Coinbase is one of the world’s largest cryptocurrency exchanges, and although it’s based in the United States, many Canadians use the platform to buy and sell cryptocurrencies. Besides having such a high trading volume, Coinbase also offers a large database of cryptocurrency assets and has a comprehensive mobile app that makes trading easy. However, their fee structure is slightly confusing.

Something that sets Coinbase apart is its extremely low minimum transaction amount, which is set at only two dollars. But they also have a very low maximum transaction amount. Coinbase has an initiative called Coinbase Earn, where you can earn cryptocurrency by taking video classes on the ins and outs of crypto trading.

Another thing to note about Coinbase is that they have two tiers: Coinbase and Coinbase Pro. Coinbase is the more simplified platform but supports fewer crypto assets and has higher fees. Coinbase Pro has more trading options but will likely be too complex for beginner traders. On top of that, Coinbase Pro offers no fiat currency trading for Canadians; you can only trade digital currency to digital currency.

Because Coinbase is super accessible for all experience levels and has a variety of extra functionalities, it’s one of the best cryptocurrency trading platforms in Canada. Whether you want to go with Coinbase or Coinbase Pro, you’ll get started on the platform the same way.

How to open an account on Coinbase

Opening an account with Coinbase is pretty straightforward. First, head to Coinbase.com and click on “Get Started.” Enter the details as requested and confirm your email address to continue the process. You will then need to add your phone number, choose your country of residence and add your address to your account. You’ll need to link your phone number since Coinbase requires SMS verification.

Coinbase will also require you to fill out some information regarding your employment status before moving on to account verification. This includes what you plan to use Coinbase for, the source of your funds, your current occupation and employer if you have one. As a Canadian, you’ll also need to enter the last four digits of your SIN number.

Verification is basically guaranteed, as long as you can provide an adequate form of identification. You’ll need to upload either your passport or national ID and wait for Coinbase to confirm, which usually only takes a few minutes.

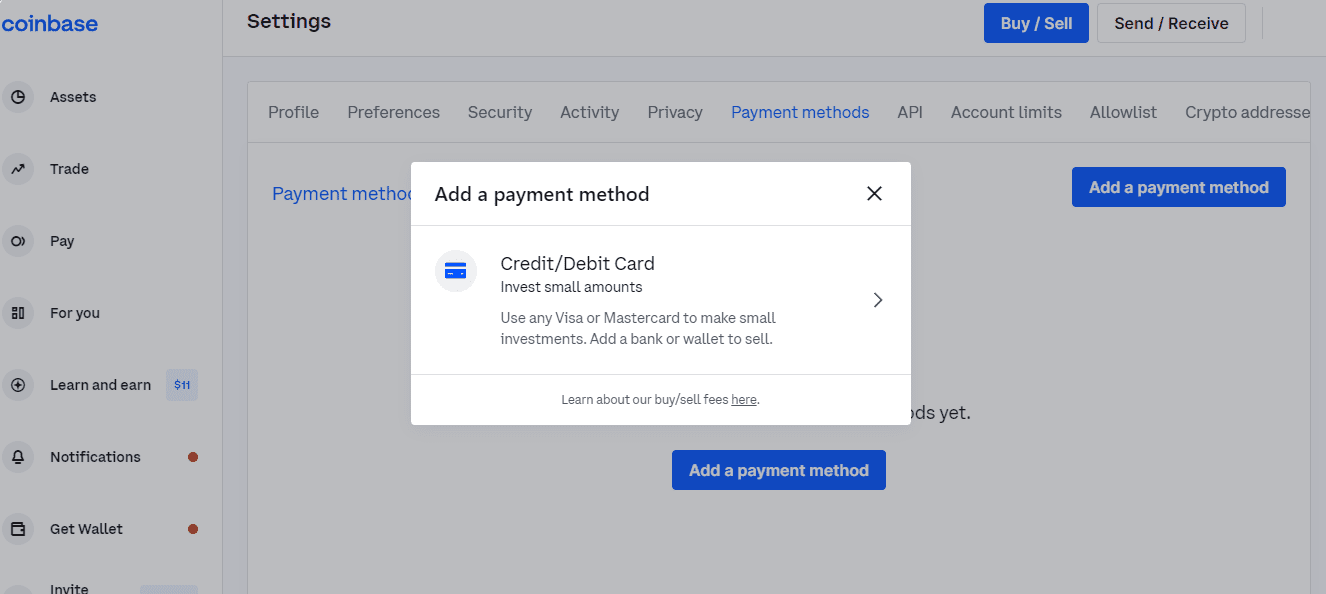

To complete the account setup process, you should link your debit card (Canadian users cannot connect their bank accounts). To do this, go to Settings and click on Payment Methods. There will then be an option to Link a New Account. Click here and select Debit Card. You’ll then need to enter your card details, including your address, at which point Coinbase will apply two temporary debits to your card. To verify your card, you’ll have to enter the amounts of the two temporary debits, and then you’ll be able to use it to buy cryptocurrency.

How to transfer money to your Coinbase account

Once your account is set up and verified, you can start purchasing cryptocurrency on Coinbase. Canadians are unable to transfer money or deposit into a Coinbase at all. It’s also not possible to use bank transfer or e-Transfer with Coinbase; you can only purchase cryptocurrency via debit card. You cannot add cash or cash out on any cryptocurrency purchases with Coinbase. You will also not be able to link credit cards or bank accounts to your Coinbase account at this time if you’re Canadian.

Something else to note is that you cannot sell your digital currency back to your debit card with Coinbase. But you can link your PayPal and sell currency directly to there.

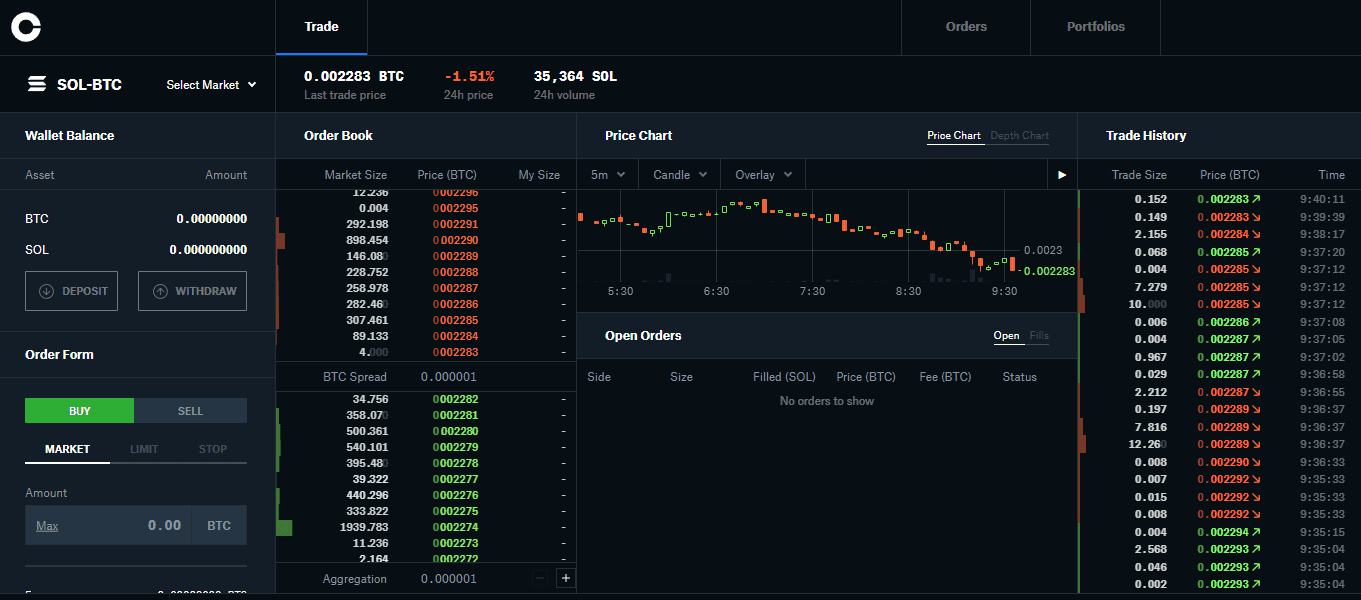

If you use Coinbase Pro, you can fund your account with cryptocurrency from an external wallet or another exchange. To do so, head to the Coinbase Pro trading page and on the left-hand side, click on Deposit. It will then show a list of all the supported cryptocurrencies, and you can choose the one you want to transfer into your account. You will then have two options: deposit via crypto address through ADA transfer or move from your standard Coinbase account to your Coinbase Pro account.

Coinbase Pro will then provide you with a QR code and wallet address for you to send the cryptocurrency to. Make sure that you send the correct digital currency, or it could be lost forever. It will also provide you with a transfer limit and processing time.

You can also withdraw cryptocurrency to an external wallet the same way.

How to make a trade on Coinbase

Buying and selling cryptocurrencies on Coinbase is pretty straightforward, even for the beginner trader, as long as you’re using the standard version. While other cryptocurrency exchanges are tailored to Canadians specifically, none offer the range of digital assets that Coinbase has. It’s a great option if you want the flexibility to dabble in altcoins, but that also comes with a price. Also, there are limitations for Canadians who wish to trade on Coinbase, which we will touch on below.

To purchase cryptocurrency on Coinbase, you will need to link your Canadian debit card. This is the only way to buy digital currency on Coinbase. You cannot link a credit card, bank account or purchase digital assets using Interac e-Transfer. This is not ideal since card transaction fees are high, but if you want to use Coinbase, that is the only way to do it. One bonus is that when you purchase cryptocurrency using your debit card, the asset is instantly credited to your account.

Head to the Coinbase Trade page to see a list of all digital assets available for purchase. You can also use the search bar to find the specific asset you want to buy or browse through the list. It will also show you the current digital asset price, plus you can see if it’s up or down. Choose a timeframe of one hour, one day, one week, one month or one year to see how the coin has been tracking.

Once you’ve chosen your coin, click Buy. You can then enter the amount in CAD that you would like to buy. Before you do, it will show you the limit of how much you can purchase, which varies depending on the coin. Coinbase has extremely low limits for Canadians, only allowing you to purchase around $400 worth per week. But you can request to increase your limit.

Choose your payment method, which will be the debit card that you’ve linked and click Preview Buy. You can also choose to set up recurring buys at this point or just set it as a one-time purchase. This will show you how much you’ll pay in CAD, how much of your currency you will receive, and the fees you will have to pay on the transaction. Click Buy Now to confirm your transaction, and the digital currency will appear instantly in your account.

How to sell cryptocurrency on Coinbase

Something super important to note about Coinbase before you get started is that Canadians cannot sell their digital assets back to their debit card accounts. Once you’ve purchased cryptocurrency on Coinbase, you have only two options: either send your crypto to an external wallet or other exchange or withdraw to PayPal. You cannot cash out to your account.

What crypto assets are supported on Coinbase?

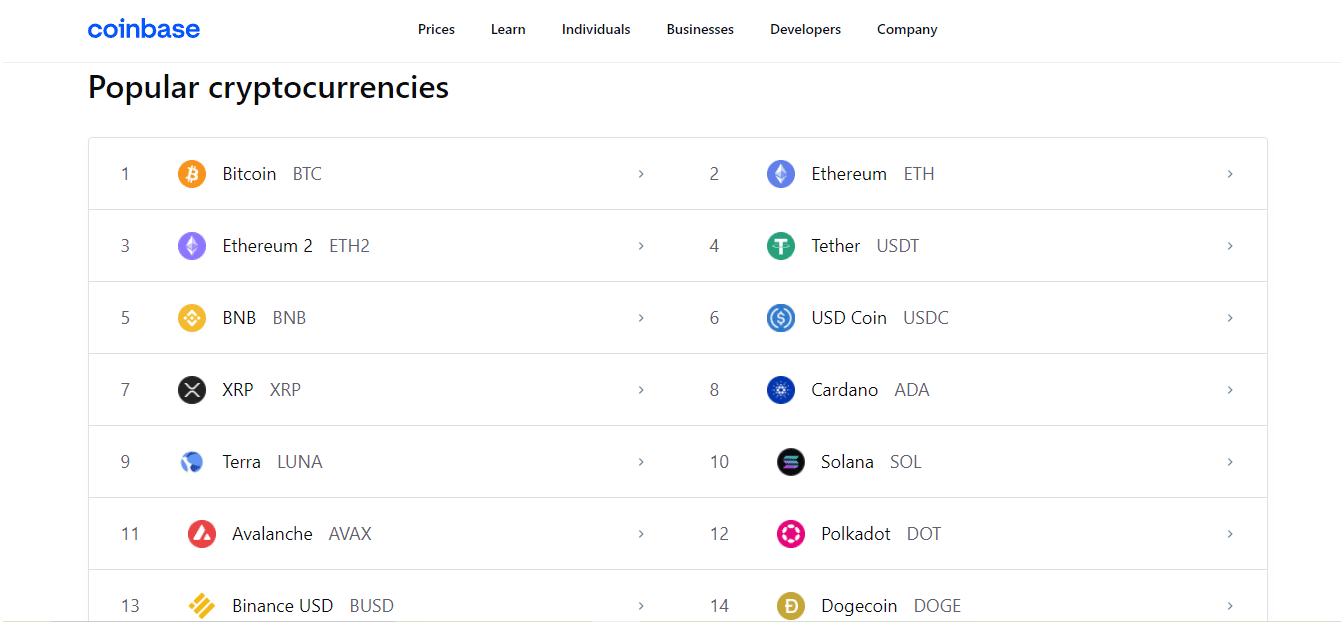

Coinbase supports well over 100 different cryptocurrency tokens, including popular assets like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Stellar Lumens (XLM), and Bitcoin Cash (BCH). Additionally, they have a considerable bank of altcoins, including:

- Polkadot (DOT)

- Bonfida (FIDA)

- EOS (EOS)

- Goldfinch (GFI)

- Solana (SOL)

- Cosmos (ATOM)

You can also trade metaverse tokens like Decentraland (MANA) and My Neighbour Alice (ALICE) on Coinbase.

What are the fees on Coinbase?

Coinbase has very high fees compared to other Canadian cryptocurrency exchanges, especially in its standard version. The Pro version has lower fees, but it’s more complicated, so beginners are likely to pay for the ease and simplicity of the standard version. As a Canadian, you won’t need to worry about the fees of Pro because you probably won’t be using it. There’s no option to trade using CAD on Coinbase Pro, solely crypto to crypto trading.

Since Canadians can only buy cryptocurrency via debit card, they are also subject to the high fees of card payments. The fee for purchasing cryptocurrency on Coinbase is 3.99%, and you’ll pay the same when you sell.

Other Coinbase trading features

Coinbase is more than just a standard cryptocurrency exchange. They also have a Visa debit card called the Coinbase Card, which allows users to spend their digital currencies and earn rewards as a result. Unfortunately, the card is not yet available to Canadians.

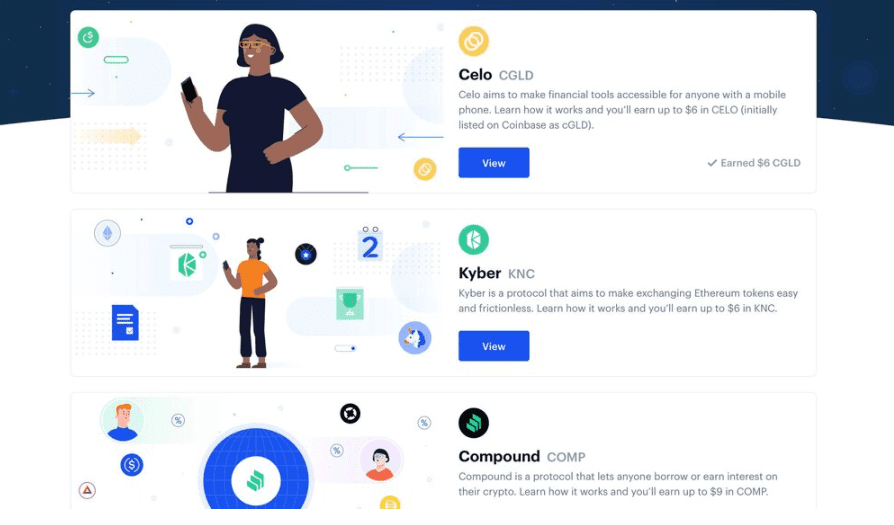

But Canadians can take advantage of Coinbase Earn, which offers educational resources on various different types of cryptocurrency. You can watch tutorials to learn about how each cryptocurrency works, and once you feel like you have a good understanding, you can take quizzes and exams that test your knowledge. When you pass a quiz, you will get a small amount of the specific cryptocurrency for free! There are only certain crypto assets available on Coinbase Earn, but they are constantly adding new ones, so keep checking back. It’s a great way to increase your knowledge of cryptocurrency while getting rewards simultaneously.

Another feature that Coinbase offers is the Coinbase Wallet, which allows you to store over 4000 different types of cryptocurrency, including a Defi app marketplace and NFT trading. With the Coinbase Wallet you can manage private keys, protecting your assets on your device using Secure Enclave, cloud backups, biometric authentication and a 12-word recovery phrase.

Is Coinbase safe?

Although Coinbase has high fees and limited capabilities for Canadians, it is extremely safe. It’s a public company, meaning that it’s entirely regulated in the United States and therefore must be fully transparent with all who hold shares. Since they are such a huge global exchange, they can provide a high level of security. 98% of all digital assets are stored offline in cold storage, so you know that they are safe, regardless of if there is a data breach.

Coinbase is also well-insured, so even the 2% of assets stored in the hot wallet system are very safe. If they did have a breach and your assets were lost, they would be able to reimburse you.

You will automatically need to set up two-factor authentication when setting up your account. Coinbase will require you to use SMS 2FA, but that’s not always the safest option. For extra security, you can use a security key or link your Google Authenticator App.

Pros of Coinbase |

Cons of Coinbase |

|

|

Coinbase for Canadians

Although Coinbase is widely popular around the world, it does have quite a few limitations for Canadian users. Where other platforms like Netcoins, Newton, BitBuy and CoinSmart allow Canadians to buy and sell digital currencies with ease, Coinbase only allows you to purchase using your debit card, and you can only sell directly to PayPal. On top of that, there are very low limits on how much crypto you can purchase per week. That said, if having access to a huge amount of altcoins is essential to you, then you may still want to consider Coinbase. When you compare cryptocurrency platforms, many of the other Canada-based platforms have a limited database of tokens to choose from.

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois