Back by popular demand, we are publishing the answers of our recent tax quiz. This quiz tests your knowledge in tax matters by answering a few questions. Many readers have contacted us asking us where they went wrong in the quiz. If you have not yet taken the quiz, it’s not too late! Click back and take the quiz and return to this page for the answers… if you did not get a perfect score .

Here are the correct answers to the 20 questions.

1. Withdrawal from a Tax Free Savings Account (TFSA) is tax. True or false?

→ It’s true. Unlike an RRSP, contributions made to a TFSA are not deductible from an individual's income. We already have paid tax on the amounts placed in a TFSA. Furthermore, returns earned in a TFSA account are tax-free, and equally, amounts withdrawn from a TFSA account are also tax-free.

2. My visit at the dentist is tax deductible at the federal level. True or false?

→ It’s true. In Canada, some medical expenses are tax deductible. This is particularly the case for dental appointments and laser eye surgery.

3. When we withdraw an amount from our Tax-Free Savings Account (TFSA), we forever lose our contribution room equivalent to the amount withdrawn. True or false?

→ This is false. You can withdraw funds from a TFSA account at any time, and the contribution room is not lost forever. On the other hand, if you reached your maximum contribution to your TFSA in 2020, for example, you cannot withdraw $ 2,000 and put back that same $ 2,000 a few days later. However, the following year, in 2021, the amount withdrawn (i.e. $ 2,000) will be added to your expected contribution room of $ 6,000, for a total of $ 8,000. Thus, the “loss” of the contribution room equivalent to the amount withdrawn, only applies during the current year.

4. Lottery winnings are taxable. True or false?

→ While lottery winnings are taxable in the United States, they are not taxable in Canada. The lucky winner therefore owes nothing to the tax people. And if he gives part of his winnings to relatives, they will not pay tax either.

5. It’s only at the age of 18 years old, that it becomes compulsory to file your tax return. True or false?

→ This is false. Everyone who earns income must file an income tax return, regardless of their age. In fact, the only thing that is required to complete an income tax return is a social insurance number. Even Canadian residents who are very young must complete and submit a T1 return to the CRA, every year if they have any income to report.

6. Canadians are not taxed on the capital gain realized on the sale of their main residence. True or false?

→ It’s true. In Canada, citizens are not taxed on the capital gain realized on the sale of their main residence. This measure aims to promote the acquisition of property and the building up of assets.

7. The federal tax rate is the same for everyone; it is the same for the taxpayer earning $ 50,000 per year, as it is for the one earning $ 150,000 per year. True or false?

→ This is false. The tax rate depends on the income bracket. In our example for 2019, the federal tax rate is 20.5% for the last dollar earned, for a person who reported $ 50,000 in income, while the one who reported $ 150,000 in income, will be taxed at 29% for every last dollar earned (see federal income tax rates for 2019 below).

Tax Rates

Federal Income Brackets for 2019 * Federal Tax Rates for 2019

$47,630 or less 15%

More than $47,630 but less than $95,259 20.5%

More than $95,259 but less than $147,667 26%

More than $147,667 but less than $210,371 29%

More than $210,371 33%

*These amounts are adjusted for inflation and other factors for each tax year

8. All interest income is taxable, even if it is less than $ 50. True or false?

→ False! Interest income less than $ 50 is not taxable; it can still be declared.

9. In my CRA file, I can track my remaining contribution room in my RRSP and TFSA. True or false?

→ It’s true! The Canada Revenue Agency (CRA) tracks all your contributions to your RRSP and TFSA. Information on your remaining contribution room is available on their portal.

10. Interest, dividends, and capital gains are all taxed at the same rate. True or false?

→ False! Not all investment income is taxed at the same rate. Interest, dividends, and capital gains have different tax rates.

11. What type of savings account should be used for someone who wants to send their children to college?

→ The RESP is the Registered Education Savings Plan. For a parent who wishes to send their children to university, this is the most advantageous option, especially because of the federal and provincial grants, which supplement the amounts contributed, when the beneficiary of the account is a minor.

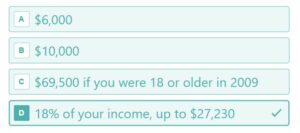

12. What is the maximum amount you can contribute to your RRSP in 2020?

→ The maximum RRSP contribution amount in 2020 is 18% of your income, up to a maximum of $ 27,230. If you were 18 in 2009 and had never invested in your TFSA, you would have accumulated a contribution room of $ 69,500 in 2020. However, this applies to the TFSA and not the RRSP.

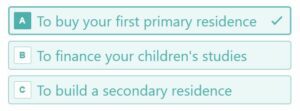

13. What is the Home Buyer's Plan (HBP) used for?

→ The Home Buyer’s Plan (HBP) can be used to buy your first home. In other words, the money invested in your RRSP can be used as a down payment for the purchase of your first home, provided that the amount is returned to your RRSP afterwards.

14. What is the usual deadline for submitting your personal tax return for the previous year?

→ Usually, personal tax returns are due on April 30th, for the previous year.

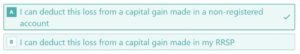

15. If the value of my investment has declined during the current year, what tax deduction can I submit?

→ In a non-registered account, a capital loss can be deducted against any capital gain. Since the money in an RRSP is already growing tax-sheltered, you cannot get a deduction.

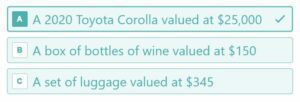

16. On which of the following gifts do you have to pay income tax at the end of the year?

→ Gifts with a value exceeding $ 500 are taxable. Thus, if one receives a Toyota Corolla valued at $ 25,000 during the year, that gift will be taxable.

17. When is your RRSP converted to a RRIF?

→ The Registered Retirement Income Fund (RRIF) is an extension of a Registered Retirement Savings Plan (RRSP). The RRSP must be converted to a RRIF on December 31st of the year when you reach 71 years old.

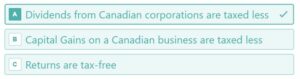

18. What is one of the benefits of investing in Canadian companies on the stock market?

→ Indeed, if you invest in Canadian companies in a non-registered account, you will be able to get a dividend tax credit.

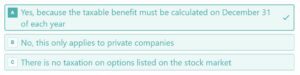

19. On my tax return, is it necessary to declare positions on public company options?

→ It is compulsory. In fact, you must calculate the taxable benefit linked to your options on December 31st of each year.

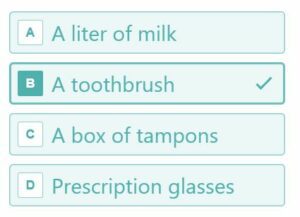

20. For which of the following products do you have to pay the Goods and Services Tax (GST)?

→ In fact, no GST is applied to the purchase of tampons, a liter of milk or prescription glasses. The idea behind these exclusions is that Canadians should not pay taxes on essentials, like unprocessed foods and drugs, among others. As for the toothbrush, this is a product that is not subject to an exclusion.

If you liked this article, you’ll definitely like Hardbacon’s mobile app, which links to your banking and investing accounts, helps you plan your financial goals, budget, and invest better. The basic version of the app is free, but you can do more with Hardbacon Premium. As a loyal reader of our blog, you can get 10% off any Hardbacon Premium subscription. To take advantage of this promotion, use promo code BLOG10 when subscribing through our website.

About The Author: Enguerrand Sueur

Enguerrand est analyste financier chez Hardbacon. Passionné de finances, il s’intéresse tout particulièrement à la gestion de portefeuille et à l’analyse de titres. Chez Hardbacon, il est responsable de la rédaction d’articles sur l’investissement. C’est également lui qui compile les listes d’actions et de FNB disponibles dans la section «Explorer» de l’application mobile de Hardbacon.

More posts by Enguerrand Sueur