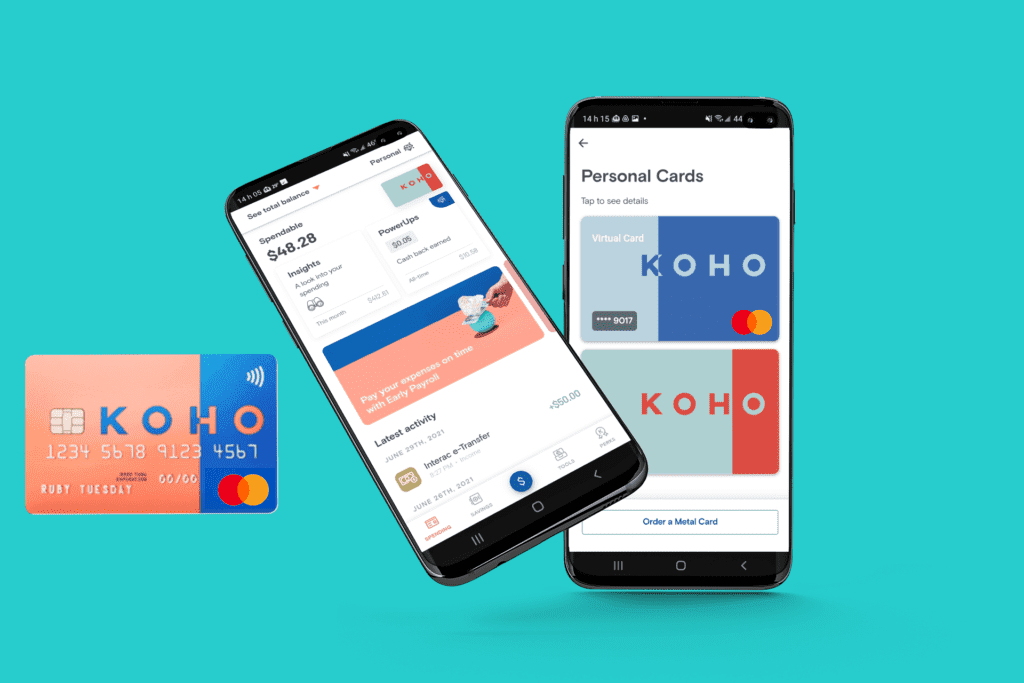

Get ready to expand your vocabulary, because very soon words like Mogo and KOHO will be part of it. What are they? Prepaid credit cards! They offer rewards, like any other credit card, without jeopardizing your credit rating if your balance goes unpaid. Interested? Read the article to find out if KOHO prepaid cards are right for you.

What is KOHO?

Credit card companies can often offer us unbelievable credit limits, going far beyond our monthly income. To maintain a good credit rating, it's best not to fill them up. These high credit card limits more often than not push the average consumer to spend more. However, a debt ratio of 30% or less contributes to maintaining a good credit rating. This means that you should not use more than $3,000 on your credit cards with a $10,000 limit. But how do you stop yourself before you go too far?

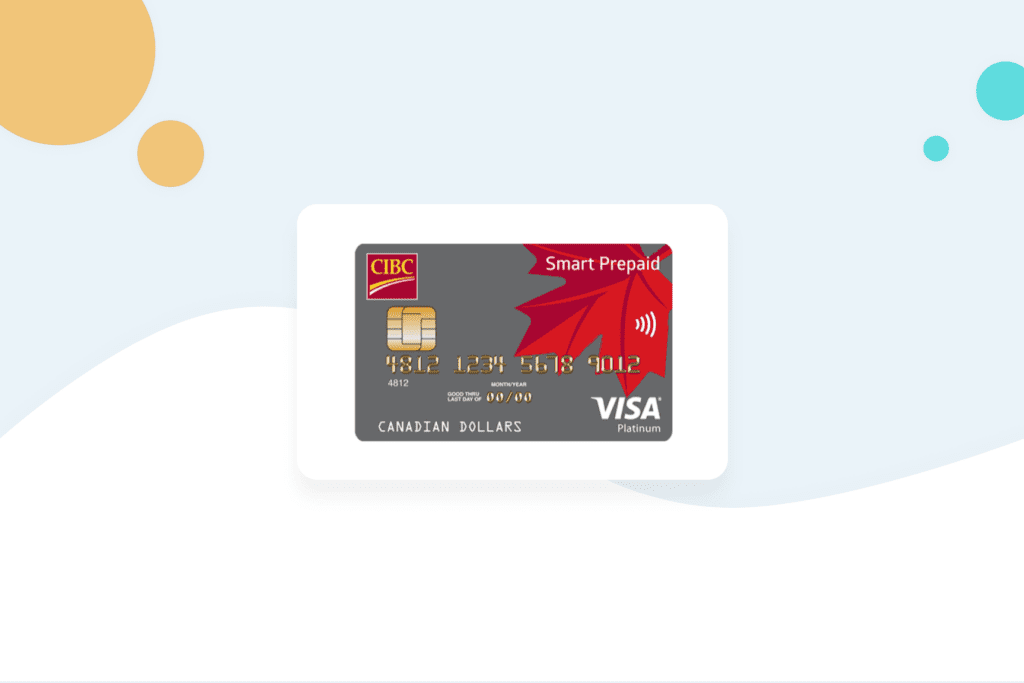

Prepaid cards are helpful for those who want to set a healthy spending limit. The KOHO Mastercard® card is accepted everywhere Mastercard is accepted. It's free and easy to reload.

Founded in 2017 in Vancouver, KOHO is a prepaid card service. Technically, KOHO is not a bank, but you can do all your spending and saving with its services. Its founder and CEO is Daniel Eberhard who had previously worked in the renewable energy sector.

He analyzed the accounts of several family members and friends. He realized that he wanted to help people save money on bank fees, which they often paid without even realizing it. KOHO describes itself as a fintech that offers Canadians an alternative to their traditional banking experience.

Let's break down the KOHO Mastercard® credit card

Any prepaid card is a sound alternative to credit cards.

KOHO prevents us from spending more money than we have in our account, while earning rewards. Like a debit card, the KOHO Mastercard® Prepaid Card allows you to spend only what you have in your account, and like a credit card, it offers you cash back rewards.

Part debit card, part credit card, choose KOHO to :

- Stay within your budget

- Get cash back on all your purchases

- Benefit from its low cost (it’s free!)

- Have no impact on your credit rating

How KOHO works

Where does the money you spend with KOHO come from? From your pocket! Or more precisely, from the account from which you loaded it. In short, it's your money, which you've already earned.

It's not an intangible debt against your future income, which changes your perspective and makes you more careful before you spend. On a day-to-day basis, it's just like using a credit card, but without the risk of adding 20% interest to your spending.

Plus, you don't have to maintain a minimum balance or make a certain number of transactions. If you try to make a payment and it runs out of funds, you will receive a notification. The money could then be withdrawn from your savings account.

KOHO may not be as well known as your typical big bank,, but that doesn't stop it from being accepted worldwide, wherever Mastercard is accepted.

Whether in Paris or online, you can pay for all your purchases with ease. KOHO also allows you to connect your card to PayPal, use Apple Pay to pay with your phone and has a bill payment function. In other words, the vast majority of your transactions are covered by KOHO.

KOHO Mastercard® Prepaid Card

The basic version of the KOHO Prepaid Card gives you 0.5% cashback on all your purchases. There is no annual fee, but it does charge a 1.5% conversion fee for foreign currency transactions and an international ATM withdrawal fee.

It gives you access to additional discounts at selected retailers and to the KOHO Save program. If you have any concerns, such as losing your card, you can also block the card directly from the mobile app.

Is this card unlimited? No, but you should be fine with its limits. You can't withdraw more than $300 at a time, and a total of $600 per day. The monthly limit is $3,000. Your card cannot hold a balance of more than $20,000.

The number of transactions you’re allowed to make is limited to 15 per day. The Joint Account has the same terms and conditions, but makes it easier to reach and track common and shared savings goals.

KOHO Premium Mastercard Prepaid Card

The Premium version will cost you $9 per month, but offers 2% cash back on groceries, restaurants and transportation, plus 0.5% cash back on all other purchases.

It allows you to make foreign currency transactions at no charge, as well as one free international ATM withdrawal per month.

The Premium card also offers financial advice. As long as you have your paycheque automatically deposited into it, a free financial coaching service is offered. For example, you’ll receive notifications on the status of your savings and budget.

If you accidentally mismanage a few bills, the pay advance service allows you to receive $100 up to 3 days before your next paycheque.

The Premium card is even more permissive. You can have up to $400 per withdrawal, for a maximum or $800 per day. The maximum per month is $4,000. But iff your goal is to get your finances under control, do you really need to spend more than $800 per day?

This card cannot hold a balance greater than $40,000. Check out the full details in the Koho Agreement.

Who is KOHO for?

KOHO is for people who want to manage their finances wisely. With this card, you only spend what you can afford so you'll be sure to stay within your budget.

Anthony, who has bad credit

Anthony doesn't have access to a credit card. In fact, he had to cut up his old card into tiny pieces because he couldn't stop overspending. He was only able to pay the minimum amount each month and his debt kept increasing. Because of his mismanagement, his credit rating dropped below 500 points.

Anthony likes to shop online regularly. He orders clothes from the U.S., China, sometimes books hostels for a weekend getaway and searches for bargains on eBay. Without a credit card, it's almost impossible. He needs a solution. The prepaid card is one of them, since it is accepted like any Mastercard card.

Anthony also has a bad habit of losing his keys and forgetting his wallet at his girlfriend's or friend's house. However, he always has his phone in his hand! Since his KOHO card is connected with Apple Pay, he was able to pay for his purchases in the store today even though his card was left at his girlfriend's house last night.

If you have bad credit and can't access a credit card with great cash back, KOHO is an option to consider. If you want to avoid credit and take control of your finances, prepaid cards are a great way to make your everyday purchases easier.

Mary, who wants to build her credit

Mary is just 19 years old and has always been on the lookout for start-up companies, so she learns about the benefits of various financial services before choosing a product.

She decided to try KOHO after her roommate told her about it. Every morning, she likes to grab a coffee on her way to work. She also likes to shop online. After all, more and more fashionable clothing companies are only available online.

With her roommate, she decided to open a joint account in addition to her personal account. This way, they share grocery spending and other expenses for their home.

Joint accounts are available to everyone, whether you're a spouse, friend, sibling, parent or child.

How does the KOHO Mastercard® Prepaid Card work?

The process of signing up for KOHO takes about ten minutes. You'll need to enter your email address and a password to create your account. A referral code could earn you bonuses.

Next, you'll need to provide information about yourself, including your full name, occupation, address and phone number.

Your identity will need to be confirmed before your KOHO card is mailed to you. This is similar to what a bank would ask you to do. Everything is done online.

Unless there’s a Canada Post strike, you’ll receive your card rather quickly. Since it's a prepaid card, you'll start by adding money to your KOHO account, most likely by making a transfer from your regular bank account.

From then on, you can use your KOHO card to make purchases in person or online. It works the same way as debit or credit.

Once you start spending, the KOHO app automatically categorizes your spending and lets you track your budget. When it's empty, you reload it.

If you're happy with your card, you may want to consider setting up your paycheque for direct deposit.

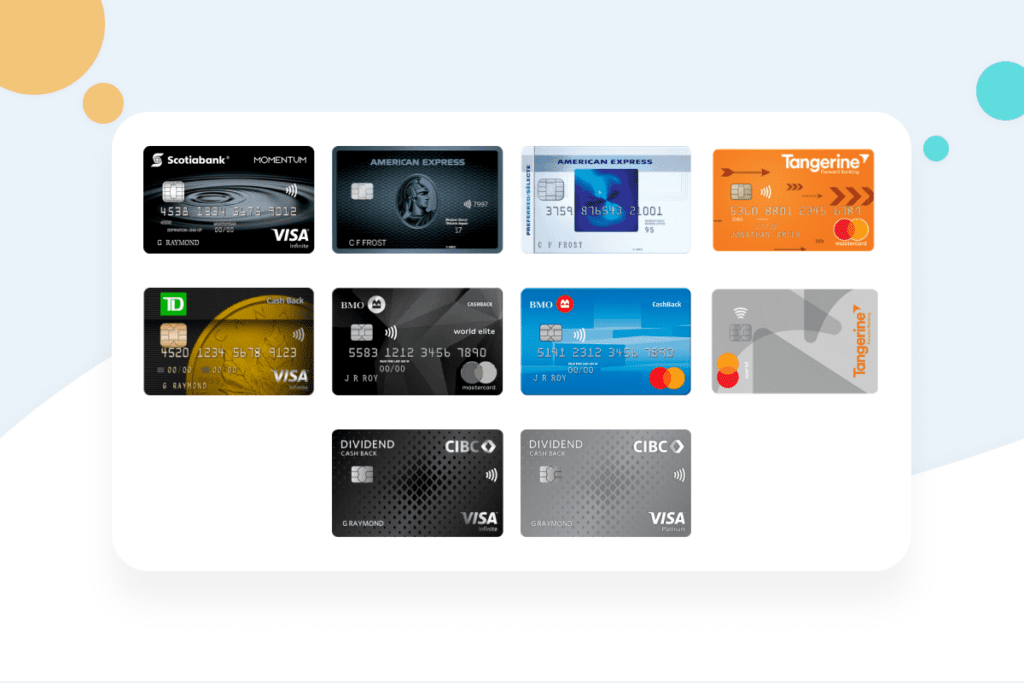

Read our comparison between KOHO and the competition:

- KOHO Mastercard® Versus Wealthsimple Cash: Which Prepaid Card Is Right for You?

- KOHO Mastercard® Vs. Mogo Visa Platinum: Which Prepaid Card Is Right for You?

- KOHO Mastercard® Vs. STACK Prepaid Mastercard: Which Card is Right for You?

The KOHO mobile application

Designed to be user-friendly and with a clean design, the KOHO application is as beautiful as its card design. What are its main features? You can view a real-time overview of your spending.

The categorization of purchases also allows you to see which spending items you might be indulging in a little too much. Thus allowing you to learn from your mistakes and try to correct them!

But KOHO’s main feature is not budgeting. While the KOHO app categorizes the spending done with the KOHO card, and offers some very useful budgeting features, other more specialized apps can assist you better for the full management of your money.

That being said, If you're a committed KOHO user for most or all of your transactions, you'll be more than satisfied with the app. But what if you deal with several financial institutions?

You'll only get the full picture with another application, such as Hardbacon, which syncs to any Canadian bank and investment account.

The KOHO app still helps you save and offers great programs.

The KOHO rewards program

The PowerUp program is KOHO's way of rewarding you. On top of the 0.5% or 2% cash back, it also gives you access to additional rewards.

Both KOHO Mastercard® Prepaid Cards offer this program of additional cash back percentages.

Many canadian merchants are partners with KOHO. These include Altitude Sports, Frank and Oak, Indigo, Public Mobile, Sunwing and many others. These specific PowerUps, which can be up to 10%, are in addition to your regular PowerUps. Purchases from participating partners must be made directly through their store, website or app.

Plus, for each friend you refer, you can earn an additional 1% on each purchase for 90 days after that friend makes their first purchase. You are limited to referring 10 friends.

The RoundUp program is also available with both KOHO Mastercard® Prepaid cards. You choose an amount to round up your purchases and save the balance towards your financial goals.

For example, purchases made with your card are rounded to the nearest $1, $2 or $10. If you make a purchase of $4.50, $0.50, $1.50 or $5.50 will automatically be set aside for you. Please note that your money is still accessible. If you attempt to make a transaction and run out of funds, the funds will be taken from this Savings account.

KOHO also values savings

Since the company helps you take back control of your finances, it makes sense to take the savings incentive a step further. By setting up direct deposit to your account, you have access to a 1.2% interest rate on all your money. This program is called KOHO Save and you can do a simulation of the interest generated in addition to the rewards.

In terms of interest rates for a savings account, this is currently one of the best accounts available. You can always use Hardbacon's savings account comparing tool to check out what savings accounts are available in Quebec.

KOHO aims not only to become the perfect hybrid between a debit and a credit card, but also between a chequing and a savings account.

No impact on your credit report, good or bad?

Prepaid cards do not affect your credit report. They generally don't report your account activity to Equifax and TransUnion.

If your credit score is struggling, you may not want to add a new inquiry, as it could have a negative impact. Turning to a prepaid card then makes perfect sense.

It's also a great thing if you've had credit problems in the past. You may not be psychologically ready to deal with credit right away. But if you ever want to regain a good credit rating, you need to take steps to improve your record. It's a must!

Getting a KOHO card will not affect your credit rating. But it won't help you improve it. To address this shortcoming, KOHO has developed a credit improvement option called Credit Building.

For $7 a month, for six months, you can sign up to this program in order to improve your credit. You can repeat the process every six months. When you sign up, Koho sets aside $225 of dedicated credit improvement funds in a separate account. You can't spend it by accident!

Each month, Koho recovers a portion of these dedicated funds and reports positive credit to the Canadian agencies. The process is done behind the scenes and the only difference you will see is the $7 program subscription fee each month.

Is it safe?

Data is the lifeblood of any business! And as we know, even large banks and cooperatives are not safe from thieves!

It is therefore legitimate to ask what KOHO does with your data. Is it well protected? KOHO assures that it has adequate security measures in place to protect against unauthorized access, alteration, disclosure and destruction of user information.

This information is stored on their servers, those of their service providers. Only authorized employees, representatives and agents have access to it.

The money you deposit at KOHO is stored with Peoples Trust Company, a traditional bank, which means your money is insured by the Canada Deposit Insurance Corporation (CDIC).

For example, if KOHO goes bankrupt, your money won't disappear into thin air! As a federally regulated financial institution, Peoples guarantees you access to your funds in all circumstances.

All the good reasons to join KOHO

If the 0.5% to 2% cash back (or more with retail partners!) doesn't convince you to order your KOHO Mastercard® Prepaid Card, maybe the 1.2% interest on your savings balance will?

Yes, KOHO is still new to the Canadian banking landscape. Since it's essentially a digital service, its operating costs are minimal and it can offer you rewards and interest (without charging you!).

It offers a range of convenient features to make your life easier, like Apple Pay compatibility and RoundUp savings. Students, new credit users, and people with bad credit can enjoy cash rewards without the high fees that typically come with regular credit cards.

Is KOHO for everyone?

Yes and no. Anyone can apply for a card. But if you already have bank accounts and credit cards with benefits, there may not be any added value to applying. Do you pay a lot of bank fees? Do you often have to pay interest on your credit card? Does your current card offer cash back or other rewards?

KOHO has its limits. Using KOHO doesn't mean you don't have to deal with a traditional financial institution. It's not the place to open and track a TFSA account or any registered savings plan. So it's not for investors, nor is it for retirement planning. But it's a great way to control your spending and give your savings a little boost!

Do you think KOHO isn't the right fit for you? See other alternatives with our credit card comparator!

About The Author: Maude Gauthier

Passionate about finance, entrepreneurship and real estate, Maude has explored these three themes in hundreds of blog posts. Before moving into writing and marketing in 2018, she worked in university research for several years. Graduated, re-graduated, and over-graduated, don't be surprised to cruise into an online course or conference. Variety and diversity are her watchwords!

More posts by Maude Gauthier