In politics, as in investment, the boundaries between the different schools of thought are porous. In fact, much more porous than you might think.

For example, while Warren Buffett might be in people's mind the ultimate value investor, his investment philosophy has many things in common with growth investing.

Unlike his mentor Benjamin Graham (the father of value investing), Warren Buffett avoids poorly managed companies like the plague, regardless of the prices their stocks are trading. Benjamin Graham, on the other hand, could be interested in any company whose price was low enough.

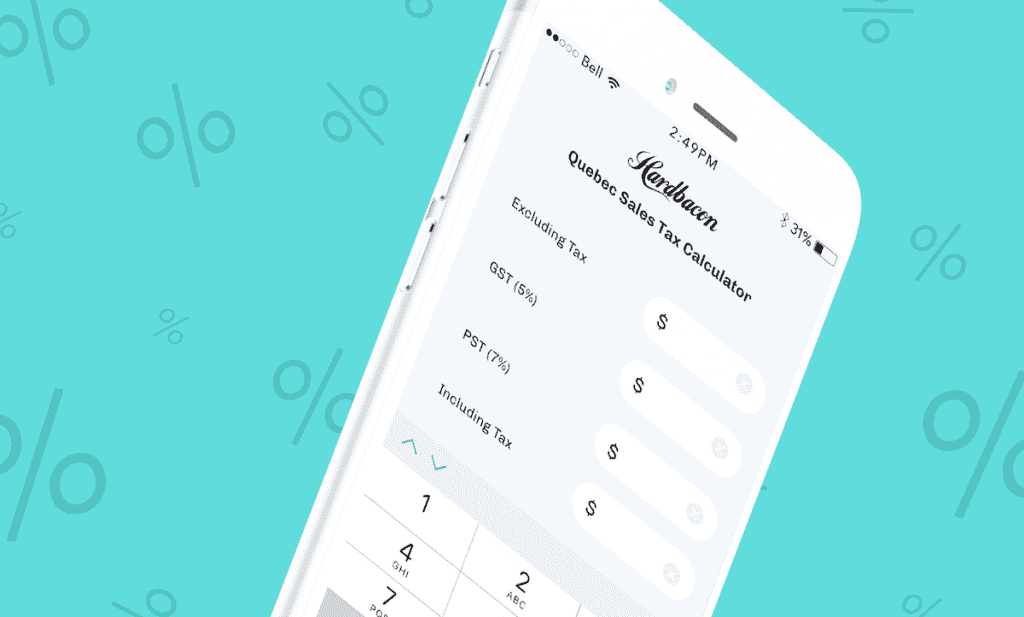

The Hardbacon compass displays Warren Buffett as belonging to the value investing crowd, but he is also more like some growth investors than his mentor, Benjamin Graham.

Besides, we did not develop a web app inspired by the Political Compass to write another article about the Oracle of Omaha (Buffett). Our goal is to let you know where you stand in terms of investment philosophy.

The Hardbacon Investor’s Compass will enable you to find out where you stand in terms of investment horizon (long term or short term) and business valuation approach (value or growth).

The test will place you on the investor’s compass and it takes less than 5 minutes to complete. It will not only enable you to know yourself better as an investor, but also to share your results with your friends that will (probably) be impressed.

If you liked this article, you’ll definitely like Hardbacon’s mobile app, which links to your banking and investing accounts, helps you plan your financial goals, budget, and invest better. The basic version of the app is free, but you can do more with Hardbacon Premium. As a loyal reader of our blog, you can get 10% off any Hardbacon Premium subscription. To take advantage of this promotion, use promo code BLOG10 when subscribing through our website.

About The Author: Julien Brault

Julien started Hardbacon to help Canadians make better investment decisions. He’s raised more than two million dollars and signed strategic partnerships with financial institutions across the country. Before starting Hardbacon, Julien shared his passion for personal finance and the stock market while working as a business journalist for Les Affaires.

Julien manages his stock portfolio with National Bank Direct Brokerage. He uses a pre-paid KOHO Mastercard® for his online purchases and Borrowell to keep an eye on his credit score. Julien also has a Tangerine high-interest savings account.

More posts by Julien Brault