By popular demand, we are posting here the answers to the quiz on Insurance: Are You A Hero or Zero? which lets you assess your level of knowledge regarding different insurance products, by answering a few questions. Many readers have written to us because they wanted to find out where they went wrong. If you haven't already taken the quiz, it's not too late! Go take the quiz and then come back to this page … if you don't get a perfect mark.

Here are the correct answers for each of the 20 questions from the quiz:

1. It is not mandatory to take out home insurance when renting a home in Canada.

→ True! Exactly, you do not have to take out home insurance when you rent an apartment in Canada. However, a tenant who is not insured may have to personally assume the consequences of any damages for which he is responsible, such as fire or water damage. Indeed, even if the owner of the building is insured, the owner's insurance company will contact the tenant (or his insurance company, if he is insured) to recover the sums disbursed if it can prove that the tenant is responsible.

2. It is mandatory to take out auto insurance when you own a vehicle in Canada.

→ True! Exactly, motorists are required to purchase automobile insurance in Canada. However, there are different types of auto insurance products, not all of which are mandatory. What is required is to have an automobile insurance policy covering civil liabilities. In concrete terms, it is mandatory to have insurance to compensate third parties for damages caused to their vehicle or for injuries.

3. It is no longer possible to take out a life insurance policy after reaching the age of 55.

→ False! There is no legal age limit for purchasing life insurance in Canada. Of course, the older you are, the higher the life insurance premium will be.

4. Generally, a term life insurance policy is more expensive than a permanent life insurance policy.

→ False! Premiums for permanent life insurance policies are typically 6 to 10 times more expensive than premiums for term life insurance policies. However, a permanent life insurance policy has a resale value, while a term life insurance policy does not.

5. The number of doors of a car is the factor with the most influence on the price of your car insurance policy.

→ False! The price of your auto insurance policy is influenced by many criteria, including your age, the number of years of experience as a driver, the model of your car, etc.

6. There is no need to compare the prices of different companies when looking for auto insurance, since the prices are determined by the Automobile Insurance Corporation of Canada (SAAC).

→ False! Insurance companies’ prices are not set by any government agency, let alone the Automobile Insurance Corporation of Canada (SAAC), an agency that does not exist. It is therefore beneficial to shop around for your auto insurance policy because prices vary from one insurer to another.

7. Smoking cannabis could increase the price of your life insurance policy.

→ True! Indeed, insurance companies will charge higher premiums to cannabis smokers, since they are considered smokers, and therefore, at higher risk. However, some insurance companies distinguish between cannabis smokers and tobacco smokers because tobacco is considered to be more harmful. The frequency of consumption will also have an influence on the premiums.

8. Accidental damages for which you are responsible are not covered by your home insurance.

→ False! Home insurance covers damages you could accidentally cause. For example, if you forget to turn off the tap and water damage occurs, you are covered.

9. A critical illness insurance policy provides a tax-free compensation in case of serious illness.

→ True! Critical illness insurance policies provide a single, tax-free payment to the insured. Of course, compensation will only be paid to him if he is diagnosed with one of the serious illnesses provided for in the contract.

10. It is possible to convert a term life insurance to a permanent one.

→ True! Indeed, several insurers allow to transform term life insurance into permanent life insurance, with an increase in premiums. However, you will not be able to convert permanent life insurance into term life insurance.

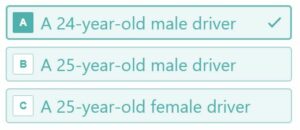

11. Which of the following customers will pay the most for their auto insurance policy?

→ Answer is A. The customer's age is the factor that most influences the price of an automobile insurance policy. Thus, the younger the client, the more expensive the insurance will be.

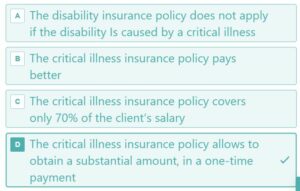

12. What is the main difference between a disability insurance policy and a critical illness insurance policy?

→ Answer is D. The main difference between a critical illness insurance policy and a disability insurance policy is that the first allows you to get a one-time payment in the event of a diagnosis, while the second only allows you to get a percentage of your salary during the period of disability. The other difference is in the coverage. While any illness or accident causing disability will be covered with a disability insurance policy, only certain critical illnesses, for example cancer, are covered by a critical illness insurance policy.

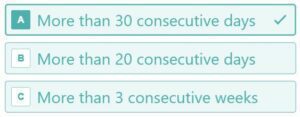

13. If you are leaving your home for an extended period of time, after what period must you notify your insurer?

→ You must notify your insurer after an absence from your home for more than 30 consecutive days. You must notify your insurer because of a clause in most home insurance contracts, which states that your home is not insured after an absence of a certain number of consecutive days. This housing clause varies depending on the contract, ranging between 30 and 90 days.

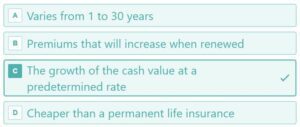

14. Which of the following statements does not apply to a term life insurance policy?

→ Answer is C. Growing cash value at a predetermined rate is a characteristic of permanent life insurance policies. Term life insurance policies have no cash value.

15. Which of the following is not an insurance product?

→ Segregated fund, travel insurance and life annuity are insurance products, since they are sold by insurance companies and protect against risks such as falling ill while traveling (travel insurance), dying at an advanced age (life annuity), or needing liquidity during a stock market trough (segregated fund). An index fund, however, is not an insurance product, and is typically offered as Exchange-Traded Funds (ETFs) or Mutual Funds (MFs) by asset managers.

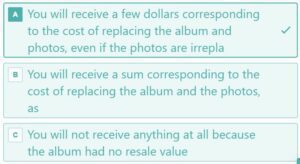

16. If you have taken out an all-risk home insurance policy, what compensation will you be entitled to if the old photo albums of your grandparents are stolen from your home?

→ In the event that your grandparents’ photo albums are stolen, you will receive compensation for the cost of replacing the album and printing the photos, even if the photos are irreplaceable. In fact, comprehensive home insurance does not cover moral damages.

17. What is a universal life insurance policy made of?

→ A life insurance policy normally includes life insurance as well as an investment product. Critical illness insurance and disability insurance are different categories of insurance from universal life insurance.

18. When can I terminate an automobile insurance contract?

→ You can terminate an automobile insurance policy at any time. However, you may be charged a penalty.

19. Which of the following insurance policies can you resell?

→ The only one of the four listed insurance policies that has a resale value is the permanent life insurance policy, which usually has a buyout clause.

20. Which of the following statements about life insurance policies is false?

→ It is true that the holder of a revocable life insurance policy can change the beneficiary of the policy without charge. Also, although this is not common, the policy owner (i.e. its owner) can be changed for a fee. In such a transfer, the insured life remains the same (usually that of the original owner), but the ownership of the policy changes.

If you liked this article, you’ll definitely like Hardbacon’s mobile app, which links to your banking and investing accounts, helps you plan your financial goals, budget, and invest better. The basic version of the app is free, but you can do more with Hardbacon Premium. As a loyal reader of our blog, you can get 10% off any Hardbacon Premium subscription. To take advantage of this promotion, use promo code BLOG10 when subscribing through our website.

About The Author: Émilie J.Talbot

Émilie is the Marketing Director at Hardbacon. A former financial security advisor, she is passionate about finance. She understands the importance of sound personal financial advice and aims to write about this topic to help readers make better financial decisions.

More posts by Émilie J.Talbot