By popular demand, we are publishing the answer key for the investment trivia game: “Are you a hero or a zero?” which is designed to assess your investment knowledge by answering a few questions. Many readers wrote to us because they wanted to find out where they went wrong. If you haven't taken the quiz yet, it's not too late! Go take the quiz and come back to this page if you don't get a perfect score.

Here are the correct answers for each of the 20 questions:

1. Stocks costing more than $50 are generally too expensive. The best value for money is between $10 and $20.

→ Share prices cannot be compared with each other. The price of a share depends on the number of outstanding shares and the value of the company. They are therefore not comparable.

2. Listed companies are required to publish their financial results regularly.

→ Financial market regulators require public companies to disclose certain types of business and financial data on a regular basis. In Canada, listed companies are required to adhere to International Financial Reporting Standards (IFRS). These require the publication of financial statements on an annual and quarterly basis.

3. The equity market is open 24 hours a day, 365 days a year, unlike the currency market, which is only open from 9:30 am to 4 pm, Monday to Friday.

→ The trading hours for equities are 9:30 am to 4:00 pm for the North American stock exchanges. On the other hand, the commodities market is open all week, from Sunday at 5:05 p.m. to Friday at 4:30 p.m. As for currencies, they are traded at all times.

4. Actively managed funds generally have a better after-cost return than index funds.

→ John Bogle, founder of Vanguard, argues that for nearly all types of equity portfolios, passively managed index funds achieve higher returns with less risk than actively managed funds. His position is confirmed by the facts. In a recent study, Morningstar shows that over the long-term, actively managed funds have failed to beat passively managed ones.

5. A company can list its shares on several different stock exchanges at the same time.

→ If it chooses to do so, a company can list its shares on more than one stock exchange, which is called double listing. For example, Shopify’s shares can be found on both the New York Stock Exchange (SHOP.K) and the Toronto Stock Exchange (SHOP.TO).

6. A company's price-to-earnings ratio is earnings per share divided by the company's share price.

→ A company's price-to-earnings ratio is the share price divided by earnings per share and not the other way around!

7. The best time to buy a dividend paying stock is in the days before the dividend is paid.

→ The value of the share will decrease by an amount equivalent to the dividend distributed. There is therefore no particular interest in buying a share before the dividend is paid.

8. When a company buys back its own shares, they are usually destroyed so as to reduce the number of shares in circulation.

→ When a company buys back its own shares, it can decide to cancel them, which decreases the number of shares in circulation and thus increases earnings per share as well as the stock price.

9. The majority of the buying and selling volume on the stock market is generated by individual investors.

→ The majority of the volume on the exchanges comes from institutional investors, namely mutual funds, fund managers, insurance companies, investment banks, etc.

10. What do you do when you buy a stock?

→ When you buy a share, you are actually buying a small portion of a company, which usually gives you the right to vote in the election of directors. The company owes you nothing, except to respect your rights as a shareholder. Also, you have no responsibility for corporate debt.

11. What is investing with 2 to 1 leverage?

→ Leverage refers to the use of borrowing in order to increase one's exposure to financial markets.

12. If a company goes bankrupt, which of the following securities is most likely to become worthless?

→ When a company goes bankrupt, it reimburses those who provided financing with the resources at its disposal. Very generally, at this point, the company does not have enough money in its coffers to reimburse everyone. Common stock holders are the last to have rights to assets, behind secured creditors, bondholders and preferred stock owners.

13. What are you doing when you buy a bond?

→ Bonds are like loans that investors give to a company or government in return for regular interest payments and the repayment of the original principal on the maturity date.

14. What does short selling mean?

→ When you sell stocks short, you borrow stocks from your broker and then sell those stocks on the stock exchange. You have to pay interest on the value of the borrowed shares, until you redeem those same shares and return them to your broker. Those who short sell hope to be able to buy back the stocks they have borrowed at a lower price in the future.

15. Which of the following assets provides the most effective protection against inflation?

→ Commodities such as precious metals, agricultural products, oil and gas are good ways to hedge against inflation. Currencies are by definition vulnerable to inflation, as are bonds, since the interest and principal repayment associated with a bond is made in a predetermined currency.

16. Which of the following bonds is considered the least risky?

→ Bonds issued by the government always guarantee the payment of interest and the repayment of the initial capital on the maturity date. A bond issued by a company is also guaranteed, but generally riskier than a government bond, because a company is more likely to fail than a government. In Canada, federal bonds are deemed to be more reliable than provincial or municipal bonds.

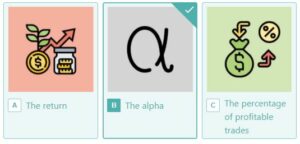

17. Which indicator best reflects a portfolio manager’s performance?

→ Alpha measures a portfolio’s outperformance compared to its benchmark. This indicator reflects a portfolio manager’s performance better than other indicators, since one manager could outperform another by taking more risk, for example, without being better.

18. Which of the following types of risk cannot be reduced by diversifying a portfolio?

→ Diversifying a portfolio reduces many risks, including specific risk and foreign exchange risk, to name only two. On the other hand, systematic risk, such as that of a global recession, cannot be reduced through diversification.

19. Which of the following companies has a beta of 0.6 assuming the stock market has risen 20% in a given time period?

→ A stock’s beta corresponds to its volatility relative to a benchmark index. If a company has a beta of 0.6 this means that the movements in its stock price are 60% affected by its benchmark. So if the stock market (often taken as a benchmark) goes up 20%, that company's stock goes up 12%.

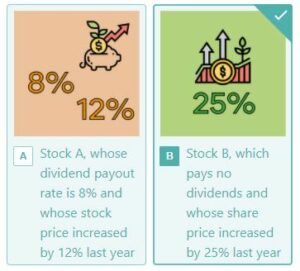

20. Which of the following two stocks outperformed over the past year?

→ A rise in a stock's market price is only part of your return as a shareholder. Beyond this appreciation of your capital, the dividends paid by your shares also represent a source of return. In the case of this question, even though share A provided close to a 20% return over the period (8% dividend + appreciation of 125), share B with its 25% market gain remains the stock that generated a higher return during the period.

If you liked this article, you’ll definitely like Hardbacon’s mobile app, which links to your banking and investing accounts, helps you plan your financial goals, budget, and invest better. The basic version of the app is free, but you can do more with Hardbacon Premium. As a loyal reader of our blog, you can get 10% off any Hardbacon Premium subscription. To take advantage of this promotion, use promo code BLOG10 when subscribing through our website.

About The Author: Émilie J.Talbot

Émilie is the Marketing Director at Hardbacon. A former financial security advisor, she is passionate about finance. She understands the importance of sound personal financial advice and aims to write about this topic to help readers make better financial decisions.

More posts by Émilie J.Talbot