Cheques are the most prevalent and widely used method of payment. Not everyone has credit cards and even the best prepaid cards can have low limits. A cheque can be for any amount that your bank account can cover. Sure, many consumers have turned to more modern and digitally advanced ways of payment, such like Canadian apps similar to Venmo, and e-Transfers. However, it is still necessary to learn how to write a cheque in Canada because not everyone accepts digital payments and it can come in handy when you need to make a payment to cash.

Writing cheques is a relatively simple operation; every cheque follows a predictable layout. You merely need to ensure you don't leave out any critical information required for cheque clearance. However, if you are new to Canada and you've just opened your bank account, are writing your first cheque, haven't written one in a very long time, or haven't needed to write one before this, then you may need to learn how to fill out a cheque.

In any case, knowing how to write a cheque is an important element of knowing how to execute financial transactions.

Using the proper manner to draft a cheque will protect you from fraud and allow banks to process your payment quickly. If any part of your cheque is incomplete or incorrectly written, the bank may reject it and stop your payment. Let's learn how to write a cheque with cents, what measures to take when writing a cheque, and other related information.

Handy tips to remember when writing a cheque

- Write out a cheque by hand with a ball-point or roller pen in black or blue ink.

- Use a minimum of 10-point font and dark ink colours that will pop up well in photographs, such as black, blue, or dark purple, if you're doing this on a computer.

- We recommend putting the payment amount in words even if it is not legally necessary, as it acts as a fallback if the sum in figures is challenged.

- You should make sure that you have enough money in your account to pay all of the cheques you write. Maintain a record of the cheques you sign so you know which payments have been cashed and which are still pending.

- Examine your account activities on a regular basis and report any problems to your banking institution.

- Put your chequebook in a secure location and never pre-fill or pre-sign checks.

Proper cheque etiquette

Accepting and depositing a Cheque

When accepting a cheque, ensure that the individual paying you has filled out all essential fields and signed them. If the cheque is written out to more than one person, or if someone is handing you a cheque made out to them, ensure that the reverse of the cheque has most of the needed signatures, also known as endorsements or endorsing a cheque. For instance, if a cheque is made out to you and Andrew Jones, you must obtain Andrew Jones' signature on the back of the check before depositing it into your chequing account. Alternatively, if a cheque is written out to Ms. Allison Jones, she can make copies and hand it over to you. Verify with your bank when you're unsure whether or not an authorization is required.

When you deposit a cheque, your bank adds the deposited amount to your account balance. Contingent to your bank's regulations, you may be able to view the funds immediately, or they may be placed “on hold.” It takes longer for cheques to clear when they are deposited on the weekend, over bank holidays, and if they are for a high amount of money.

Holds

Government-regulated financial firms are obligated by law to limit the number of times cheques can be held. The Financial Consumer Agency of Canada (FCAC) website contains important information about your rights and obligations. If an individual deposits a cheque in person at the bank, the first $100 is accessible immediately.

Stale-dated

Unless certified, cheques are deemed stale-dated after six months. A stale-dated cheque indicates that the item is beyond its expiration date and not automatically invalid. These cheques may still be honored by banking firms, which are under no duty to do so. Cheques issued by the Government of Canada do not expire, and your banking firm may confirm that they are still valid.

Post-dated

Cheques must not be deposited before their due date. However, some goods may slip between the cracks due to the enormous volume of cheques and automated processing. If you observe a post-dated cheque being cashed early, you can request that your banking institution refund it up until and including the day before the cheque's expiration date. To pay the beneficiary, you will need to make alternative arrangements.

Steps to write a cheque in Canada

Did you know that banks and other financial institutions still process approximately a billion cheques every year? That is a staggering figure. If you're a newbie, and this is your first time writing out a cheque, here's some valuable advice regarding the use of checks and how to write a cheque in Canada.

1- Cheque date

The date should be inscribed in the top right corner of the cheque. It symbolizes the day you wrote the cheque and the day it can be redeemed. Cheques can also be used after the due date has passed for up to six months. If you don't have the necessary cash in your account but need to write a check to someone, you can post-date the cheque. According to the Canadian Payments Association's clearing and settlement standards, a post-dated cheque cannot be redeemed earlier.

Some cheques feature a faded watermark on the date field. Most of the time, it will be in the format YYYY-MM-DD. But if the watermarks are missing, you could still use this format or approach your bank to find out what format is best.

2- Payee

On the “Pay to the order of” line, write the payee's name. This is the most crucial field, and you must ensure that just the correct name with the proper spelling is typed/written in it. The name could be that of a person, business, college, charitable organization, or any other institution with a bank account.

It should be capitalized if an acronym or abbreviation is used in a person's or institution's name. You can pull funds for yourself by writing “cash,” “bearer,” or “myself” on this line. However, mentioning “cash” and “bearer” is not suggested because it can lead to theft if the cheque is stolen.

3- Amount in number form

Many people are unable to write a cheque in pennies; mainly because the penny is no longer in circulation in Canada! Kidding aside, if your cheque is for $125 and 50 cents, you must write it as “125.50.” The dollar sign ($) is now on the cheque. Simply begin writing your balance amount in the monetary amount box using numbers.

It is best to start writing the numbers right after the printed $ symbol. Putting these numbers there leaves no room for anyone else to add more numbers. When writing the cents figure, make sure to utilize two decimals. You should write the number as “$125.50” and never as “$125.5.”

4- Amount in words

The next step is to type the same amount underneath the payee's name in the appropriate field. Although this area is not legally necessary, it is strongly advised that you put your cheque amount in words as well. If the amount written in words does not match the amount entered in numerical format, the teller will accept the cheque for the amount stated in words. You may easily fill in this section if you know how to draft an RBC (Royal Bank of Canada) cheque.

You will write $654.32 as “six hundred and fifty-four and thirty-two cents” or “Six hundred and fifty-four and 32/100.” Conversely, you can write the sum as “654 and 32/100 dollars.” The cents value is either represented as a proportion or as a number trailed by the word “cents.”

5- Signature

The bottom right corner of the cheque contains a signature line that must be signed. Only use a readable signature that has been recorded with your bank. This signature validates the cheque and informs the bank that you have agreed to pay the specified amount to the payee.

Always sign the cheque after completing out all of the information and double-checking it. Your cheque will be invalidated if it does not contain a signature. Make sure to sign only in the appropriate places, as signatures are also used to rectify errors and substitute names and sums on cheques.

6- Memo

The memo area allows you to write a brief description or a note explaining why that certain cheque payment was made. An example of a memo could be a “Payment of fees for July” or “Rent payment for February.” It serves as a reminder of why you wrote the cheque.

Furthermore, knowing the rationale for each payment makes it easier for you or for your accountant to treat the transaction appropriately. The memo line allows both parties to preserve a record of their payment and receipt details, which helps to minimize conflicts and uncertainty. You should copy this memo into your cheque register, also known as a booklet. We cover that later on.

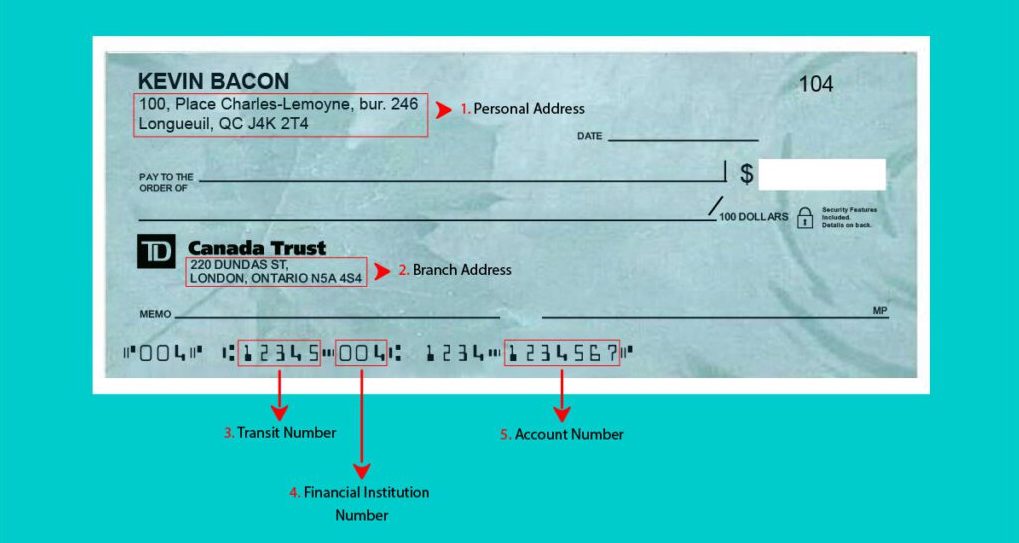

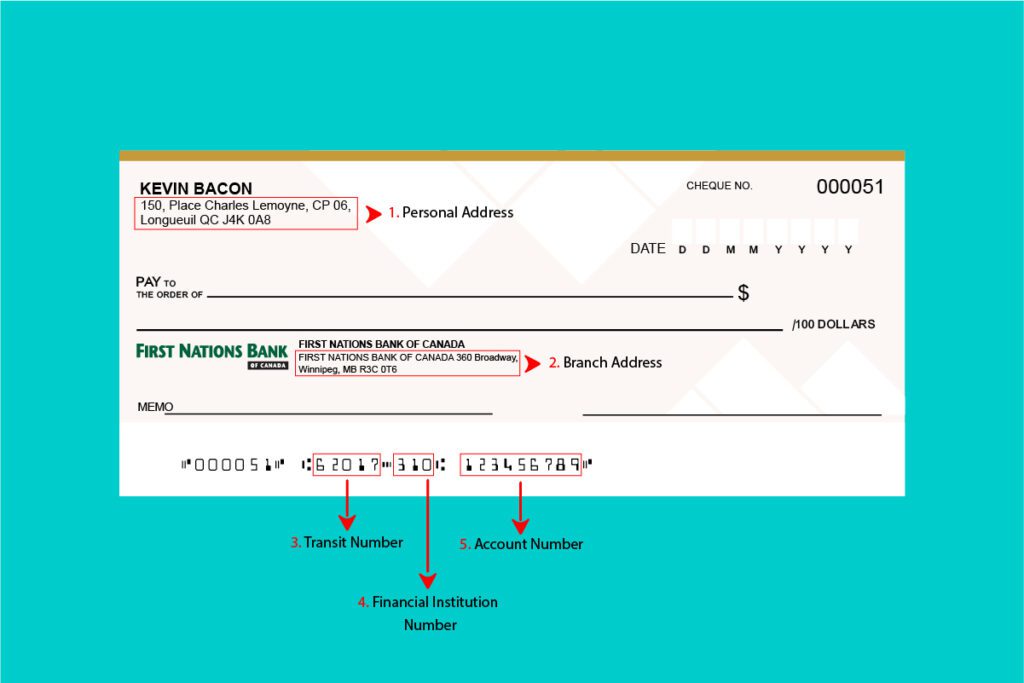

Understanding your cheque

Other aspects of a cheque include the names and addresses of the cheque writer, which are already pre-printed on every cheque. You can also include your phone number and address on the cheque by contacting your bank. The MICR line is an additional significant feature on cheques. Your cheque number, account number, transit number, and banking organization code are all featured on it.

Cheque numbers are unique to each cheque, delivered in sequence so that you can track your cheques and see if one is missing. All other digits remain consistent across all cheques written, printed, and mailed. Regardless of the branch you use, the transit number reflects your primary branch, and the organization code identifies your bank.

Using a cheque register

A cheque register or booklet is usually attached to the front or back of your checkbook. This cheque register has a few blank columns for you to fill out each time you write a cheque. It allows you to keep track of all the cheques you've written and to write memos to yourself of the specifics of each payment.

If you did not receive a cheque register with your cheques, there are likely stubs or pay-slips connected to each cheque that remain in place even after your cheques are pulled out. Quickly fill in the cheque information on these pay-slips and save them for future use. If you did not receive a cheque register or associated pay-slips, either purchase one or keep your cheque details in a database. In any case, you must keep accurate records whenever you write a cheque. In the cheque register, insert all needed information such as the cheque date, number, summary, and payee name.

Benefits of a cheque register

You can benefit from a cheque register in the following ways:

- It can assist you in keeping track of your cheques, allowing you to spot missing ones and remember when you need to reorder them. This way, you'll always know how many cheques you have on hand, allowing you to arrange your payments properly and reorder cheques from your bank as soon as possible. Banks often take several days, if not weeks, to mail your cheques.

- Individuals and organizations can use a cheque register to keep track of their expenditures. It can provide you with a quick overview of how much you have spent in a given period. This phase is useful for balancing your monthly or annual income and expenditure.

- Cheque registers are an excellent tool for determining whether you and your bank have logged the same transactions and are on the same page when it comes to reconciliation. If you find any discrepancies, you should call your bank because it could be a fraud case. Identity and fraud thefts can be detected immediately if you keep a cheque register.

- To avoid making duplicate payments, consult your cheque register before writing a cheque. For example, you may have previously paid your gardener, insurance, or daycare with a cheque. But over time, you forgot about it and wrote another cheque, resulting in a double payment to the same person. Cheque registers can assist you in avoiding such errors and wasting cheques.

- View your account status in real-time. If you solely use cheques as a payment option, a cheque register is highly suggested to keep track of your account's available funds at all times.

Security measures and tips on how to write a cheque in Canada

Some relatively frequent but useful hints to keep in mind when constructing a cheque are as follows:

- Use clear and neat handwriting. Make sure that everything you've written is intelligible and that there is no room for ambiguity. This is not the time to be creative. Make sure the signature you use is the most natural one for you.

- Double-check that all of the information and spelling are right. Make no spelling errors that can cause the payee's name to appear as someone else's.

- Before giving out a cheque or putting it in your bank account, always double-check the amount, payee name, and other data. For example, writing the wrong date can result in unnecessary delays and complications. As a result, it is best to proofread them as soon as possible after composing them.

- Your cheques should be used exactly as you intended, and the correct amount should be paid to the correct person. It is feasible to keep your cheques safe from fraud if you adopt some enhanced security steps in addition to the fundamental ones mentioned above. For example, if you are mailing a cheque to someone, use an envelope with security features so that you cannot make out the cheque through the paper.

- Always avoid pre-writing or pre-signing cheques to avoid providing someone with unrestricted access to your account. Never give somebody a blank cheque. Write your signature only after you have written all of the information on your cheque and double-checked everything.

- After putting in the relevant information, do not leave any blank areas on your cheque. To avoid leaving any space for extra numbers, begin putting the number in the dollar amount box from the farthest left boundary of the box. If there is any remaining space after you finish writing the amount, you can draw a horizontal straight line.

- Additionally, you can fill up the full space by writing the amount in large numbers. After writing the payee's name and the sum in words, you must draw additional horizontal lines. Fraudsters can place their name in front of the payee's name following the term “or,” implying that any of the two persons can have the cheque cashed. You can simply avoid this type of fraud by drawing a straight line and allowing no room for anything further to be added.

- Use a consistent and clear signature on all cheques. This signature should correspond to the one on the paperwork and documents you presented to your bank when creating an account. For starters, if you consistently use the same signature, it becomes more difficult for fraudsters to falsify your signature and have the cheque cashed. Furthermore, if your bank has wrongly authorized the payment even though your signature does not match, you can forgo any charges and take action. Otherwise, if you continue to use other signatures and get tied up in a fraud scheme, you will be liable for the entire loss.

- To increase the security of your cheque, never write the words “cash” or “bearer” on the “pay to the order of” line. Do not write these terms even if you need to withdraw dollars for yourself; instead you can write your own name or ‘”myself”. Cheques made payable to cash can be cashed by almost anyone. Giving away a blank cheque or carrying a blank cheque is the same as issuing a cheque payable to the bearer.

- Cheques that you no longer require should be shredded or destroyed. Store your chequebook in a secure area at all times.

- Examine your bank balances and statements regularly to ensure that no monies have been fraudulently removed from your account without your awareness.

Payment options other than writing a cheque in Canada

If you are still unsure about utilizing cheques or don't know how to write a cheque in Canada, there are various methods of payment accessible to you. Electronic payments are straightforward to use because everything is automatically saved and available to you at any time. Alternative payment methods to writing a cheque mean transferring or receiving funds without having money present physically by your side. Online transactions are relatively simple to trace and already exist in an accessible and downloadable database with all relevant information.

Online banking

Use online banking to pay all of your bills or just request that your bank send a check directly to your client or vendor. This procedure will save you time and money because you will not have to pay postage.

Credit, debit, and prepaid cards

You can also use credit, debit, and prepaid cards for making online payments. Furthermore, these cards may be used to make offline payments, such as supermarket, retail, and restaurant expenses, among other things. Credit cards are far safer and handier to carry than cash. This is the ideal solution if you want to conserve your cheques and minimize reordering.

Automatic monthly payments

You can also set up your bank account to collect monthly installments automatically. Funds are automatically deducted from your account and sent to your client or vendor in this case. Utilities, rent, insurance payments, education expenses, and other comparable payments can be set up to be routinely paid monthly.

Remote or mobile cheque deposits

Since many Canadians are still using cheques as a means of payment, you should be aware of a new method of depositing cheques. You can deposit your cheque or money order digitally by snapping a photograph of it with your smartphone using the remote and mobile cheque deposit feature. Several Canadian banks have started to offer this option for electronically depositing cheques.

Frequently asked questions about writing a cheque in Canada

What to do if a mistake has been made while writing a cheque?

It is possible to write the incorrect payee name or amount by accident. Your cheque may be denied owing to incorrect or illogical details, or your payment may be forwarded to whoever is named on the cheque. As a result, you must be aware of these issues and use extreme caution when writing cheques.

To easily invalidate a cheque, you can write VOID in block letters, spanning all of the fields. Make certain that you do not write it across the MICR line. To increase security, shred the cheque after it has been marked void. Voiding the cheque involves declaring a cheque invalid so that no one can use it. This step is critical in the process of limiting fraud or invalidating cheques.

Correctable errors can be crossed out with a simple strike and rewritten correctly. You must sign your name or initials next to these adjustments to convey to the bank that you accept them. If the errors are irreversible, you should return the cheque and use a new one.

How can I cash or deposit a cheque?

Cashing a cheque involves gaining access to the sum of the cheque by depositing it in your chequing account. It is dependent on what is specified on the “Pay to the order of” line if you will be paid in cash or the money is put into your chequing account.

When depositing a chequing, the date of the cheque and the date of the deposit should be the same. Otherwise, you may cash the cheque after the due date has passed.

Post-dated cheques are not accepted by banks. If you do not have enough money in your account, when someone tries to cash a post-dated cheque you receive, the cheque will bounce. And when your cheque bounces, the bank will also charge you an NSF (non-sufficient funds) fee.

Keep in mind that cheques are only valid for six months after they are printed. Your cheque will therefore be considered “stale-dated”; however, your bank may declare them “void.” The simplest approach to cash a cheque is to take it to any bank office where you have an account. The teller will most probably ask you to verify your debit card and input your PIN to validate your identity.

You can also transfer cheques using an automated teller machine (ATM). Simply insert your debit card and PIN into the ATM slot, and the ATM will guide you through the rest of the process. Once the cheque has been processed and received, the funds will be sent to the payee's account.

What Do the Numbers On a Cheque Mean?

The numbers on a cheque serve as a guide to your account. This enables the recipient to “locate” your funds and withdraw the amount indicated on the cheque. Theoretically, the recipient does nothing more than the deposit the cheque at their bank; the rest is handled electronically via Canada's processing and payment systems.

- The cheque number corresponds to the order of the cheques in the cheque book (the first cheque will be 001, the second will be 002, etc.).

- The transit number is used to locate your local bank, which is most likely the place where you started the account. This is similar to the 9-digit routing number used by U.S. banks; however, the terms transit and routing numbers are not interchangeable.

- To avoid misunderstandings, online banks that do not have physical branches may assign the same transit number to all of their customers.

- Your banking firm is identified by the institution number (also known as the bank number).

- The account number is unique to your account.

Is It Possible to Cancel a Cheque After Writing It?

You have the power to reject a cheque at any time between the time you present it to someone and the time they cash it. You cannot invalidate the cheque with a standard stop transaction if they cash it.

Call your bank as quickly as possible to rescind a cheque you've signed. Inform them that you wish to cancel the cheque. You may also be required to provide written notice of your intention to cancel the cheque. So, send a cancellation request straight away.

Keep a record of the circumstances leading to the cheque's cancellation. It's always a good idea to notify the receiver that you've cancelled the cheque as well. Your responsibility is to ensure that the cheque is lawfully cancelled and that any payment commitments are met.

How to Turn Your Cheque Into a Void or Sample Cheque?

Turning your cheque into a void or sample cheque takes only a few moments. All you need to do is write out the word “void” in large, bold letters across the surface of the cheque. Try to make the word as large as possible to ensure that someone cannot tamper with the cheque.

It's a good idea not to cover the routing or account number at the bottom of the cheque, as banks and other vendors need this number to identify your bank account. Also, keep a copy of the void cheque in your records in case you have to straighten out any discrepancies that arise.

Alternatively, you could also print out or save a PDF of a void cheque by using your online banking portal. To do this, you should log into your online banking portal and scroll through the print or save void cheque options. You can then either print the void cheque for physical use or save it as a PDF for electronic use.

Voiding a cheque is not a difficult endeavour; however, it can be complicated depending on your financial institution. So, if you require detailed instructions relevant to your financial institution, you can check out one of the articles below.

-

- Understanding your BMO void cheque

- Understanding your CIBC void cheque

- Understanding your Desjardins void cheque

- Understanding your Laurentian Bank void cheque

- Understanding your Manulife Bank void cheque

- Understanding your National Bank void cheque

- Understanding your RBC void cheque

- Understanding your Scotiabank void cheque

- Understanding your Tangerine void cheque

- Understanding your TD void cheque

- Understanding your Affinity Credit Union void cheque

- Understanding your Alterna Savings And Credit Union void cheque

- Understanding your Assiniboine Credit Union void cheque

- Understanding your ATB Financial void cheque

- Understanding your B2B Bank void cheque

- Understanding your Canadian Western Bank void cheque

- Understanding your Coast Capital Savings void cheque

- Understanding your Conexus Credit Union void cheque

- Understanding your Envision Financial void cheque

- Understanding your EQ Bank void cheque

- Understanding your First Nations Bank void cheque

- Understanding your First Ontario Credit Union void cheque

- Understanding your HSBC Canada void cheque

- Understanding your Libro Credit Union void cheque

- Understanding your Meridian void cheque

- Understanding your Motusbank void cheque

- Understanding your PC Financial void cheque

- Understanding your Prospera Credit Union void cheque

- Understanding your Simplii Financial void cheque

- Understanding your Uni Financial Cooperation void cheque

- Understanding your Vancity void cheque

- Understanding your Steinbach Credit Union void cheque

- Understanding your Wealth One void cheque

- Understanding your Servus Credit Union void cheque

About The Author: Arthur Dubois

Passionate about personal finance and financial technology, Arthur Dubois is a writer and SEO specialist at Hardbacon. Since his arrival in Canada, he’s built his credit score from nothing.

Arthur invests in the stock market but doesn’t pay any fees because he uses National Bank Direct Brokerage online broker and Wealthsimple’s robo-advisor. He pays for his subscriptions online with his KOHO prepaid card, and uses his Tangerine credit card for most of his in-store purchases. When he buys bitcoins, it’s with the BitBuy online platform. Of course it goes without saying that he uses the Hardbacon app so that he can manage all of his finances from one convenient place.

More posts by Arthur Dubois