Do you Zillow? Admit it, you do. We all do.

Do you wish that you could see the market values for Canadian properties? You can with HouseSigma, at least in the blazing hot housing markets in Ontario and British Columbia. House Sigma is great because it provides something other real estate sites do not. It shows the estimated market value of a home and its neighbourhood as well as its selling history.

Until now, it’s been more of a real estate agent’s tool than something buyers and sellers look for. If you check their reviews, many of them are from Realtors. But that doesn’t mean it’s restricted to real estate agents! Here’s what we found looking through HouseSigma.

How to use HouseSigma

You do need to sign up to use HouseSigma. But there’s no initial cost, and you only need to provide an email address and set up a password. If you’re using HouseSigma online, just head to www.housesigma.com to get started. If you want to use the app on your mobile device or tablet, you’ll need to have something with iOS. The full name of the app is HouseSigma Canada Real Estate.

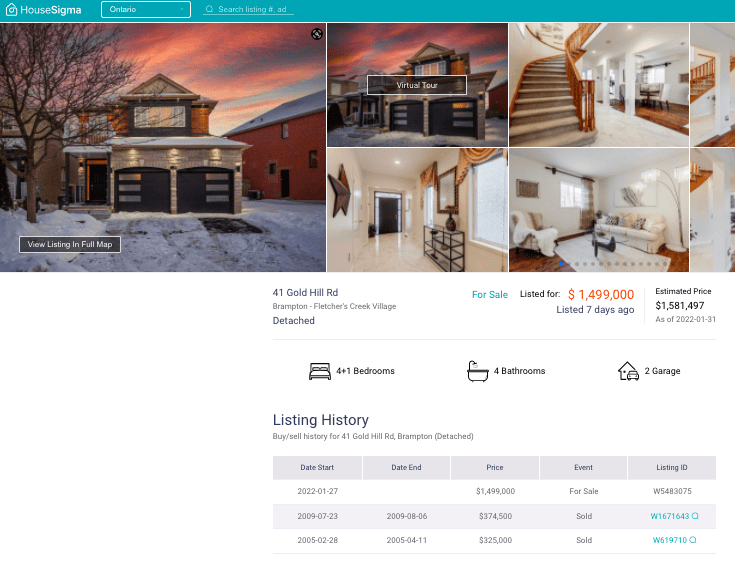

Once you’re logged in, you can easily lose a few hours looking at all their data! Things like properties sold below purchase price, properties sold for high returns, information on properties just sold, and much, much more. Let’s look at this example of a beautiful house in Brampton. Just by clicking on the thumbnail of the listing on HouseSigma, we see the following information:

It’s easy to see the listing price, HouseSigma’s estimated price, and the purchase history for the home. Further down the page, there’s information about comparable houses in the neighbourhood and what they sold for, comparable rentals, real estate statistics for the community, and you can even schedule a viewing.

This listing was found using a general map search for the Greater Toronto area. You can also do searches for a specific property. Or just zoom right in to your perfect neighbourhood and get to know what’s available and for how much.

What’s the catch?

The good news is that if you’re looking to buy or sell in the Greater Toronto Area, Greater Vancouver area, in Ottawa, or generally in Ontario, you’re going to get a lot of good information from HouseSigma. Don’t live in those areas? Unfortunately, HouseSigma won’t be much help. Unless you just want to look up sale prices in those high cost cities and feel better about living in a ‘quieter’ real estate region in Canada.

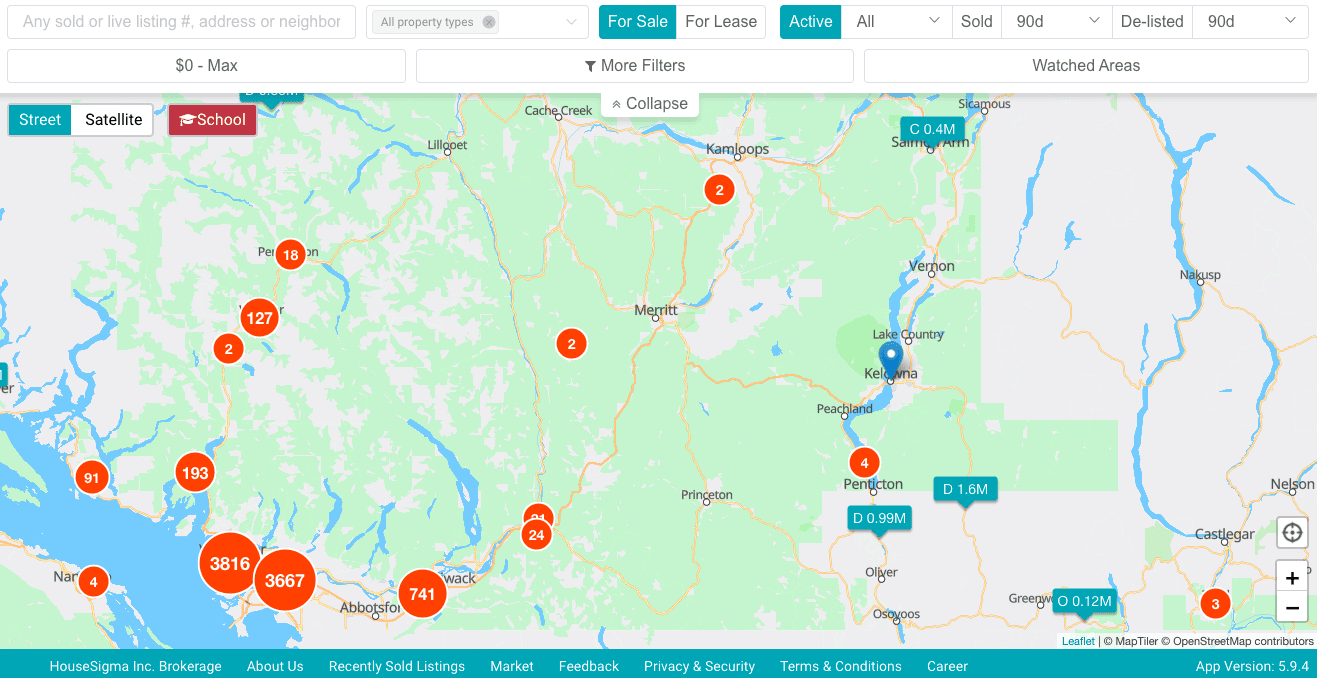

Here’s what you’ll see if you’re not in one of HouseSigma’s targeted areas. We’ve got BC as an example this time. Although there are some areas outside of Greater Vancouver that have a few data points, it’s not enough to gain any useful knowledge,especially for highly popular markets like in the Okanagan.

By contrast, Ontario (with a good overview here of the distribution of results extended from Toronto) can let you do a much more detailed search and compare quite a few areas:

How Does HouseSigma Work?

All online market value estimation services use a combination of artificial intelligence technology, MLS listings, and specific features of homes to create an almost-instant home valuation.

We do know that Zillow claims their valuations have a median error rate of 1.9% for on-market homes. That means that comparable homes tend to be within 1.9% of a Zillow estimate. This does not guarantee they sell for that price. But a quick look shows that about 80% do sell within that error rate.

HouseSigma does not provide error rates or show how sale prices compare to evaluations. It’s possible they’re less accurate than Zillow because the app has less data to draw from. But looking at agents’ reviews, it seems like some of them place quite a bit of confidence in HouseSigma’s evaluations.

Of course, every algorithm that’s working to determine valuations is going to be a little different. And companies won’t give out the specifics. However, we do know that the more data an algorithm can access, the more accurate its valuations will be.

It will be interesting to see how HouseSigma expands. Of course, we want to see it expand to include real estate across Canada. And it would be great to access a more detailed sold history. The most up-to-date information we have at the time of publication is that sold history for Greater Toronto and Greater Vancouver areas goes back to 2003. That is pretty impressive! For Ottawa and the rest of Ontario, it goes back to 2018.

What’s the difference between an assessment and a valuation?

You may have seen words like appraisal and valuation used when discussing home prices. What’s the difference? An assessment is done by the city, region, or county to determine a home’s value for tax purposes. Every year, homeowners receive a new property assessment along with their property tax bill for the year.

Assessments are determined based on the location, the replacement cost of the home, renovations and upgrades, and what other homes in the area are selling for. When it comes to tax bills, the lower your assessment, the lower your property tax bill for the year. So, homeowners tend to push for lower assessments.

If it looks like the home is assessed too high, or too low, there’s a process to challenge this. It can potentially change the amount of the assessment. Homeowners who want to refinance their homes will sometimes request a re-evaluation of their assessment, so their new financing is based on a higher home value.

A valuation is an estimate of the current selling price of a property. Right now, across Canada, almost every property sells for more than its assessment. In some places, the assessment has almost no bearing on what a property will sell for.

Traditionally, a valuation is determined by the overall condition of the property, its size, including both the square footage and the number of bedrooms, amenities, what other properties in the area have sold for, curb appeal, and whether the market is currently favouring buyers or sellers. In a seller’s market, valuations will be higher and in a buyer’s market they’ll be lower.

Another way of thinking about these terms is to use ‘assessed value’ and ‘market value’. Assessed value is for property tax purposes. Market value is what the market is expected to pay for that same property.

Methods for getting a house valuation

If you’re a homeowner in Canada, there are a few ways to get a house valuation. Note that we’re talking about a formal valuation or market value that can be used to set a sale price, refinance a mortgage, get a secured line of credit, or for use by investors.

Many real estate brokers offer an appraisal service to their clients. This is primarily used for setting sale prices. If you’re going to do this, be sure to use a reputable firm and an experienced agent.

You can also hire an expert to conduct a professional appraisal of your property. This is an individual or company that frequently provides house valuations that can be used for any of the purposes listed above. It’s much more in-depth than an online valuation like you’d get with HouseSigma and will be accepted by mortgage companies and insurance agencies.

When should you use HouseSigma?

We agree with HouseSigma’s reviews by real estate agents. It’s an excellent tool for everyone living in coverage areas to find out what comparable houses in an area sold for, learn about trends in your neighbourhood, and get their online valuation if you’re a homeowner. When it comes to the whole house buying process, every dollar in savings means can add up to savings on your mortgage interest fees. Even when you’ve found the best mortgage rate possible, the price you pay for your house is likely the biggest cost of your lifetime. And HouseSigma gives a helpful service that makes you a more informed buyer.

Sellers can also get valuable information from HouseSigma. That valuation is your starting point for everything from finding the right listing agent to negotiating effectively. It might even give you some insight into improving your home’s market value!

We’re pleased to see this app gaining ground in the Canadian market. Anything that puts power into the hands of everyday Canadians is a good thing, and that includes HouseSigma. Plus, there’s absolutely no risk in giving it a try. I cannot wait until HouseSigman expands to all regions in Canada

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois