The Borrowell credit score is just one of the perks involved with this leading digital finance service for Canadians. It used to be that you’d have to pay for credit checks but since Borrowell teamed up with Equifax in 2016, they’ve made it free for Canadian residents. It’s easy to sign up and once you have, you’ll be given your Canadian credit score.

Not only that, they immediately generate the loans you’re eligible for. All services are free because they make their money referring the companies and the loans to you. Borrowell gives you valuable insights that can help you improve your credit score. This company has been striving to offer Canadians an easier way to get loans and improve credit scores.

- Getting the free Borrowell credit score

- What is Borrowell?

- Borrowell features

- Borrowell products and services

- Free credit score and credit report

- Interest rates offered by Borrowell

- Credit scores explained

- How to get the Borrowell free credit score and credit report

- Borrowell dashboard

- Borrowell pros and cons

Getting the free Borrowell credit score

Usually, Canadians have to pay to get their credit score. This could be anything from $20 or more, depending on where you’re getting it from. Borrowell partnered up with Equifax in 2016 so they could offer Canadians the free services of accessing their credit score. This Canadian fintech company revolutionized the lending industry by providing free credit reports to Canadians. This is just one of the personal finance services they offer to Canadians, all in an effort to save you money.

When I signed up to see what my credit score was at Borrowell on my laptop, it was an easy sign up process but still felt secure. I had to tell them my name, address, and other personal details. From there, they asked questions about me personally. Things relating to my social insurance number (SIN), what credit cards I had, and the balances of them. The questions they asked me were things only I would know when going through the ID verification. As soon as I had filled out all the information they asked for, the credit score was given to me instantly. There was a lot of information in my personal dashboard as well.

I just signed up upon writing this review but I will be using it to improve my credit score rating. With Borrowell’s advice, I know what I have to work on in order to get a better credit rating. It’s going to take a bit of time but at least the guesswork is out of it.

What is Borrowell?

Borrowell was introduced in 2014 and is the biggest digital lender in Canada. Based out of Toronto, they provide low-interest loans to individual Canadians looking for a general loan. They also do consolidation loans. They’re backed by the largest banking institutions including:

- CIBC

- BMO

- EQ Bank

- Scotiabank

- National Bank of Canada

- Capital One

- Wealthsimple

- MBNA

The Borrowell credit score service has been around since 2016 thanks to their collaboration with Equifax. It was the first company to offer free credit scores to Canadians. They keep loan options simple with three to five year loans anywhere from C$1,000 – C$35,000. You can diversify any options available thereafter.

Another great thing about Borrowell is they make their loans easy to understand. They explain why you get a certain amount of money at an interest rate that’s made clear to you at the beginning. Then you pay the same amount every month until the loan is paid back in full. They are unsecured loans that are similar to how your mortgage is paid back. It’s labeled “fully amortizing” and you can use the loan for anything.

Other services include Canada’s first AI-powered credit coach. Molly helps Canadian users of Borrowell improve their credit. The company has always been strictly digital with all services online. Borrowell currently has over one million members with success largely due to the Borrowell free credit service as well as low-interest loans. The free credit score doesn’t come with any strings attached either.

Borrowell features

There is a lot to love about Borrowell. It makes borrowing less stressful. Here are some of its best qualities:

- The free Borrowell credit score is based on the patented model of Equifax.

- Free credit score monitoring.

- Free update of your credit profile done monthly.

- Canadians can get unsecured loans good for up to $35,000.

- Loans are on a three or five year term.

- Guarantors are not necessary.

- Digital credit card comparison on features, fees, and interest rates.

- Highest level of security with 256-bit encryption.

Borrowell products and services

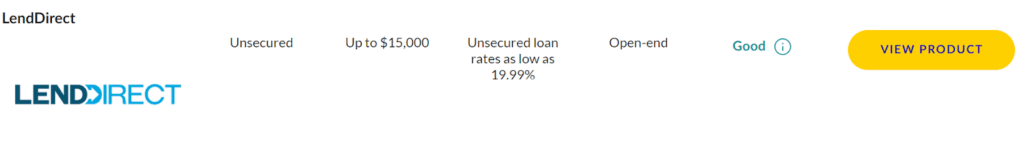

The Borrowell credit score is a big benefit but there are a lot of others. You can get a variety of loan options through Borrowell including personal loans, mortgages, credit cards, insurance, banking products, and more. It strives to be a one-stop-shop.

Free credit score and credit report

The Borrowell credit score provided is the Equifax Risk Score 2.0. It ranges from 300 to 900 and you get the added bonus of a free Equifax credit report. On top of that, Borrowell updates your credit score and report weekly. You can monitor your credit to make sure there are no errors or fraudulent activity. This service is usually something you pay for from the TransUnion credit bureau. You can also download and print off your credit report without being charged anything.

Interest rates offered by Borrowell

The interest rate attached to the loans by Borrowell are anywhere from 5.6% to 29.19%. The median is 11%. Their rates are much less than most of the credit cards while being higher than a loan you could get when you’re using collateral. If you have good credit and have paid a good part of your mortgage down, you can choose to borrow from someone other than Borrowell.

However, Canadians can benefit from getting a loan through Borrowell. It even works if their credit isn’t great or they don’t have a large amount of equity built up in their home. The loans are straightforward and can be done online quickly.

Credit scores explained

Borrowell is going to give you the chance to look at the loans you qualify for after you’ve done your Borrowell credit score for free. You don’t have to apply for a loan to get your free credit score but when you’re ready, you can also get a loan. Borrowell is 100% accurate with their credit scores but there are others out there as well. Some come from other credit bureaus that weigh different factors that contribute to your credit score.

While Equifax is based on a proprietary model, it won’t be the same score that other third parties use to define how much credit you can get. The Borrowell credit score is mainly used for your information. The Equifax Risk Score (ERS 2.0) is what you get from Borrowell and can be different from other scores that are connected to your name. However, Borrowell truly does take out the guesswork as they give you options on what loans you can get based on your credit score.

How to get the Borrowell free credit score and credit report

It’s easy and quick to find the free Borrowell credit score and your credit report. This process takes less than five minutes. Here are the steps:

- Signup on the official Borrowell site

- Fill in the form, including your name and password.

- Confirm you’re not a robot and click “Create Account.”

- The next page will let you know what information you’ll need to supply them. Once you’ve read it, click “Get Started.”

- Fill out the forms starting with your name, address in Canada, when you were born, phone number, how much you make annually, and financial goals for the year.

- Then click, “Consent.”

- From here, there are questions to answer. This is for ID verification as they’re a highly secure site. Once you’ve verified, your credit score will appear.

Borrowell dashboard

There is an easy to read dashboard that lets you in on recommendations on how to improve your score. You’ll see what credit offers are available to you based on the credit score you have. They let you know what your chances are of getting the loans available.

In addition, they show you what credit cards are likely to give you approval and up to what amount they will give you. Some of the options we saw were low, good, and excellent. Other loan options include car loans, mortgages, bank accounts, and insurance.

In the dashboard, you can take advantage of the electronic credit coach. Great advantages to this include:

- Help with your credit score, letting you know what it means and how it compares to other Canadians.

- They’ll show you credit updates and what has changed since your last credit report.

- They also offer transparency on what’s impacting your credit scores.

- Tips on how to improve your credit score.

You can see the printable version of your credit score and all the information about you. Right on this page, you’ll see a message that says if there’s anything that doesn’t look right, you should contact Equifax. They have the contact information available for Equifax so you can dispute or inquire about what you’re seeing on your report. Checking this out is advisable in the event that there are fraudulent activities revolving around your credit report.

Borrowell pros and cons

Pros

- Free Borrowell credit score and credit report

- Free monitoring so you can improve your score

- Easy access to loans that are hassle-free

- User friendly with an easy-to-view dashboard

- Good option to manage debt for lenders

- Banking security features (256-bit encryption technology)

Cons

- Higher interest rates

- Loan options are slightly limited

- There is no physical location to visit

Borrowell is one of the best companies when it comes to unsecured loans. They are focused on offering you an easy alternative to gaining a loan beyond what the traditional banks offer. If you’re looking for a small loan, Borrowell is a good option.

They offer you choice, education on your credit, and total transparency. It’s a refreshing way to get a loan and you can apply based on what they recommend for you. You can also shop for credit cards, loans, and mortgages. This alleviates having to ask for multiple loans that you’re not sure you’ll be approved for. Borrowell is a force to be reckoned with, offering Canadians a different option past the large corporations of Canadian banking.

About The Author: Loraine Couturier

Loraine Couturier has been freelance writing since 2012 while enjoying global travel. She writes helpful articles and whimsical books in her spare time while swinging in hammocks by the sea. Loraine loves writing about pretty much anything and likes to pass on the knowledge she has to others. Visit her at https://www.facebook.com/jetsetwritingchick

More posts by Loraine Couturier