Amazon.ca Mastercard. If you want to use Visa or American Express card points, you have significantly more choice.

TD Rewards Visa* card

Annual fee: $0

Interest rate: promotional rate of 9.99% for first 6 months. Then 19.99% on purchases, 22.99% on cash advances (20.99% in Quebec)

Welcome Offer: earn a $50 value in TD Rewards points to use at Amazon.ca with Shop with Points. Apply by October 29, 2022

†Conditions apply

The TD Rewards Visa* card is a rewards card and an Amazon credit card in Canada eligible for the SWP program. While all of the TD cards on this list understand how most Canadians shop or treat themselves, the TD Rewards Visa* has a Welcome Offer that understands inflation.

If you apply by October 29, 2022, you get a 9.99% promotional interest rate valid fo the first 6 months you have the card. You can also earn extra points, $50 in value, to use with the SWP program value. Add to that the SWP eligibility and 50% more Starbucks Stars when you use your card at Starbucks.

†Conditions apply. Visit the TD site to know all of the terms and conditions.

TD First Class Travel® Visa Infinite* Card

Annual fee: $120, waived year 1

Interest rate: in Quebec 20.99% for all transactions; rest of Canada 19.99% purchases, and 22.99% for cash advances

Welcome Offer: up to 100,000 points.†Conditions apply. Must apply by October 29, 2022

The TD First Class Travel® Visa Infinite* card is another Amazon credit card in Canada, but this time the focus in on travel lovers. The card is one of the best TD cards in Canada for a reason.

Essentially, you get the best of both worlds: the Amazon SWP porgram and travel rewards every time you use your TD First Class Travel® Visa Infinite*.

Instead of cash back, you earn TD points. The current Welcome Offer is up to 100,000 TD points plus no annual fee for the first year.

You have to apply for the card by October 29, 2022. This card gives you Amazon's SWP porgram and the Starbucks Star advantage. Wait, it gets better.

When you are ready to travel, you earn 9x the TD points when you book through ExpediaforTD, and there is never any blackout periods.

†Conditions apply. Visit the TD site to know all of the terms and conditions.

TD Platinum Travel Visa*

Annual fee: $89

Interest rate: in Quebec 20.99% for all transactions; rest of Canada 19.99% purchases, and 22.99% for cash advances

Welcome Offer: up to 50,000 points. †Conditions Apply. Must apply by October 29, 2022

TD Platinum Travel Visa* is another travel affinity card that is part of the SWP program. It is also one of the best TD credit cards in Canada. You can earn up to 50,000 TD Rewards points in the first year.

The annual fees are waived for the first year. You just need to apply by October 29, 2022. This card makes the list of the best rewards cards in Canada for good reason.

The regular earn rate is 3x the points on groceries and recurring payments, and 2x the points for all other purchases. You still benefit from the Starbucks Stars incentive.

This card gives you 5x the points when you use your card on Expedia for TD and there are still no travel blackout dates.

†Conditions apply. Visit the TD site to know all of the terms and conditions.

American Express The Platinum Card

Annual fee: $699

Interest rate: NA

Welcome Offer: up to 80,000 points

American Express The Platinum Card has a hefty fee and endless perks. That is why it is one of the best American Express Cards in Canada.

There is no minimum income requirement and the interest rate technically doesn't exist because it is not a traditional credit card.

You earn 3 Membership Rewards points per $1 spent on dining and food delivery. You get 2 Membership Rewards points per $1 spent on travel, and 1 Membership Rewards points per $1 on all other purchases.

As a cardholder you get all of the American Express Experiences plus access to good travel insurances.

American Express Cobalt Card

Monthly fee: $12.99

Interest rate: 20.99% on purchases, 21.99% on cash advances

Welcome Offer: earn up to 30,000 Membership Rewards points in the first year

The American Express Cobalt Card is an Amazon credit card for Canada, but it is a great card to have regardless. It is also among the top American Express cards in Canada.

You get 5x the points for restaurants and delivery, 3x the points for streaming subscriptions, 2x the points on travel or transit, and 1x points for all other purchases.

It seems like the most reasonable card in the Amex lineup. Plus, you still benefit from all of the perks of being an Amex member. Try comparing it to other credit cards and you will find that it is one of the most generous.

American Express Gold Rewards Card

Annual fee: $250

Interest rate: 20.99% on purchases, 21.99% on cash advances

Welcome Offer: earn up to 50,000 Membership Rewards points in the first 17 months

The American Express Gold Rewards Card is another example of a SWP Amazon credit card in Canada. This top American Express card helps you earn up to 50,000 Membership Rewards points in the first 17 months that you have the card.

You can also get the card in Rose gold. Still, the earn rate is pretty good. This card is different because it explicitly names pharmacy as a high earning category.

You earn 2x the points on travel, 2x the points on eligible grocery, gas, drugstores purchases, plus 1x the points on everything else.

In terms of eligible grocery, gas and drugstore purchases, it excludes superstores, wholesale clubs, alcohol retailers and general merchandise retailers.

Still, it leaves a lot of opportunity to earn a lot of points elsewhere.

American Express Green Card

Annual fee: $0

Interest rate: 20.99% on purchases, 21.99% on cash advances

Welcome Offer: earn up to 10,000 Membership Rewards points in the first year

The American Express Green Card is a no-fee credit card that earns 1x the rate on all eligible purchases.

Plus, you earn one additional bonus Membership Rewards point for every dollar charged to your American Express Green Card for eligible travel bookings.

The only thing is that you have to book through the American Express Travel website where American Express Travel, not the hotel or car rental company, is the merchant.

There is no annual fee for any additional cards and you earn the 10,000 Welcome Offer if you sepnd $1,000 in the first 3 months of having the card. if you miss a payment, the interest rate will increase to anywhere between 23.99% and/or 26.99%.

Amazon credit card Mastercard

Annual fee: $0

Interest rate: 19.99% for purchases, 22.99% for advances and transfers (20.99% in Quebec)

Welcome Offer: Get 5% back for the first 6 months on purchases totalling a maximum of $3,000

Canada's Amazon Mastercard offers two different cash back rates.

If you are a Prime Member you earn back for purchases made on Amazon.ca and or at Whole Foods Marke. If you don't have a Whole Foods in your area, you can order online. Prime members also earn 2.5% cash back on foreign currency transactions. For all other purchases made anywhere else, you get a 1% cash back incentive.

Do I need a subscription to Amazon Prime?

If you do not subscribe to Amazon Prime, your cash back rate drops to 1.5% for purchases made on Amacon.ca or at Whole Foods. You also earn only 1% on foreign currency transactions. Again, you earn 1% cash back on all other purchases made anywhere that accepts Mastercard.

Since this is a retailer card, it makes sense that the Amazon.ca Mastercard has purchase and extended warranty insurance. However you also get discounts at participating Avis or Budget car rental.You save a minimum of 10% off the base rates in the U.S. and Canada. Internationally, you get a minimum of 5% off the base rates.

Like any credit card, there is an attractive Welcome Offer. The current Welcome Offer is 5% back on restaurant, Whole Foods, Amazon.ca, and grocery store purchases. It is only valid on your first $3,000 in spending, and it expires after you've had the card for 6 months.

About The Author: Stefani Balinsky

Stefani Balinsky is the Editor in Chief at Hardbacon. She has been writing professionally since her days at McGill University and her summer internship at the Just for Laughs Festival. She has multiple degrees from McGill University and her PMP from the Project Management Institute. She loves data and research as much as she loves a good story. She has held marketing positions in publishing, health, and fintech companies. She also has an entrepreneurial mindset that feeds her curiosity.

More posts by Stefani Balinsky