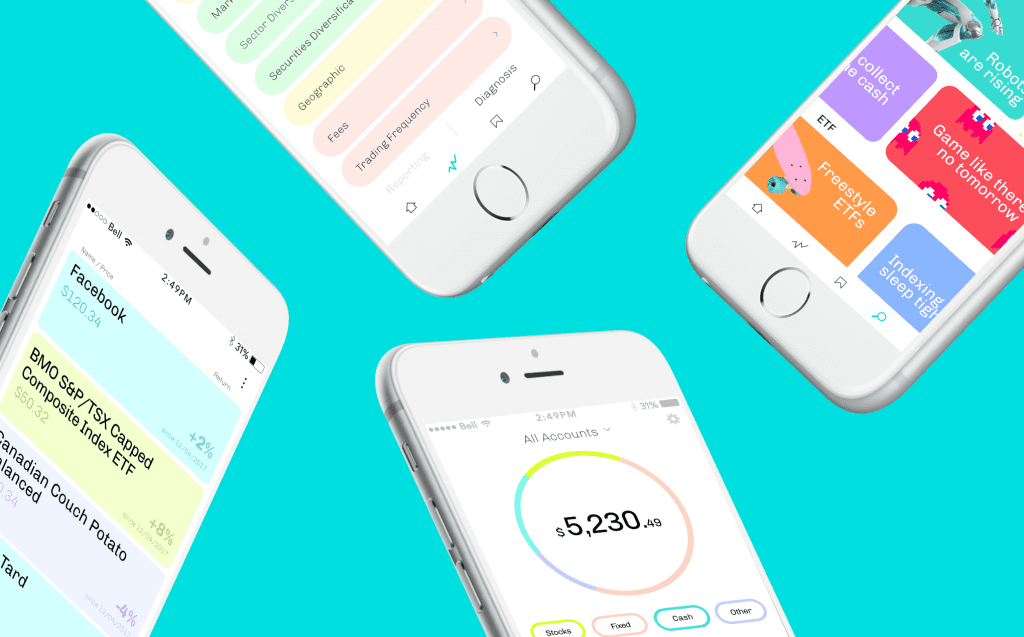

There are a lot of stock market apps in the App Store. However, if you're a Canadian self-directed investor, I'm pretty confident our app is what you need to succeed. Here are the five top reasons why you should download our app on your iPhone right now. :

1. We analyze your portfolio for you

Portfolio analysis is our secret weapon. It can be found in the “diagnostics” section of the app, with green, red or yellow attributed to each criteria. Each criteria analyzes in simple terms the strengths and weaknesses of your portfolio, in a way that you can easily understand and better manage your investments. In particular we show you the diversity of your portfolio, how it performs in relation to the stock market as a whole, how your fees are calculated, and whether the valuation of the companies is high or not.

2. We provide you with Thomson Reuters Data

Unlike your online broker's app, Hardbacon's app is not just about giving yous stock's prices. We are fortunate to have a partnership with financial data giant Thomson Reuters, a multinational based in Toronto with no less than 45,000 employees. Thanks to this partnership, we are able to provide you with a lot of stock information, such as profit margins, profit ratio and the nature of the company's activities. You can even call the investor relations department of each company without leaving the app. On the Exchange Traded Funds side, you are also provided with all relevant information, including the management expense ratio and the securities that make up each fund.

3. We give you investment ideas

Most stock market apps simply have a search bar to help people find financial stocks to invest in. The problem is that it's not easy to know what to look for when you know that there are tens of thousands of securities traded on the North American stock exchanges. In the “Explore” section of Hardbacon, there's a search bar, but it's just a small part of what's on offer. This section presents thematic lists of stocks and ETFs prepared by our analyst. Among our lists, we find for example “Invest like Warren Buffett”, “Belle province”, “The revolt of the robots” and “Invest in the indices and sleep well”. There are also many model portfolios built by portfolio managers.

4. We gather all your investments in one place

The fact that Hardbacon can connect to most online brokers in Canada makes life easier for our users. In fact, all you need to do is to synchronize Hardbacon to your brokerage account(s) to see all your investments in the app. Your securities are immediately categorized by asset classes, and you can click on each of them to get everything you need to know about it. If you have multiple brokerage accounts, you can have an overview of all your investments or select an account to analyze only a portion of your assets. What's more, no need for another app to watch for securities you do not have in your wallet: our app also offers a watchlist.

5. We explain what you don't know yet

I often repeat that Hardbacon was designed for the novice investor, but is also strong enough to retain the interest of the experienced investor. When designing the application, it was important to serve both types of investors well. Also, the investor who knows the stock market will understand our interface the first time, but it is possible that the novice investor wonders what a stock symbol means, like the average purchase price or the consensus of analysts. By pressing for two seconds on any element belonging to the Hardbacon interface, a definition will display in a bubble. Experienced users, on the other hand, will never be shown with these definitions if they don't need them. The same principle applies to our portfolio analysis. For each analysis criterion, the user can press “In English, please” for a more in-depth explanation of the analysis done by Hardbacon.

About The Author: Julien Brault

Julien started Hardbacon to help Canadians make better investment decisions. He’s raised more than two million dollars and signed strategic partnerships with financial institutions across the country. Before starting Hardbacon, Julien shared his passion for personal finance and the stock market while working as a business journalist for Les Affaires.

Julien manages his stock portfolio with National Bank Direct Brokerage. He uses a pre-paid KOHO Mastercard® for his online purchases and Borrowell to keep an eye on his credit score. Julien also has a Tangerine high-interest savings account.

More posts by Julien Brault