Most financial experts will advise people to be passive investors and allocate funds towards exchange-traded funds or ETFs. As the majority of people don’t have the time or expertise to pick individual stocks, it makes sense to invest in a financial instrument that diversifies your risk significantly.

Exchange-traded funds provide investors with the required diversification and are one of the best instruments for passive investors. An ETF holds a basket of stocks giving you exposure to several sectors or industries. These funds can be thematic or sector-focused.

For example, an ETF may hold a portfolio of growth stocks, value stocks, or dividend stocks. It may provide you exposure to a particular sector such as tech, energy, or banking. There are also ETF instruments for investors looking to add other asset classes to their portfolios such as bonds or gold.

So, an ETF is basically a financial instrument and its performance depends on that of its underlying assets. One of the most popular ETFs is the S&P 500 fund that replicates the performance of the underlying index. The S&P 500 index gives investors the opportunity to gain exposure to the top 500 companies in the U.S.

The S&P 500 is one of the most diversified indexes in the world and has derived annual returns of over 10% in the last five and a half decades. In the last 10 years, the index has returned 283% compared to the S&P/TSX 60 ETF which is up just 100% in this period.

Warren Buffett is a huge fan of the S&P 500

The S&P 500 is a fund that has always been advocated by Warren Buffett. The Oracle of Omaha explains that the average investor should buy the broad market and invest in these funds keeping a long-term view, instead of following the stock picks of other advisors. Buffett said, “In my view, for most people, the best thing to do is owning the S&P 500 index fund.”

According to Buffett, investors need to have exposure to the U.S. economy which is the largest in the world. The stocks part of the U.S. markets are a top bet as corporate earnings and revenue should continue to move higher in the upcoming decade.

Warren Buffett also advises it makes little sense to bet against the U.S. economy and stated, “Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a fly epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

How can Canadian gain exposure to the S&P 500?

Now that we have established why the S&P 500 is the ideal ETF for a long-term passive investor, let’s see how Canadians can add the fund to their portfolio. There are several investment companies that provide Canadian investors access to the S&P 500. One such fund is the Vanguard S&P 500 Index ETF or VFV that aims to track the S&P 500 Index.

The VFV ETF employs a passively managed, fully-replicated index strategy to provide Canadians with exposure to large companies south of the border. The ETF has a management fee of 0.08% and ended April 2021 with $4.5 billion in assets under management.

Vanguard launched the VFV ETF back in November 2012 and Canadians can hold the fund in multiple registered accounts such as the RRSP, RRIF, TFSA, DPSP, RDSP, and RESP. It pays a quarterly dividend of $0.269015 per unit indicating a forward yield of over 1%.

If you would have invested $10,000 a year back in the VFV ETF, your investment would be worth $12,857 today. A similar investment three years back would have ballooned to $15,829 today. An investment of $10,000 at the launch of the VFV ETF would be worth over $41,000 today.

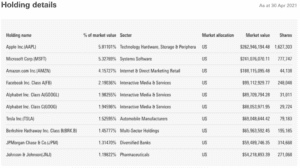

The VFV ETF has 507 stocks with a median market cap of $217 billion. Canadians should note that Shopify which is the largest company in the country in terms of market cap is valued at $187 billion. The fund has a price-to-earnings multiple of 27.9x and a price to book ratio of 4.4x. The return on equity is 20.2% while the earnings growth rate stands at 19%.

The top holdings of the ETF include tech heavyweights such as Apple, Microsoft, Amazon, Facebook, and Alphabet Inc that account for a cumulative 21.5% of VFV.

The information technology sector accounts for 26.7% of the VFV ETF followed by healthcare, consumer discretionary, financials and communication services at 12.8%, 12.7%, 11.4% and 11.2% respectively.

About The Author: Aditya Raghunath

Aditya Raghunath is a financial journalist who writes about business, public equities, and personal finance. His work has been published on several digital platforms in the U.S. and Canada, including The Motley Fool, Stock News and Market Realist. With a post-graduate degree in finance, Aditya has close to nine years of work experience in financial services and close to seven years in producing financial content. Aditya’s area of expertise includes evaluating stocks in the tech and cannabis sectors. If you are considering investing in the stock market, he recommends reading The Intelligent Investor by Benjamin Graham before taking the plunge.

More posts by Aditya Raghunath