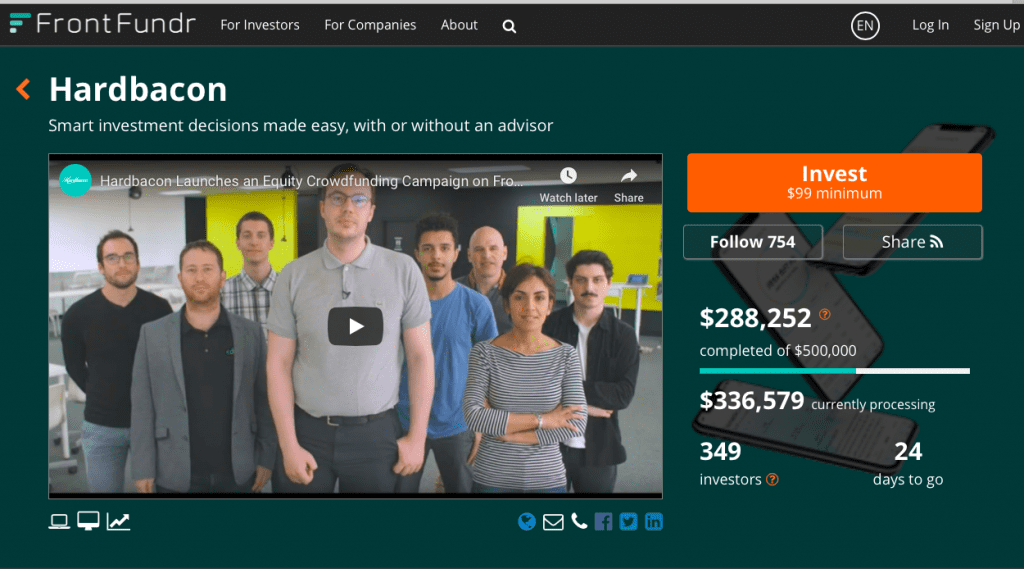

The success of Hardbacon's investment round on FrontFundr has exceeded our expectations. As a matter of fact, our goal was $500,000 and we have already raised $600,000, which includes both completed and “in process” investments.

Moreover, if there is one thing that I have learned is that you must double your efforts when you are successful.

Therefore, we have decided to spice up our investment round on FrontFundr.

We will offer you one of the following three perks: an online introductory course on investment (value of $199), a one-year subscription to the Hardbacon application (value of $99), or increased visibility for a year on our directory of financial advisors (offer is valid only for registered financial advisors, value of $69)

However, there are two conditions that you must meet in order to be eligible for this offer :

- You must complete your investment before July 22, 2019

- You must fill in this form, before July 22, 2019

As of July 15, 2019, you have 7 days to take advantage of this offer. Hurry up, because, at Hardbacon, we never run promotions.

Moreover, each investment must be validated by FrontFundr, so it will probably be too late if you invest at the last minute.

In addition to the perks, participating in Hardbacon's investment round is a unique opportunity to become a co-owner of a fintech that has a potential for high-growth.

The average investment in the round is around $1,000, but anyone can invest up to 10,000$, as well as $99. If you are looking to invest more, it is possible, but you must qualify.

Do not procrastinate. Now is the time to invest in Hardbacon's round.

About The Author: Julien Brault

Julien started Hardbacon to help Canadians make better investment decisions. He’s raised more than two million dollars and signed strategic partnerships with financial institutions across the country. Before starting Hardbacon, Julien shared his passion for personal finance and the stock market while working as a business journalist for Les Affaires.

Julien manages his stock portfolio with National Bank Direct Brokerage. He uses a pre-paid KOHO Mastercard® for his online purchases and Borrowell to keep an eye on his credit score. Julien also has a Tangerine high-interest savings account.

More posts by Julien Brault