Expedia is one of the first websites travellers turn to when they get down to planning their next journey. The business has joined hands with TD Rewards to introduce the Expedia for TD portal that allows travellers to use their TD Rewards points to pay for their trip on an Expedia-like portal. In this article, we’ll cover all there is to know about Expedia for TD so you can maximize your benefits.

- Introduction to Expedia for TD

- What does Expedia for TD offer?

- Expedia.ca and ExpediaforTD.com: what’s the difference?

- How can I earn TD Rewards points?

- Expedia for TD: pros and cons

- Expedia for TD: which credit card can you use?

- TD First Class Travel® Visa Infinite* Card

- TD Platinum Travel Visa*

- TD Business Travel Visa* Card

- TD Rewards Visa*

- How to redeem points through Expedia for TD

- Can Expedia for TD help me save money?

- Frequently asked questions about Expedia for TD

Introduction to Expedia for TD

Expedia for TD is a travel booking portal introduced by TD Rewards. It operates under the TD umbrella and is a result of a partnership between Expedia and TD. As a TD credit card holder, you will be able to use TD Rewards points to make purchases on Expedia for TD.

The platform seems reliable. TD is one of the largest banks in Canada. It offers a variety of financial products including credit cards, chequing accounts, savings accounts and even an online brokerage. On the other hand, Expedia is a well-recognized company with an international standing.

Using a qualified TD credit card on eligible purchases earns you TD Rewards points that you redeem for a variety of products and services. However, the best way to maximize the benefits is to use these points to make travel-related purchases through Expedia for TD. The platform is very easy to use. Login to your account and make a booking.

With this travel booking portal, you can spend your points but also earn more points faster. Spending $1 through ExpediaforTD.com will earn you up to 9 TD points. However, the program is only for eligible TD credit card holders. Also, there is a threshold. Points can only be used in 200 TD points or $1 increments. Each point is worth 0.5 cent.

Expedia for TD is simple and the 0.5 cent is low. However, there are some tricks that you can do to maximize your earnings and reduce your travel expenses. We’ll cover Expedia for TD tips and tricks later in this review.

What does Expedia for TD offer?

Expedia for TD is different from Expedia.ca, but it offers all that you will find on the original Expedia website including hotels and apartments, flights, all-inclusive holidays, car rentals, train tickets, and cruises. You can search for future dates, put filters such as “beach holidays”, and even enjoy discounted rates.

You can find some exclusive deals on special occasions. A great way to keep an eye on the latest offers is to sign up for the newsletter. You get timely updates about the newest discount offers including promo codes. It must be mentioned that your points will be worth the same value no matter what you purchase through the platform.

Expedia for TD offers dedicated customer support. Agents are available 24/7 and can be contacted at 1-877-222-6492. We found the team highly professional and helpful.

Expedia.ca and ExpediaforTD.com: what’s the difference?

Technically speaking, both platforms do the same job but they both operate very differently. Expedia.ca is the Canadian version of Expedia, the travel platform that anyone can use to book a flight, hotel, car, etc. The website offers deals at discounted rates and is available around the world.

On the other hand, Expedia for TD is not open to everyone. It is a co-branded website that can only be accessed by TD credit card holders. It offers exclusive perks including the ability to use TD Rewards points to pay for your next booking. The Expedia for TD platforms contains all products and services found on Expedia.ca.

In addition, you can earn more points when you use your card at the Expedia for TD platform. There are no blackout dates or limitations. Also, both platforms allow users to make date changes, cancel bookings, etc.

How can I earn TD Rewards points?

You need TD Rewards points to benefit from the Expedia for TD portal. The Rewards program works just like any other. You earn points if you meet these two conditions:

- You have a qualified TD credit card.

- You make an eligible purchase.

TD offers a variety of eligible cards each coming with its own list of qualified purchases. Also, the number of points awarded depends on different factors including the type of credit card. The TD First Class Travel® Visa Infinite* card, for example, is highly sought after as it offers up to 3 TD points for every dollar.

This is a very good promotion and better than what some other travel credit cards in Canada come with. However, TD offers you a chance to earn even more. Every time you use your card to buy travel-related services through Expedia for TD, you will get a chance to earn up to 9 TD points per dollar.

Expedia for TD: pros and cons

Here are some of the main pros and cons of Expedia for TD:

Pros:

- Can be a great way to save money by using TD points instead of cash.

- You can choose from a variety of TD credit cards to access the travel booking platform.

- Customer service is excellent.

- You’ll get all the perks offered by Expedia.ca.

Cons:

- Only for TD credit cards holders.

Expedia for TD: which credit card can you use?

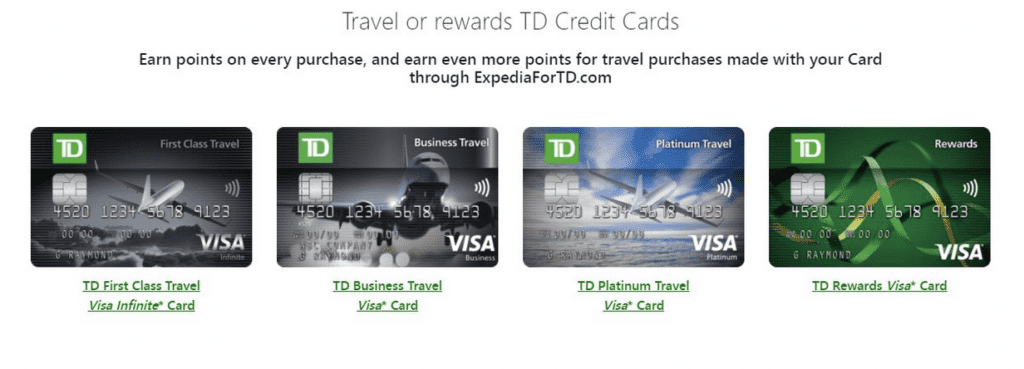

TD offers a large number of credit cards, but only four presently allow their users to access Expedia for TD. Applicants must be of maturity age, which depends on the province, to sign up for an account. Let’s know more about each card below:

TD First Class Travel® Visa Infinite* Card

Annual fee: $120, waived year 1

Interest rate: in Quebec 20.99% for all transactions; rest of Canada 19.99% purchases, and 22.99% for cash advances.

†Conditions Apply. Must apply by October 29, 2022

The TD First Class Travel® Visa Infinite* Card can be a great option for travellers who want to save money. You need $60,000 in personal or $100,000 in household income to qualify for the credit card. Cardholders enjoy Priority Pass Membership discounts and some other cool perks including vehicle rental insurance, purchase security, travel insurance, travel medical insurance, and flight delay insurance with baggage insurance. Those who want more perks can consider other credit cards in Canada.

Cardholders can earn 3 TD points on every $1. It goes up to 9 TD points on every $1 of spending when using the card on Expedia for TD. Users can earn more TD points by linking their card with their Starbucks Rewards account and earn up to 50% more points. We think this is a great feature since Canadians love Starbucks.

TD points earned through this card will remain active as long as the account is active. Plus, the company puts no seat restrictions or travel backouts. However, remember that there is a $5,000 minimum credit limit. TD points can be redeemed for all kinds of Expedia for TD purchases. Plus, they can be used to buy gift cards and merchandise from TD’s online store.

TD Platinum Travel Visa*

Annual fee: $89

Interest rate: 19.99% for purchases/22.99% on advances for rest of Canada.

†Conditions Apply. Must apply by October 29, 2022

The TD Platinum Travel Visa* is a lot easier to get as it has no stringent income requirements. Plus only your first supplementary card is $35 per year while any other supplementary cards are free. This credit card is more affordable than the TD First Class Travel Visa Infinite* Card but it does offer fewer benefits. There are no Priority Pass Membership discounts but users will still enjoy excellent insurance services including flight delay insurance with baggage insurance, vehicle rental insurance, travel accident insurance, purchase security, and travel medical insurance.

This card has no minimum annual income requirements and users with an average credit score can easily qualify. The credit limit for this card is $1,000 minimum. Still, it’s important to be careful as the card can impact credit scores.

The TD points system is clear: 3 TD points for every $1 spent on eligible grocery purchases, and 2 TD points on every other purchase. It goes up to 5 TD points for every $1 spent through ExpediaforTD.com. On the plus side, TD points earned through this card do not come with an expiry and the Starbucks program is valid on this card.

TD Business Travel Visa* Card

Annual fee: $149/$49 supplementary card

Interest rate: 19.99% on purchases/22.99% on advances

†Conditions Apply. Must apply by September 5, 2022

The TD Business Travel Visa Card is expensive but worth it due to its impressive benefits. It comes with a $1,000 minimum credit limit and pays up to 9 TD points for every dollar spent on ExpediaforTD.com. Cardholders can earn up to 6 TD points when spending at a restaurant or paying recurring bills. It can be a great pick for users who shop internationally as it gives 6 TD points on foreign purchases. Plus, it offers emergency cash up to $5,000. TD points do not expire and you can use them in many places. The †TD website has the terms and conditions, but right now there is a potential 150,000 points Welcome Offer and $247 fee rebate.

Every other purchase will earn 2 TD points and 50% more with the Starbucks program. It comes with some impressive benefits including travel medical insurance, trip cancellation insurance, delay insurance, emergency travel insurance, and lost baggage insurance. Cardholders will have the option to buy Business TD Auto Club Membership and enjoy car insurance.

TD Rewards Visa*

Annual fee: $0 including additional cards

Interest rate: 19.99% for purchases/22.99% on advances

†Conditions Apply. Must apply by October 29, 2022

Last on the list is the TD Rewards Visa* Card. It is the most affordable TD card to own. Just like the TD Platinum Travel Visa card, this one also has no income requirements and anyone, including applicants with a poor credit score, can qualify for this card. The credit limit starts at $500. The †TD website has the terms and conditions, but right now there is a potential 15,152 points Welcome Offer.

This card only awards 2 TD points for every $1 on eligible grocery, restaurant, and fast good purchases. Every other purchase will earn only 1 TD point for every $1 spent. It goes up to 3 TD points for $1 through ExpediaforTD.com. The Starbucks offer is valid with this card and TD points don't expire as long as the account remains valid. This card doesn't come with additional perks such as travel insurance. Users will, however, enjoy Purchase Security & Extended Protection Insurance.

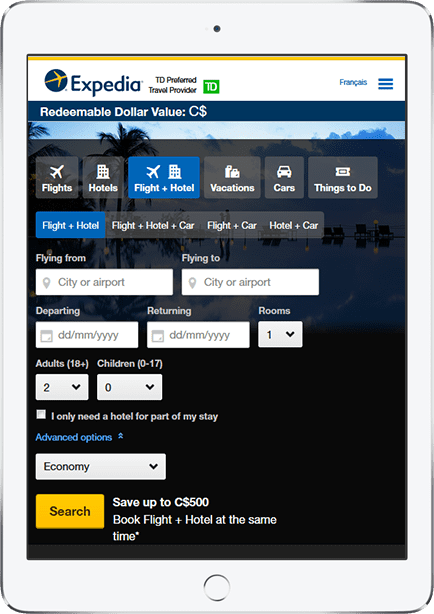

How to redeem points through Expedia for TD

In order to book a trip through Expedia for TD, you need to create an account so that you can redeem points. Go to ExpediaforTD.com, login to your account, choose the product or service you’d like to purchase, and decide how you wish to pay at the checkout page. You can even choose a combination of points and cash.

Points can be used to pay the basic price as well as for additional charges including taxes, carrier fees, and airport fees. The website will tell you the worth of your points and how much cash you will need if you do not have enough points to cover your purchase. If this happens, you will have to add a payment method such as PayPal or your credit card to cover the fee.

Some bookings will require pre-payment and some might allow you to pay at a later date. Make sure to read the fine print before you confirm a booking. Not all bookings will come with free cancellation.

Can Expedia for TD help me save money?

Yes, Expedia for TD can help you save money. It does so in two ways: by offering great discounts through promo codes and allowing you to use points instead of cash. How much you save depends on how many points you have. The more you shop, the more points you’ll earn. Plus, TD is known for offering special bonuses such as double points on some purchases and sign up bonuses. Try to take part in these offers to earn more points.

You will find similar offers from other providers, but Expedia for TD appears to have an edge. It offers a very high number of TD Rewards points to TD credit card holders, up to 9 points per dollar, and you only need a minimum of 200 TD points to redeem them, which is very low.

Frequently asked questions about Expedia for TD

Expedia for TD is a co-branded website that allows TD Travel Rewards cardholders to use TD reward points to make travel-related purchases. Users can leverage Expedia's vast catalogue and flexibility to save money. The platform offers all products and services found on Expedia.ca.

Expedia for TD is very easy to use. Sign up for an account and shop like you normally would and choose to redeem your points. The website will show points you have earned and you will have the option to redeem some or all of your points (increments of 200) when you make a purchase. It, however, is only for TD Travel Rewards Card holders.

Expedia has a Price Match policy that allows users to book hotels or flights at the cheapest possible rate. Under this policy, the platform will match ‘prices’ if you find the same offer at a cheaper rate.

Here’s how it works: You search for a hotel on Expedia and find one that costs $110 a night. You book the hotel and then run a Google search and find the same hotel on a different website going as low as $90 per night. You will now have the option to contact Expedia and request that they bring the price down under the ‘Price Match’ policy as the same hotel is available at a lower rate. However, the policy will come into effect only if the following conditions are met:

Your check-in time is at least 48 hours away for hotel bookings.

The travel dates on both platforms are identical.

You must have booked in the last 24 hours in case of a travel package.

The airline’s booking code, cabin class, and cancellation policy must be identical.

The hotel’s room type, check-in timing, cancellation policy, and add-ons such as breakfast must be identical.

The policy will not be applicable if any of these requirements are not met. For example, if the Expedia package comes with a free breakfast or early check-in but the other booking doesn’t come with these perks. You will have the option to request a refund of the difference ($20 in this case) if all these requirements are met.

Expedia for TD is up and running. Consider using a different platform or browser if it doesn’t work for you. Clearing your cache and using a VPN might also work.

You can earn up to 9 TD points for booking hotels through Expedia for TD.

Expedia is cheap and one of the best platforms for booking hotels, airline tickets, and tours. It offers discounted rates and even has special promo codes that can help users save even more.

One point is said to be worth half a cent. This means you will need 200 TD points to spend 1$ on Expedia for TD. It is in line with what other providers offer.

You will be able to use airline discount codes on Expedia for TD. Check the official site for the latest codes or sign up for the newsletter.

You might have the option to change your seat based on your booking type. Some airlines offer free changes and some require a fee. Check the terms and conditions before you book a flight.

À propos de Arthur Dubois

Passionné de finances personnelles et de technologies financières, Arthur Dubois est rédacteur et spécialiste SEO chez Hardbacon. Depuis qu’il est arrivé au Canada, il a su décoder les rouages du système financier canadien, notamment en bâtissant sa cote de crédit à partir de rien.

Arthur investit en Bourse sans payer de frais par l’entremise du courtier en ligne Banque Nationale Courtage Direct et du robot-conseiller Wealthsimple. Il paye pour ses abonnements en ligne par l’entremise de sa carte de crédit prépayée KOHO, et utilise sa carte de crédit Tangerine pour la plupart de ses achats en magasin. Finalement, il achète des bitcoins par l’entremise de la plateforme BitBuy. Bien entendu, il utilise aussi l’application mobile de Hardbacon pour gérer ses finances à partir d’un seul endroit.

Plus d'articles parArthur Dubois