If you’re a Canadian considering investing in crypto, there are many different ways to buy Bitcoin as well as other cryptocurrencies. Depending on the cryptocurrency exchange you use, you can purchase Bitcoin via e-transfer, bank wire, debit, cash, or credit card. But if you’re using a credit card to buy cryptocurrency, then there are some important factors you’ll want to consider. In this article, we will go over all the different ways to buy cryptocurrency with a credit card in Canada.

- Why should you buy cryptocurrency?

- Are Bitcoin and other cryptocurrencies a risky investment?

- How to buy cryptocurrency with a credit card in Canada

- 1. Buy cryptocurrency via CoinSmart

- 2. Buy cryptocurrency via MyBTC.ca

- 3. Buy cryptocurrency via Trust Wallet

- The pros and cons when you buy cryptocurrency with a credit card in Canada

- To buy or not buy cryptocurrency with a credit card?

- Frequently Asked Questions

Why should you buy cryptocurrency?

Bitcoin, the most popular cryptocurrency in the world, is a decentralized digital token. That means it’s free from the regulation of financial authority, like a central bank for example. This is generally a plus because there is more transparency and lower transaction fees since there are no intermediaries.

That said, it also means there is less stability because the price is controlled solely by supply and demand. There are only 21 million Bitcoins that can be mined in total, making it different from cryptocurrencies like Ethereum. So, once they are all mined, that’s it!

No more Bitcoin will ever be created. The great thing about buying Bitcoin is that it is borderless, meaning you can transfer it internationally within seconds without paying fees.

Are Bitcoin and other cryptocurrencies a risky investment?

As with all cryptocurrencies, Bitcoin is highly volatile, with its value rising and falling every day. So, investing in Bitcoin will always be a risk. You’ll often hear advice to “buy the dip,” but there is no way to truly know when it will dip and how low the price will go.

You could buy $100 worth of Bitcoin today, and it could be worth only $80 tomorrow.

The best advice we can give is to never invest more money into Bitcoin than you’re willing to lose. That way, even if its value tanks, you’ll still be financially stable.

However, because Bitcoin is the most valuable and popular cryptocurrency available, it also comes with the lowest risk compared to other low-value alternative coins, called altcoins, and crypto projects that may not survive in the market.

How to buy cryptocurrency with a credit card in Canada

If you’re ready to buy Bitcoin or other cryptos with a credit card in Canada, here are three different ways you can do that:

1. Buy cryptocurrency via CoinSmart

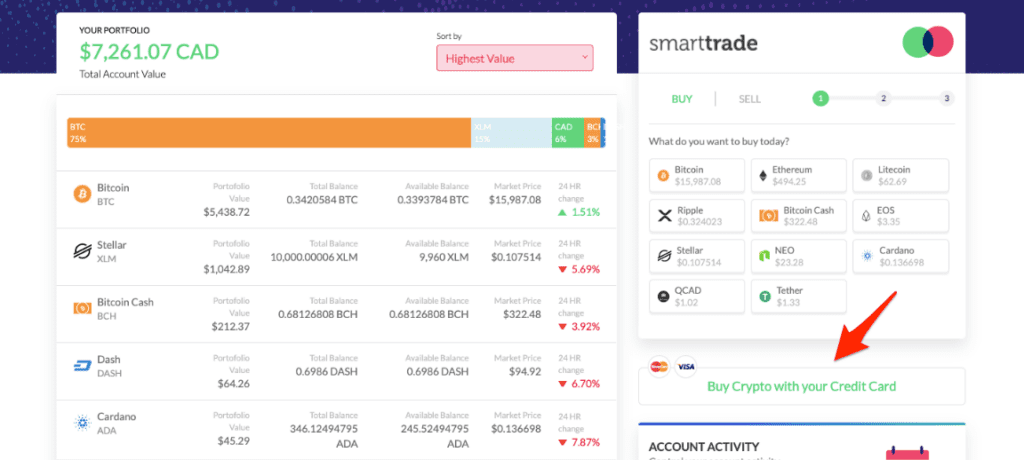

CoinSmart is a Canadian-based cryptocurrency exchange that allows users to trade Bitcoin using debit, e-Transfer, bank transfer or credit card. The platform is incredibly user-friendly, making it easy for new traders to buy and sell 16 different digital tokens including Bitcoin, Cardano, Stellar, Litecoin, Ethereum and Solana.

CoinSmart also has more advanced trading tools if you’re interested in learning more. Best of all, because it’s a Canadian company you can pay in Canadian Dollars so you won’t incur any foreign transaction fees.

There is a pretty steep fee to buy cryptocurrency with your credit card, but that’s true across the board regardless of the platform you use. CoinSmart charges up to 6% per transaction and the minimum transaction is $100.

To buy Bitcoin using your credit card on CoinSmart you will first need to set up an account. Head to the home page and click on “Get Started.” Follow the prompts to set up your account, choose a password and verify both your email address and phone number.

Some people will receive instant verification whereas others may require more details, such as a copy of identification, in order to fully verify your account.

Once you’re verified you’re ready to purchase Bitcoin. You can link the credit card that you’d like to use for the purchase to your CoinSmart account and then use it to fund your account with Canadian dollars. Once you choose how much you’d like to deposit into your account the transaction will be processed immediately. You can then use those funds to buy Bitcoin.

Alternatively, you can make instant purchases of Bitcoin through CoinSmart without funding your account because they partner with Simplex. You can do so via the “SmartTrade” section by clicking on “buy crypto with a credit card.”

When you purchase this way you can even send your Bitcoin to an external wallet, or simply send it to your CoinSmart wallet. If you go this route, you will need to provide identification and also verify the transaction via email and SMS because it’s through Simplex not direct through CoinSmart.

MORE : Read our CoinSmart Review for 2022

2. Buy cryptocurrency via MyBTC.ca

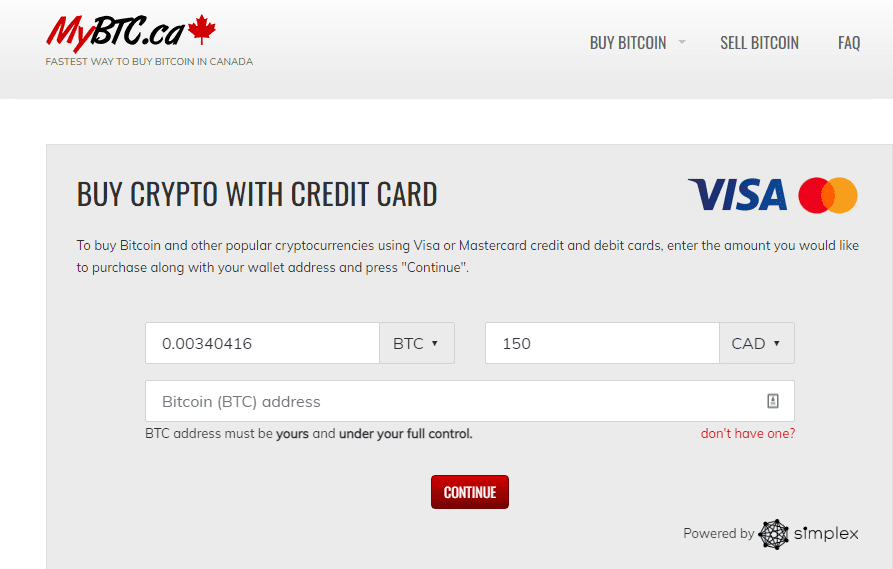

MyBTC.ca is a Canadian company set up in 2016 specifically to make Bitcoin accessible to all Canadians, regardless of their experience with crypto. You can buy Bitcoin on the platform with Interac e-Transfer, cash, debit, bank wire or credit card. There is a daily purchase minimum of $75 and a maximum of $25,000 with a credit card.

MyBTC.ca accepts both Visa and Mastercard via their partner, Simplex, an online merchant offering fraud-free payment processing. Simplex is also a partner of Binance and is the go-to payment processor in the cryptocurrency world. Unfortunately, Binance is not available in Ontario.

To buy Bitcoin using MyBTC.ca you will first need to set up an account. As part of the process, you’ll need to verify your identity with both a photo ID and address verification which can be done online or in person at a Canada Post.

Once your account is verified, you can simply log in and click on “buy crypto with credit card.” That is where you will choose how much Bitcoin you’d like to buy, and it will show you how much that will cost you.

Something to note about MyBTC.ca is that your account does not include a cryptocurrency wallet to store your Bitcoin. You will need to have your own external Bitcoin wallet that you can send it to.

You won’t be able to purchase Bitcoin until you provide a BTC address for your tokens to be sent to. Accounts on cryptocurrency exchanges do not count as wallets, so you will need to set one up on something like Exodus, Zengo or Electrum.

The transaction fee to purchase Bitcoin with your credit card with MyBTC.ca is very high at 9.75%, which could be a significant deterrent. But even their fee for e-Transfer is 7.75%, so they are just high in general.

MORE : Read our MyBTC Review

3. Buy cryptocurrency via Trust Wallet

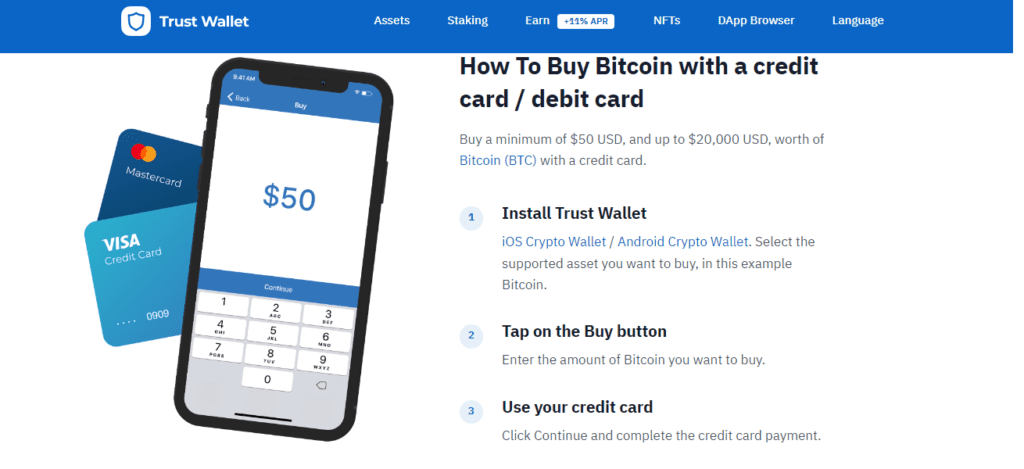

One other option that Canadians have to purchase Bitcoin with their credit cards is Trust Wallet. Trust Wallet is a mobile crypto wallet where you can buy and store Bitcoin and other digital currencies.

There is no desktop version of the platform, so you’ll have to download the app if you want to purchase Bitcoin with your credit card. Like Binance and MyBTC.ca, Trust Wallet partners with Simplex to process your credit card payment, as long as it’s Visa or Mastercard.

To buy Bitcoin using your credit card, you’ll first need to install Trust Wallet on iOS or Android. Once you’ve got the app, you can set up your account and then choose the asset you want to purchase. Once you select Bitcoin, you’ll enter the amount you want to buy and click continue.

Then you just need to enter your credit card details and your purchase will be completed instantly. Trust Wallet doesn’t charge any fees themselves, but you’ll pay a 3.5% transaction fee to Simplex.

MORE : Read our Trust Wallet Review

The pros and cons when you buy cryptocurrency with a credit card in Canada

We’d always recommend buying cryptocurrency via e-Transfer or bank transfer, since it’s the safest and most cost-effective option. That said, if you want to buy Bitcoin with a credit card, here are the pros and cons of doing so.

Pros

1. Instant transactions

When you purchase cryptocurrency using a credit card, the transaction is nearly instant. Bank transfers can take days. The price of the cryptocurrency you intend to buy will undoubtedly fluctuate by the time you are actually able to purchase it. If the price goes up, you’ll be buying at a higher rate than you planned.

2. User-friendly

For beginner crypto traders, purchasing with a credit card is one of the most straightforward options. Many cryptocurrency exchanges are built for more advanced traders, but the process can be overwhelming if you’re new to trading. But when you’re purchasing cryptocurrency with a credit card, you just need to enter your card details, choose how much you want to buy, and that’s it!

Cons

1. It could impact your credit score

The amount of credit you use on your credit card directly impacts your credit score. The more that you use your credit, the higher your score, provided you always pay off your monthly bills. But if you buy a lot of cryptocurrencies on your credit card and don't pay it off, it will damage your credit score. Never buy more cryptocurrencies than you can afford to lose, and ensure that you are always able to pay off the amount you buy on your credit card.

2. Not all credit cards support cryptocurrency transactions

Some credit card companies don’t support cryptocurrency transactions. Issuers like HSBC, Tangerine, CIBC and Scotiabank do not allow cryptocurrency purchases with any of their credit cards. TD bank allows the purchase of cryptocurrency with their credit cards on a case-by-case basis, and it may be charged as a cash advance, meaning that you’ll start to accrue interest immediately after the transaction takes place.

3. High transaction fees

You will have to pay high transaction fees no matter which option you use to buy cryptocurrencies with your credit card. It is much more cost-effective to purchase cryptocurrency via e-Transfer or by funding your exchange account with a bank transfer. Not only will the platform charge you transaction fees, but your credit card issuer will also charge you per transaction.

To buy or not buy cryptocurrency with a credit card?

While you can buy cryptocurrencies using a credit card in Canada, it’s not the best option, and you will need to jump through some hoops. Not many platforms allow you to purchase cryptocurrency using a credit card, and not many Canadian credit card issuers allow the purchase of crypto either. If you want to buy cryptocurrency using your credit card, you can use the options in this article to do so.

Frequently Asked Questions

Yes. You can buy cryptos with your credit card in Canada, but the options are limited. Most Canadian cryptocurrency exchanges do not allow you to purchase cryptocurrencies with a credit card, and the ones that do so will charge high fees.

You can buy Bitcoin in Canada through almost every single cryptocurrency exchange. Some of our favourite cryptocurrency platforms in Canada are Newton, Bitbuy, Netcoins, NDAX and CoinSmart. But these platforms do not allow you to buy cryptocurrency with a credit card. To purchase with a credit card, you’ll need to use Binance, Trust Wallet, MyBTC.ca or CEX.io.

The only Canadian credit card issuers that allow you to purchase Bitcoin are TD Bank and the National Bank of Canada. Where there are many crypto-friendly banks that will allow you to buy with your debit card or via e-Transfer, there aren’t many banks that allow the purchase of any cryptocurrency with your credit card.

Also, Visa and Mastercard are generally accepted on most platforms, but American Express is not as widely accepted.

Buying cryptocurrencies come with a level of financial risk because of their volatility. But the safety of your credit card information is based on the platform you purchase through. If you use the methods listed in the article, such as platforms that use Simplex for payment processing, then your information will be very safe.

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois